Retail

Once again, the ritual that is the January National Retail Federation Big Show is upon us. Over 40,000 people, 6200+ brands, 1000+ exhibitors, from 100+ countries participated in the NRF 2024 edition. My retail innovation leadership activities stretched out over five days logging over 75,000 steps or to be more exact 32.62 walking miles.

The greatest pleasure at this event is reconnecting with retail and technology leaders from around the world in one single location. This year was a reminder that we are well past the pandemic. Refreshingly, the hearty handshakes and hugs were back with both friends and business colleagues.

Personally, NRF 2024 was even more special as I returned as President of Sensormatic, the leading retail portfolio business of Johnson Controls. My agenda was super packed with retailers, press, and analyst’s meetings. Being a true retail technology industry ‘geek’, I did squeeze in my traditional trend spotting walk.

This article summarizes some of my favorite events and themes of NRF 2024. It highlights both the ‘hits’ that made NRF 2024 memorable and the one ‘miss’ that could have improved it.

Best Way to Start Each NRF: Retail ROI Super Saturday

- Details

Are we becoming more physical stores or online digital shopper consumers? Prior to the pandemic, a topic that was popular in general media was the “retail apocalypse”. This Armageddon industry ending realization was being driven by rising retail bankruptcies and store closures.

The opposite force was the rise of digital commerce. Back in the year 2000, less than 1% of USA retail sales came from ecommerce. Fast forward to 2018 and it reached nearly 10% and by 2027 it is projected to reach 20.4% of total retail sales.

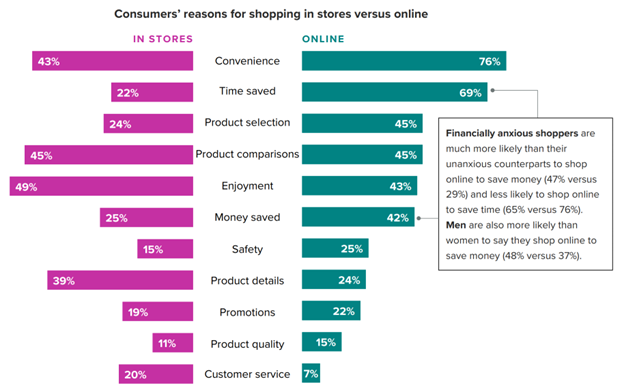

The digital revolution of the retail industry is here to stay. For the first half of 2023, according to Morning Consult, these are the reasons for shopping online versus instore.

Above chart is important as it points to the drivers of the digital versus physical instore model. This is a general view across the shopping population. As I pointed out in a previous article, leading retailers have realized the digital and physical are blending into phygital strategies. It’s no longer one versus the other, but the growing intentional strategy to combine the business models to drive higher consumer engagement across channels.

Just as interesting, if not more important, are technology adoption trends for the younger consumers and the innovation they would to see introduced into shopping journeys. As a new research study from Tata Consultancy Services pointed out, “consumers of all ages want new technologies, based on their preferences, to enhance their shopping experiences, instore and online, today and in the future.”

Privacy is Less of Concern for Younger Generations

- Details

Over the past two weeks, I had the pleasure of visiting several futurist retail stores in Europe. What became clear from those visits is that the linkage between physical stores and online ecommerce is growing stronger and much more innovative. Progressive retailers are moving on from omnichannel to phygital.

Differentiating these two concepts from a customer point-of-view:

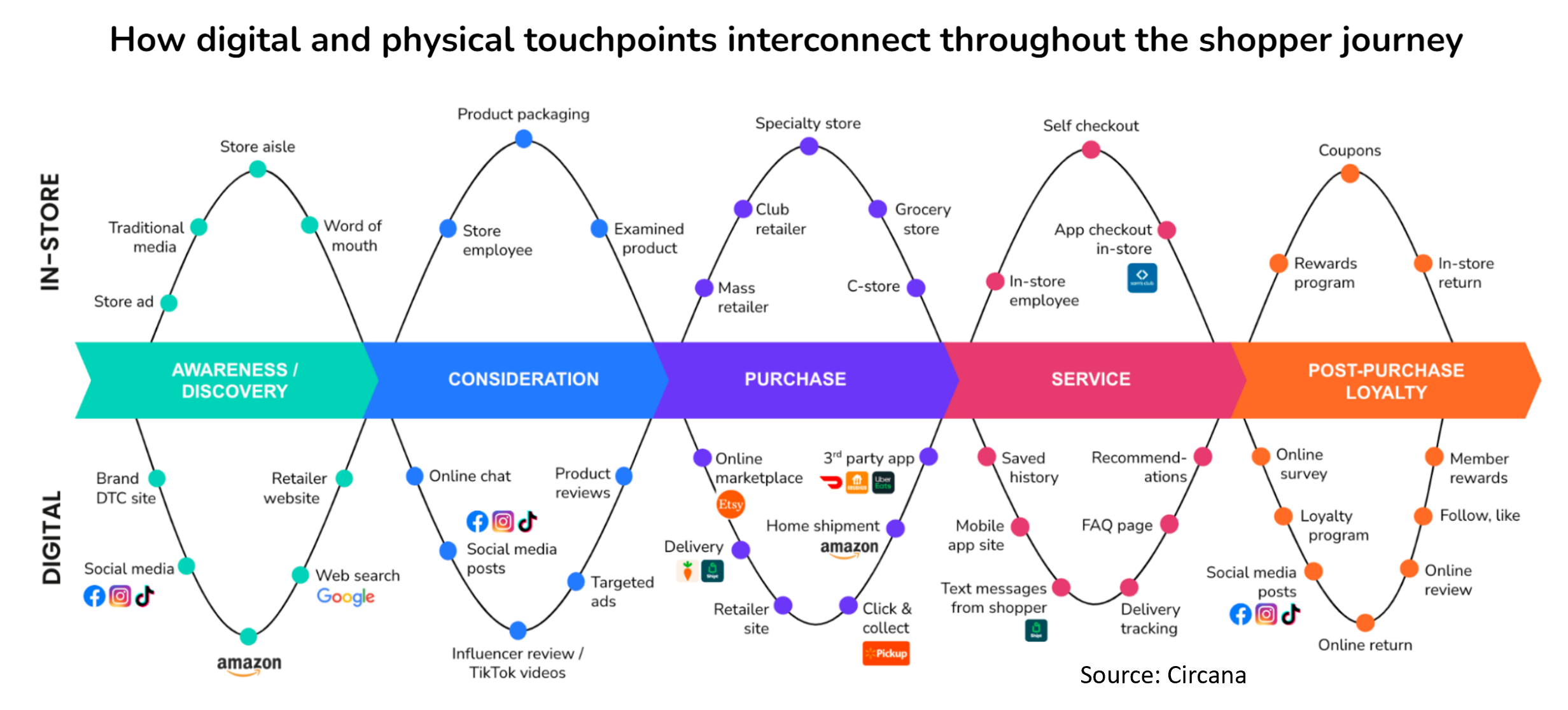

The omnichannel consumer is one who shops using both online and offline channels. Phygital is the deliberate focused operational strategy to combine digital and physical experiences across channels.As visualized by Circana, in a phygital world, there are substantial interconnections between digital and physical retail:

Phygital is all about the data created at the intersection of physical stores and ecommerce. As a strategy, it heavily embraces technology to deliver differentiated and memorable consumer experiences. It is the natural evolution of the growing digitization trends around us, heavily embracing smartphones as windows into the shopping journey. This article looks deeper at these trends and provides examples from my European retail store tours.

The Phygital Consumer Wish List

- Details

It is only September and thoughts of a hopefully happy retail holiday season are already swirling through my mind. Looking back to last year, for the November- December season, retail sales in USA grew 5.3%, to $926.3 billion, falling short of the National Retail Federation’s (NRF) forecast amid continuing inflation and high interest rates. While holiday growth was less than expected, for the year USA retail sales grew 7% to $4.9 trillion, meeting NRF’s forecast of 6% to 8% growth for the year.”

For 2023, NRF has tempered USA retail growth prospects to between 4% to 6%, equaling $5.13 trillion to $5.23 trillion. The good news for the USA economy is that according to JP Morgan, it grew 2% to 2.4% in the first six months this year and is expected to continue to grow at 2% in the second half of 2023.

The elephant in the room remains inflation which is currently going in the right direction. “Core goods inflation has dropped from 12% to 0.8% over the past year, while core services inflation has only slowed to 6.1% in July from its peak of 7.3% in February. JP Morgan expects gradual improvement with inflation over the coming months, though a return to the Fed’s USA targeted 2% could take until late 2024. For the first half of 2024, USA GDP growth is projected at only 0.4%.

An additional headwind this holiday season is high credit card debt. In the United States, consumers are now carrying $1 trillion in credit card debt with the average balance at about $6,000 and more than half of credit card holders worrying about paying their debts. While higher debt, depleted pandemic savings, and inflation are introducing risk of a recession, at a global level, retail will remain resilient.

With all this mixed news, what can we expect for the 2023 holiday season? What are the key trends that will drive shopping behavior in this important shopping time of the year?

Will We Shop Till We Drop This Holiday Season?

- Details

Having just finished my first book on personal branding which will be published later this year starting in the UK, you can guess that I am a big fan on the potential of the concept of branding. When it is well-executed, branding commands higher margins, creates loyal consumers, and creates that special buzz many like to follow.

The advent of smartphones and social media has increased the importance of branding. With the smartphone, we can all provide instant feedback to a brand about our experiences. Social media creates opportunities to generate viral content which increases the value of the brand.

Branding at all levels, including you as an individual, will increase in importance as digitization continues to become ubiquitous. It is for reason, that every year I look forward to the latest Kantar BrandZ most valuable global brands reports.

For the world’s top 100 most valuable brands, their value declined a surprising 20% in 2023 in the face of strong macroeconomic headwinds. The total value of the world’s top 100 global brands now stands at $6.9 trillion. As the research summarizes, reinforcing the importance of paying attention to you brand, “over the 17 years in which we have been tracking the world’s strongest brands, the companies behind the top-ranking brands have outperformed stock market benchmarks.”

This article summarizes the top 10 most valuable global brands in the key categories that I am most passionate about – Retail, Apparel, and Luxury. The actual research is very comprehensive and covers all industries and makes for a good read on differentiation strategies for growth which are critical to brands. All quotes and data in this article are from the Kantar BrandZ report.

The Top 10 Most Valuable Global Brands and New Entrants

- Details

The past two weeks have been truly inspirational in activities of continuous learning and sharing knowledge that helps us all have a brighter retail future. The first week was the keynote delivery of my latest edition on ‘The Disruptive Future of Retail’ presentation. The venue was the beautiful PGA National Resort in Florita were 200+ IT professionals attended the Retail Technology Solutions Summit. Impressed by both the format and the engagement of the audience during, after my presentation, and throughout the conference.

The second week included the launch of my new webinar Retail Technology Series Series which focuses on disruptive retail technologies, new innovative retail revenue streams, and once in a while a check-in on the state of the industry. Over 400 people registered for the first episode which was titled ‘AI’s $9.2 Trillion Impact on Retail through 2029’.

Additionally, in the second week, I had the pleasure of joining senior retail leaders, solution providers, and academia members at the Consortium for Operational Excellence in Retail at Wharton, University of Pennsylvania. The 2023 edition included highly interesting research innovation topics plus some candid retailers’ reflections on the past 30 years and projections on the next 30 for the retail industry.

This article summarizes just a few of the charts included in the keynote at PGA National. If you would like a copy of the full presentation, reach out either on LinkedIn or through my personal website Contact Page.

The full presentation covers the latest global economic headwinds, the challenges facing retail, insights on why retail will continue to be resilient, the pace of technology innovation, the critical future retail technologies, the smarter store of the future, and as title implies, a review of the AI revolution that is underway, including its impact on the retail industry.

Global Headwinds Persist

- Details

“The unfortunate fact is that violent incidents are increasing at our stores and across the entire industry. And when products are stolen, simply put, they are not longer available for guests who depend on them. Beyond safety concerns, worsening shrink rates are putting significant pressure on our financial results.” – Brian Cornell, Target CEO, Wall Street Journal May 21, 2023

Earlier this month Target highlighted that organized retail crime “will fuel $500 million more in stolen and lost merchandise this year compared with a year ago." Other major retailers triggering the same retail theft alarms include Home Depot, Walmart, Best Buy, Walgreens, and CVS.

The three major challenges which from discussions with technology companies and retailers have been elevated as the highest USA priorities for loss prevention are active shooter, safety, and organized retail crime. What is the latest data telling us? Is technology delivering on its solution promise? How do we ultimately solve this problem?

81% Increase in Shrink

- Details

In a previous CEO role, I was on a mission to transition physical security infrastructures into smart highly visual advertising delivery platforms. The rationale is similar to what happening with CCTV video technologies. In 2021, we crossed over 1 billion video cameras installed around the world.

Originally designed as a safety technology to monitor the launch of V-2 rockets in World War II and later taking more prominent roles as security devices, many of today's CCTV cameras are now data gathering eyes. Coupled with Artificial Intelligence and Edge Computing and renamed as Computer Vision, the CCTV camera is a key transformational technology improving many industries including retail.

Look up or the side of shelves in multiple retail formats, and in most modern retail stores you will see yourself on in-store Public View Monitors (PVMs) which were designed to increase visual deterrence against theft. Those same video monitors along with multiple other strategic locations inside the physical store are the perfect location to now add cloud-based digital advertising. Concurrently many of these screens can perform their security functions when needed, but more importantly they can also actually generate revenue for the retail chain through advertising.

PVMs are only the beginning of what is possible with digital advertising inside retail stores. There are multiple other strategic locations, including exits, point-of-sale, self-checkout, in-aisles, end-caps, on shelves, etc. where the digital advertising revolution is possible to substantially improve profitability.

The $100+ Billion Retail Media Networks Revenue Opportunity

- Details

The history of RFID is long and interesting. As I wrote in a previous article, the technology has its roots in World War II. For the retail industry, the adoption fuse has been slow to burn. Multiple times, I have asked the question myself, are we there yet?

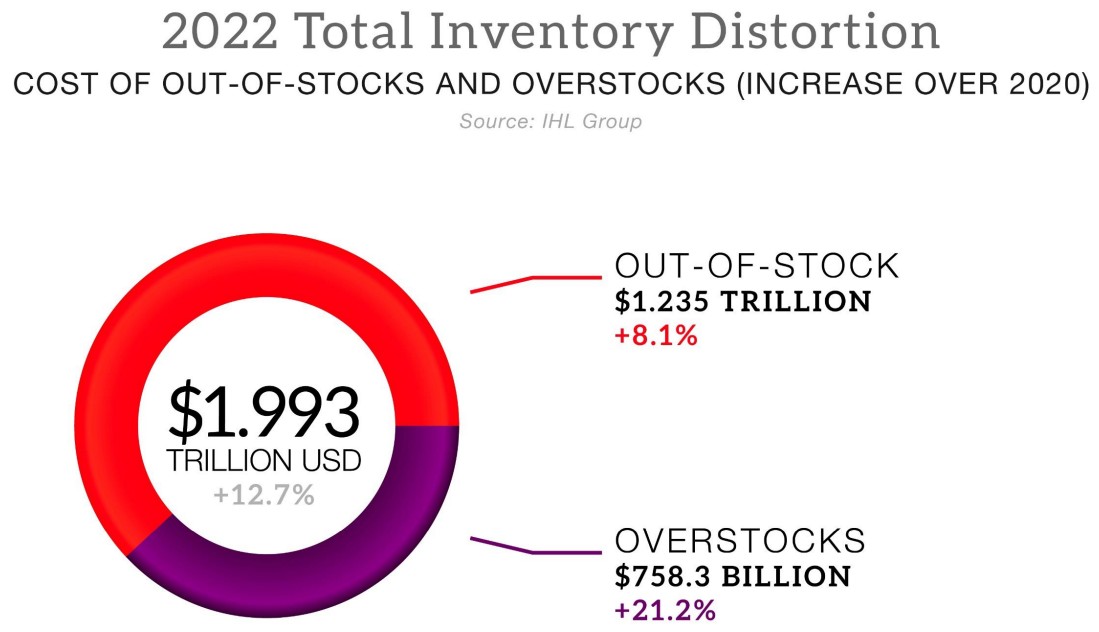

In my view, we are closer than ever to making RFID one of the key standards to address inventory visibility whose importance was accelerated by the COVID-19 pandemic. In 2022, the problem of inventory distortion worldwide totaled an astounding $1.993 trillion.

importance was accelerated by the COVID-19 pandemic. In 2022, the problem of inventory distortion worldwide totaled an astounding $1.993 trillion.

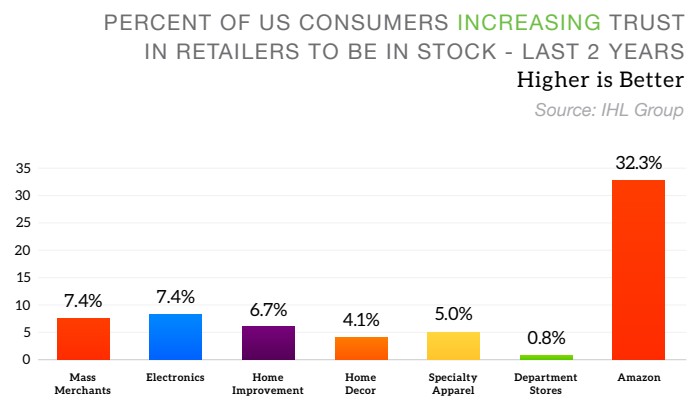

The same IHL research confirms that the number 1 reason, why customers leave your store without buying are empty shelves or out-of-stocks. "This occurred 62.2% of the time consumers didn’t buy, and panic buying in 2020 was a significant driver for this reason. In 2022, this issue overall dropped to 58.9% of the problem in the minds of consumers." By comparison the next reason for leaving the store without buying was "can't find help" at only 13.8%.

The most dramatic insight from the IHL research is inventory distortion lowers consumers trust with the retailer. Note the increase in trust in Amazon in the last two years.

Omnichannel or harmonized retailing requires intensified focus on accurate inventory across the enterprise. RFID today is one of the leading technologies to deliver it.

Inventory Visibility as a Technology Priority

- Details

The National Retail Federation Big Show this past week in New York did not disappoint. As I summarized in my post NRF 2023 social media post:

“THAT'S A WRAP: An inspiring Retail ROI Super Saturday, an astounding number of NRF 2023 retailer meetings, a roaring 20s Rethink Retail Top 100 influencers bash, hosting the NRF Loss Prevention Council, kicking off LPRC 2023 at Bloomingdale’s, named a top 10 NRF original Twitter, on Linked-in 45,000+ impressions / 100%+ engagement, nearly 90,000 steps, launching multiple Prosegur next-gen RFID tech, trend spotting for next article, and most essential FRIENDSHIPS rekindled -- it has been an exceptional Retail Innovation Leadership few days. Thank you ALL. “

Appreciative that just prior to the opening of NRF 2023, I was named once again a Top 100 Retail Influencer for 2023 by Rethink Retail. Congratulations to everyone on this important list. Retail needs a broader set of voices more than ever as we transition to a continued disruptive future for the industry.

What were the big hits and misses of the immersive NRF 2023 week? How could the misses improve both the trade event and also create new revenue streams for retailers?

Hit 1: Start with Making a Human Difference to the World

- Details