In a previous CEO role, I was on a mission to transition physical security infrastructures into smart highly visual advertising delivery platforms. The rationale is similar to what happening with CCTV video technologies. In 2021, we crossed over 1 billion video cameras installed around the world.

Originally designed as a safety technology to monitor the launch of V-2 rockets in World War II and later taking more prominent roles as security devices, many of today's CCTV cameras are now data gathering eyes. Coupled with Artificial Intelligence and Edge Computing and renamed as Computer Vision, the CCTV camera is a key transformational technology improving many industries including retail.

Look up or the side of shelves in multiple retail formats, and in most modern retail stores you will see yourself on in-store Public View Monitors (PVMs) which were designed to increase visual deterrence against theft. Those same video monitors along with multiple other strategic locations inside the physical store are the perfect location to now add cloud-based digital advertising. Concurrently many of these screens can perform their security functions when needed, but more importantly they can also actually generate revenue for the retail chain through advertising.

PVMs are only the beginning of what is possible with digital advertising inside retail stores. There are multiple other strategic locations, including exits, point-of-sale, self-checkout, in-aisles, end-caps, on shelves, etc. where the digital advertising revolution is possible to substantially improve profitability.

The $100+ Billion Retail Media Networks Revenue Opportunity

Retail media advertising is not new. At its basic level, "Simply put, retail media is advertising products or brands at or near the point of purchase. Before ecommerce, retail media presented itself (and still does) as end-cap displays, sampling tables, in-aisle coupons, and more in physical stores." In 2012, Amazon changed the game by creating the first retail media network (RMN) applied directly to their e-commerce digital platform.

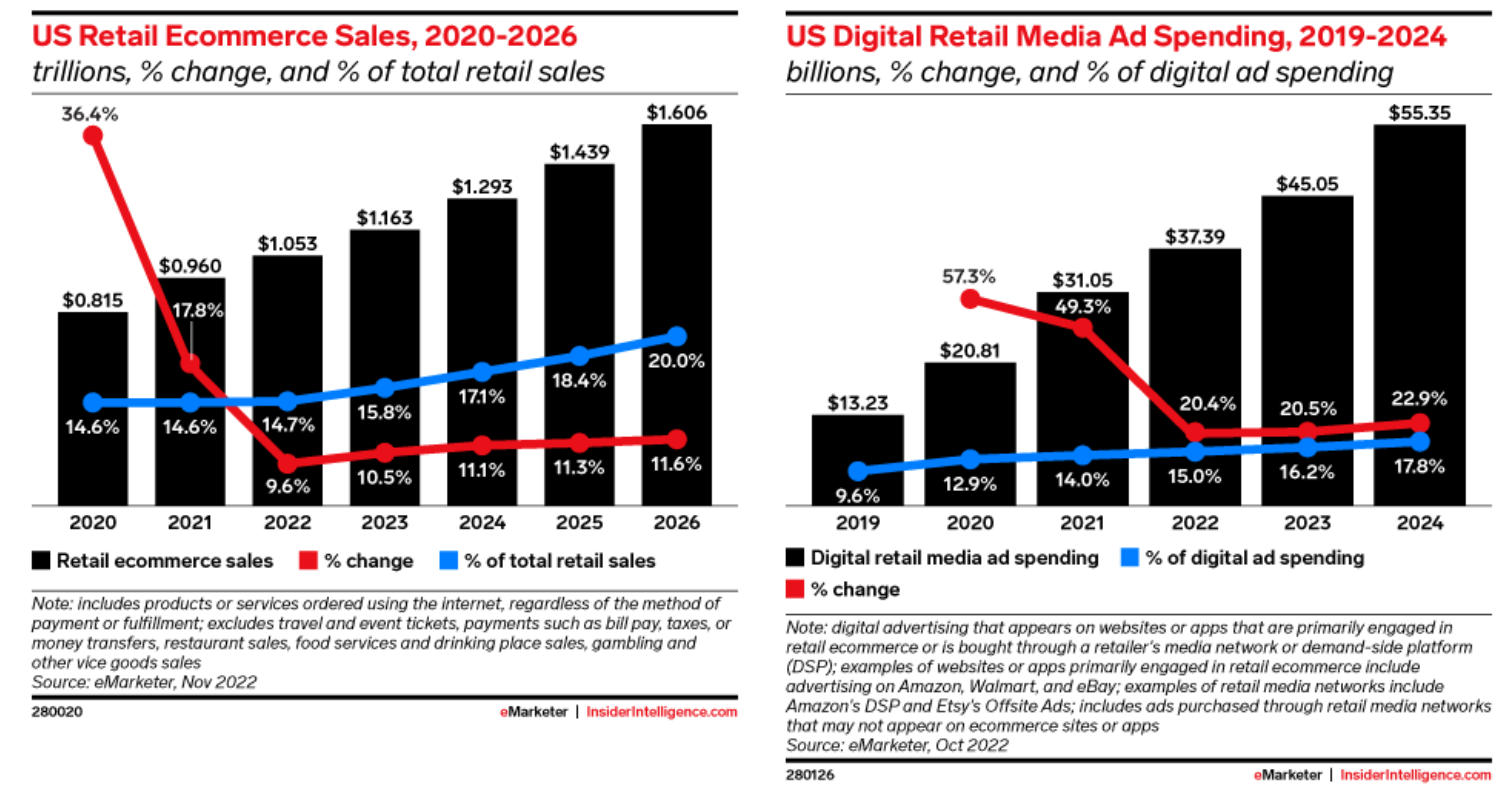

Retail Media Networks are already the fastest growing ad-supported media channel. In 2022, GroupM estimated that global retailers had $88 billion in ad revenue and in 2023 it will reach $101 billion. "This represents 18% of all global digital advertising and 11% of all advertising. GroupM projects retail media advertising to grow by about 60% by 2027, exceeding the expected growth for all digital advertising."

Other interesting projections:

- Forrester projects strong growth in USA market with retail ad dollars doubling in the next four years.

- McKinsey is expecting retail ad spend to grow from $45 billion to over $100 billion by 2026.

- eMarketer predicts RMNs will be the third big wave in digital advertising following search and social.

Ecommerce was already a driver of increased digital ad spend for retailers.

The next logical and in my view most valuable retail media network revenue frontier is the physical store.

The Walmart versus Amazon Retail Media War

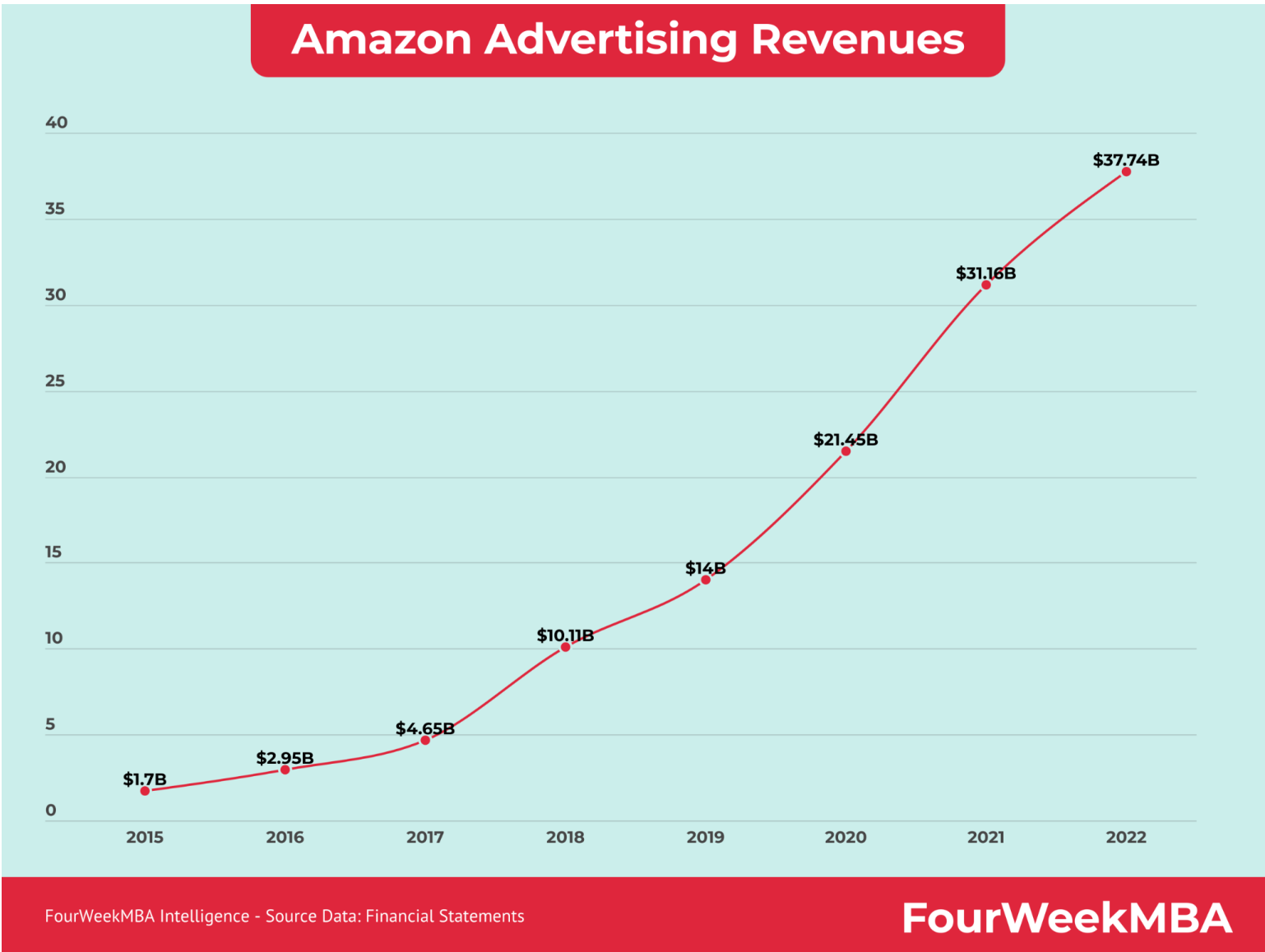

The gorilla in the room with retail media networks is Amazon. To put it in more context, for 2022, below total ad revenue for Amazon is now larger than YouTube Ads for the same year.

eMarketer estimates that Amazon had a 76.9% of the total retail media spend in 2022. Walmart came in second at just 6.1% share, followed by Instacart at 1.9%. In the United States, 6 in 10 households have Amazon Prime and worldwide the number of members now exceeds 200 million which are certainly a plus for the advertising business.

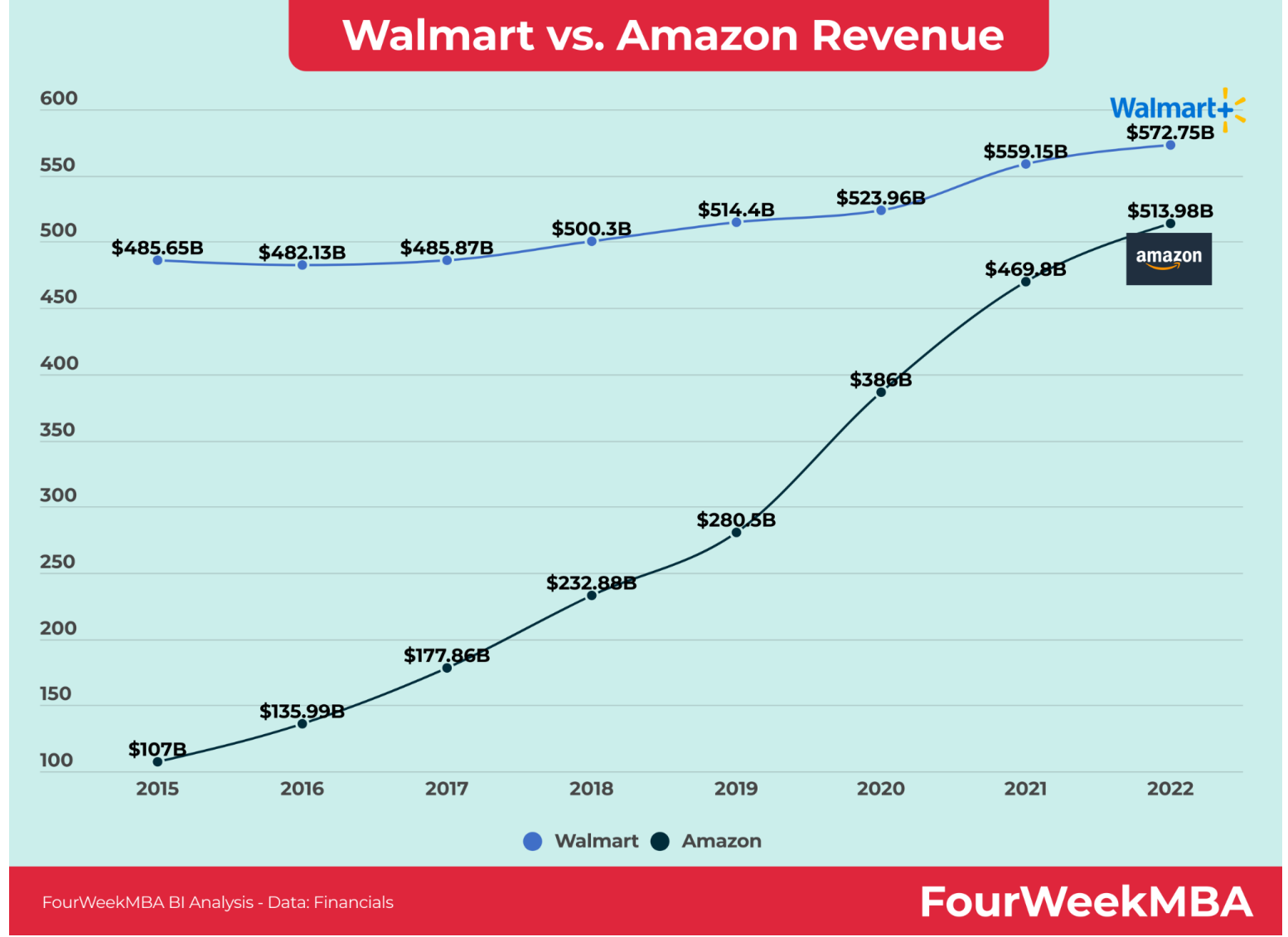

The meteoric revenue rise of Amazon has been interesting to watch.

However, several recent headlines in Amazon halting and re-examining their Amazon Fresh and Amazon Go physical store strategy, point to several Walmart advantages in the retail media network wars.

In 2022, Walmart's ad business grew a massive 130% over 2020. "Each week about 220 million customers and members visit Walmart online and in approximately 10,500 of its stores and clubs under 48 banners in 48 countries. This network provides an enormous reach for potential advertisers, both online and in store. And let’s remember that behemoth Walmart serves 90 percent of U.S. households."

The Most Promising Retail Media Networks Revenue Frontier

Short term, the most promising retail media network revenue frontier is food and drug. As Amazon has challenges in this space, mobilizing the physical store for immersive digital content can lead to substantial profitability growth especially when you consider that the average margins for RMNs range from 50-70% and even more with on-site advertising at 70-80%, according to Forrester.

Success of RMNs in physical stores will depend on developing advertising programs beyond existing trade funds. As Nikki Baird points out, "trade spending is the deals, placement fees, and other incentives that CPG companies put on the table in deals they make with retailers. In the grocery industry, as much as 40% of sales are made on promotions funded by CPG trade funds." In her recent Forbes article, Nikki also points to some upper limits that need to be considered.

The alarming changing nature of retail crime trends is leading to greater focus on security technologies. Multiple of these new and even recently deployed loss prevention solutions have dual function capability to both deter crime and also can be leveraged for incremental revenue and profitability. The two functions of crime deterrence and marketing messaging actually increase the value of both applications. Starting in food and drug, it is time to re-look at your security technology and make that promising next retail media network revenue opportunity a reality.