- Home Page

Phygital vs Digital: How Retail Will Thrive in the Next Ten Years

Digital retail transformation continues to be on my mind. This follows increased engagement with retailers on multiple continents and observing how they are embracing technology to create immersive experiences that drive more profitable operational efficiencies. From their lessons, the questions that I continue to contemplate include:

- Will the future of retail be phygital or omnichannel?

- How will current trends from next generation shoppers such as Gen Z change retail in the next 10 years?

- What emerging technologies must make progress to deliver a more profitable future of retail?

The Retail Boss nicely summarized the key differences between phygital and omnichannel retail strategies. "Phygital and omnichannel strategies both aim to enhance customer experiences but differ in their approaches. Phygital focuses on merging physical and digital worlds to create immersive, personalized experiences, often leveraging technologies like QR codes and augmented reality. On the other hand, omnichannel integrates various communication channels to provide a seamless and consistent brand experience across all touchpoints, such as physical stores, websites, and mobile apps. While phygital emphasizes the fusion of online and offline interactions, omnichannel prioritizes a unified customer journey across multiple platforms."

As Morningstar reported, "Generation Z, the first truly digital-native cohort, is rewriting the rules of engagement in the retail sector with their preferences and behaviors. Born into a world where the internet, smartphones, and social media are ubiquitous, zoomers' influence is shifting the retail paradigm from predominantly in-store interactions to a complex, integrated model that blends online and offline experiences seamlessly. Their comfort with technology and demand for instant, on-demand access to products and services are driving retailers to reimagine how they connect with consumers."

Technology will continue to disrupt retail business models. The industry's future requires increased digital strategies to turn consumers into brand ambassadors. Concurrently, the entire retail ecosystem and especially the physical store, must increase its digital stickiness through tech empowered store associates as equal brand ambassadors.

Future Consumers Technology Preferences

Digital Acceleration and the Top 5 Global Risks for 2024

With the not too distant second half of 2024 ahead for all of us, digital acceleration and the global risks we still face have been on my mind. The world's population has now reached 8.1 billion people, all on an accelerated march towards greater connectivity and digitization. Nearly 70% of the world's population now has a unique mobile phone subscription; just over 67% of us are using the internet; and maybe not surprisingly, nearly 63% of all individuals living on earth have unique social media identities.

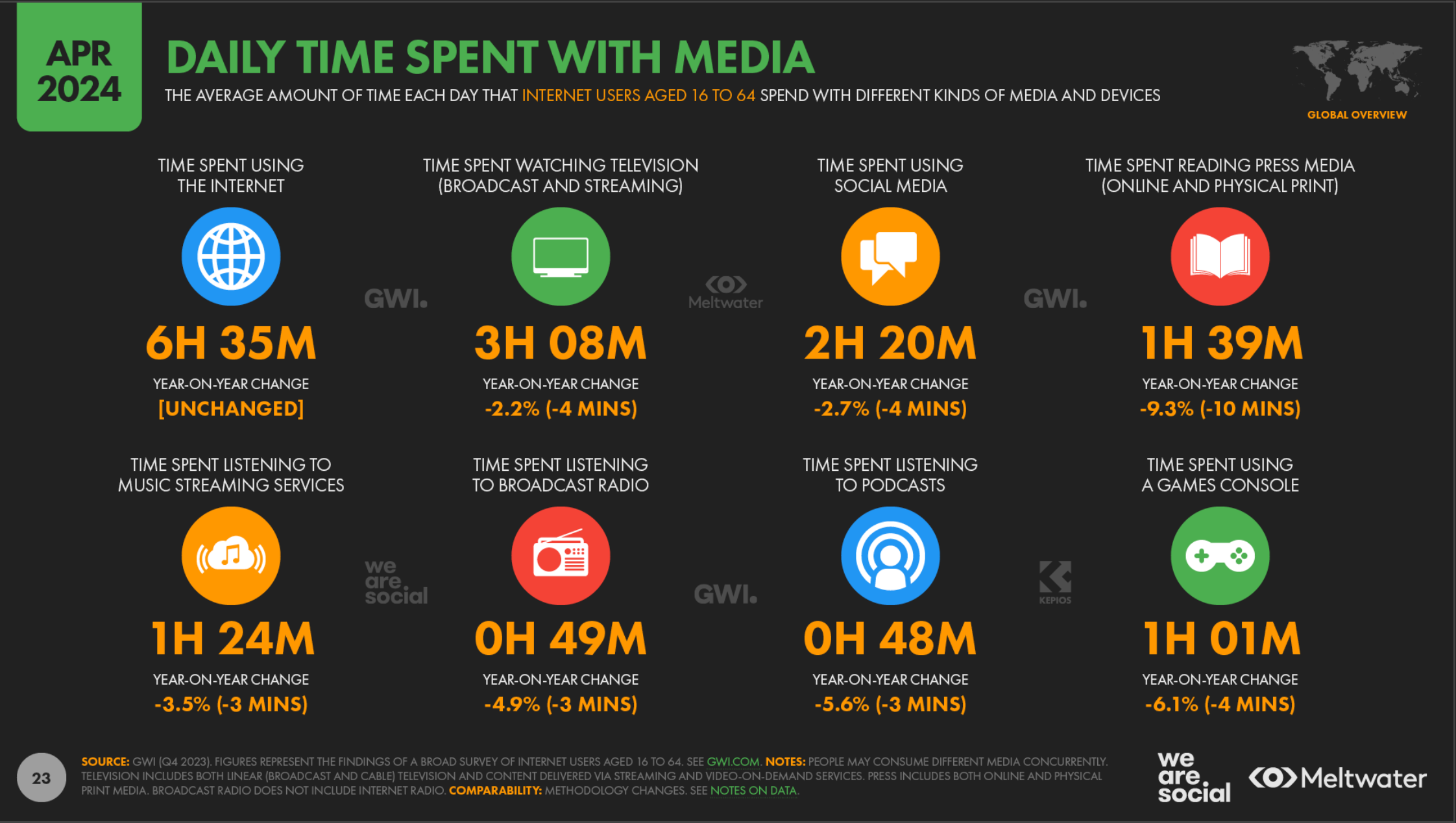

On average, each one of us is spending 6 hours and 34 minutes per day on the internet. Note the changes in media consumption that are taking place.

Traditional media such as television and radio continue its spiral decline. Americans are now roughly twice as likely to prefer getting their news from digital devices than television. Three-in-ten USA adults regularly get their news on Facebook with YouTube coming in second at 26%. For GenZs, one-third regularly scroll TikTok for news, up 255% since 2020.

Are these social trends driving us towards a brighter, more cooperative future?

AI is Just Getting Started

Retail RFID: Table Stakes or a Game Changer Technology?

A favorite retail industry report which I hope Chain Store Age continues post their acquisition of RIS News was the annual Store Experience Study. The research highlighted the yearly technology priorities for retailers and its summary continues to be a mainstay as one of the charts in my 'Disruptive Future of Retail' keynote presentation.

According to the latest Store Experience Study, the top five technology priorities for retailers in 2024 are personalizing customer experiences, upgrading CRM / loyalty programs, empowering store associates, inventory visibility, and refreshing the point-of-sale infrastructure.

Will 'the Steal' Slow Self-Checkout and Frictionless Commerce?

“(Self-Checkout) It’s facilitating errors, and in some cases, the steal.” – Santiago Gallino, Associate Professor at the Wharton School

According to the latest NRF Security Survey, retail shrink represents $112.1 billion in losses, up nearly 20% from the previous year. Similar high shrink growth rates can be seen in other countries such as the UK where in the latest British Retail Consortium research, customer theft, doubled to just shy of £2 billion ($2.5 billion).

As I predicted many years ago, the problem of retail shrink is on a collision course with frictionless commerce consumer trends. This growing challenge actually bring new positive opportunities for to both retail and the loss prevention function.

The shrink challenging counter revolution taking place in the retail industry, led by younger generations, is frictionless commerce. “Over 50% of consumers will switch to a merchant with less friction in the shopping experience. And, 41% of all consumers will pay more for simple, fast and efficient shopping experiences.”

Specifically to self-checkout, the 2024 Digital Commerce Index found that 43% of consumers favor self-checkout when shopping in a grocery store. By age range, that preference is even more interesting with 55% of 18-29 years old favoring it, 30-44 at 51%, 45-60 at 40%, and those aged 60+ at only 26%.

The genie is out of the bottle in terms of increased frictionless commerce in all retail sectors. To understand its impact in the apparel industry, read one of my previous article titled “Let’s Get Phygital and Get the Future of Retail Party On.” This article explores deeper the challenges at retail shrink at self-checkout and the accelerated adoption trends of frictionless commerce.

Stealing at Your Local Self-Checkout

The World's Most Valuable and Powerful Brands for 2024

With a Mix of Brand Challenges in the Retail Industry

Earlier this year, Brand Finance published its latest ranking of the world's most valuable brands. Displacing last year's number 1 Amazon, Apple has roared back to the top spot with an astonishing 74% brand value increase. The company's 2024 brand value growth is approximately equal to the total value of Starbucks’s, Mercedes-Benz’s, Tesla’s, and Porsche’s brands combined.

"Apple has grown its brand value through strategic diversification and premiumization, moving away from heavy reliance on iPhone sales towards ventures into wearables and services such as Apple TV subscriptions." According to Brand Finance research, more that 50% of respondents recognized Apple as expensive, but worth the price, reinforcing the brand's ability to demand a price premium.

This article looks deeper into the success at Apple and explores the overall most valuable / strongest global brands. Finally, it summarizes the retail and apparel companies that emerged as the global brand value leaders in 2024.

The Next Apple Big Thing

Four Major Hits and One Miss from NRF 2024

Once again, the ritual that is the January National Retail Federation Big Show is upon us. Over 40,000 people, 6200+ brands, 1000+ exhibitors, from 100+ countries participated in the NRF 2024 edition. My retail innovation leadership activities stretched out over five days logging over 75,000 steps or to be more exact 32.62 walking miles.

The greatest pleasure at this event is reconnecting with retail and technology leaders from around the world in one single location. This year was a reminder that we are well past the pandemic. Refreshingly, the hearty handshakes and hugs were back with both friends and business colleagues.

Personally, NRF 2024 was even more special as I returned as President of Sensormatic, the leading retail portfolio business of Johnson Controls. My agenda was super packed with retailers, press, and analyst’s meetings. Being a true retail technology industry ‘geek’, I did squeeze in my traditional trend spotting walk.

This article summarizes some of my favorite events and themes of NRF 2024. It highlights both the ‘hits’ that made NRF 2024 memorable and the one ‘miss’ that could have improved it.

Best Way to Start Each NRF: Retail ROI Super Saturday

The Magical Meaning and Good Tidings of the New Year

For multiple reasons, 2024 has copiously been on my mind. Maybe it is the magic of the holidays or thinking about the meaning of the New Year. Possibly for me personally, it is the number 24 as I was born on the 24th day of the month.

Each new year is typically a moment of reflection for all of us. We think back on the previous year and a substantial number of us engage in the ritual of setting 'New Year Resolutions'.

From the results of a new YouGov survey, just over one-third of USA adults plan to make New Year's resolutions or set specific identifiable goals for 2024. Adults under 20 (52%) are most like to do so, followed by 30-to-44-year-olds (44%). Older individuals are either wiser or simply seem to ignore this goal setting ritual. Only 27% of 45-to-64-year-olds and 18% of people 65 and older will set New Year's Resolutions.

For 2024, the top 5 New Year Resolutions for Americans are:

- Saving Money 23%

- Be Happy 22%

- Exercise More 21%

- Improve Physical Health 21%

- Eat Healthier 20%

The idea of preparing for a new year is a human condition with a long historical tradition. The month of January which kicks off the New Year gets its name from the Roman god Janus. For the Romans, Janus was the god of beginnings and transitions. He presided over passages, doors, gates, and endings as well as between war and peace. He was usually depicted as having two older men faces looking in opposite directions, one towards the past and one towards the future.

which kicks off the New Year gets its name from the Roman god Janus. For the Romans, Janus was the god of beginnings and transitions. He presided over passages, doors, gates, and endings as well as between war and peace. He was usually depicted as having two older men faces looking in opposite directions, one towards the past and one towards the future.

This reflective celebratory article analyzes the number 24 and provides some insights from the Chinese Zodiac Calendar of what is ahead in 2024.