Retail

The National Retail Federation Big Show this past week in New York did not disappoint. As I summarized in my post NRF 2023 social media post:

“THAT'S A WRAP: An inspiring Retail ROI Super Saturday, an astounding number of NRF 2023 retailer meetings, a roaring 20s Rethink Retail Top 100 influencers bash, hosting the NRF Loss Prevention Council, kicking off LPRC 2023 at Bloomingdale’s, named a top 10 NRF original Twitter, on Linked-in 45,000+ impressions / 100%+ engagement, nearly 90,000 steps, launching multiple Prosegur next-gen RFID tech, trend spotting for next article, and most essential FRIENDSHIPS rekindled -- it has been an exceptional Retail Innovation Leadership few days. Thank you ALL. “

Appreciative that just prior to the opening of NRF 2023, I was named once again a Top 100 Retail Influencer for 2023 by Rethink Retail. Congratulations to everyone on this important list. Retail needs a broader set of voices more than ever as we transition to a continued disruptive future for the industry.

What were the big hits and misses of the immersive NRF 2023 week? How could the misses improve both the trade event and also create new revenue streams for retailers?

Hit 1: Start with Making a Human Difference to the World

- Details

A cornerstone of my social media growing personal brand has been the continuously updated “Disruptive Future of Retail” presentation that I have delivered on global stages in the past seven years. Crystalizing in the 2022 editions are the five strategies and the three primary technologies that will deliver a more profitable future of retail into the new year.

At the core of these strategies are two stakeholders that hold the key to what happens to retail next: the consumer and the store associate. The smartphone as now the third retail innovation megatrend has re-defined the successful retail formula.

This article summarizes the five strategies for success into 2023, along with the three technologies that are the strategic levers to their successful implementation. It closes with a summary of the smart more profitable store of the future.

The One Chart that Defines the Successful Future of Retail

- Details

"There is a Chinese curse which says, “May he live in interesting times.” Like it or not, we live in interesting times. They are times of danger and uncertainty; but they are also the most creative of any time in the history of mankind." - Robert F. Kennedy, June 6, 1966

The title of this article is from the latest International Monetary Fund (IMF) report on the state of the economic world in the fall of 2022. IMF now forecasts global GDP growth to slow dramatically from the 6% in 2021 to 3.2% in 2022 and an even lower 2.7% in 2023. The news is especially bleak for advanced economies.

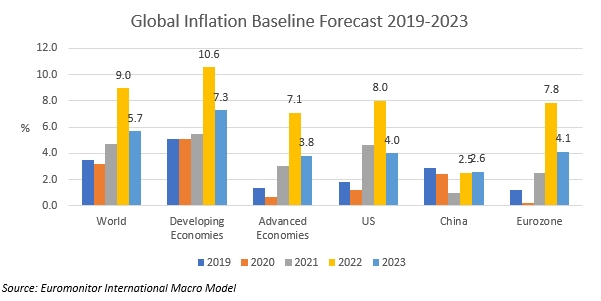

According to the IMF, a third of world economy faces two consecutive quarters of negative growth, the technical definition of a recession. Global inflation is forecast to rise from 4.7% in 2021 to 8.8% in 2022, 6.5% in 2023 and 4.1% in 2024. Euromonitor forecasts similar higher inflation into 2023.

This article summarizes the state of the economic world, the 2023 risks, and more importantly the impact on consumers and retailers.

A Risk Filled 2023 Year Ahead

- Details

Even though it's only very early fall, it is beginning to look a lot like Christmas in many of the stores that we go. Santa must be anticipating a mad rush on limited supplies as multiple major retail chains already have their trees and trimmings out for sale.

Typically, late summer and early fall is when all the retail holiday predictions are published. The key words that are bubbling up in this year's cloudy crystal ball are early, inflation, recession, discounts, and the continuing battle between physical and digital retail. Timing of the economic cycle will potentially lead to more winners than losers.

COVID has moved to the rear-view mirror and it has been replaced by financial headwinds. "In fact, concerns related to COVID have decreased significantly, from 52% (in 2021) to 16% this year, while the financial concerns have surged 153%." It is now time for my annual summary of those prognostications, along with my own thoughts for Retail Holiday Season 2022.

USA Holiday Sales Projected to Increase, But...

- Details

The world faces multiple challenges for the balance of 2022, into 2023, and it may even extend into 2024. Multiple negative forces are combining to slow the dramatic growth of the pre-pandemic decade.

A recent Wall Street Journal article, 'COVID-19 is Still Killing Hundreds of Americans Daily', reminded us that the disease is on pace to remain the third-leading cause of death in 2022. The war in Ukraine continues to place a harsh toll on people's lives and feeds global economic uncertainty, especially with energy prices.

The retail industry recovered quickly from COVID-19, but Inflation is now placing additional burdens on growth. Supply chains are in some cases doing better, but shortages and long waits on basic products continue.

Adding to my popular webinar series, 'The Disruptive Future of Retail', this article expands on the global economic and retail headwinds section included in the September 2022 edition. The overall presentation examined the challenges we are facing, how the retail industry is responding, and where technology will take us next.

Global Economies Facing Dramatic Slower Growth

- Details

In Part 1 of this series, we presented the latest crime statistics including the pandemic impact and the recent trends on increased violence.

In this final Part 2, we profile the criminals and their preferences. We explore retail crime scenarios with inflation and a potential recession. Finally, we summarize my thoughts (and yours) on whether retail crime is out of control and what we can do about it. The introductory picture is a big hint on the key answers.

The Who, What, and When in Retail Theft

Here are some interesting statistics profiling retail criminals from the National Association for Shoplifting Prevention:

- Details

Part 1 of 2: Latest Retail Crime Statistics and Inflation--Recession Impact

Late last year sensational ‘flash rob’ pre-holiday events elevated concerns with retail crime. “On Black Friday alone, a crew of eight made off with $400 worth of sledgehammers, crowbars and hammers from a Home Depot in Lakewood, Calif.; a group ransacked a Bottega Veneta boutique in Los Angeles; and roughly 30 people swarmed a Best Buy near Minneapolis, grabbing electronics.” In the era of social media, these events and more led to riveting television coverage (NBC Bay Area).

It’s not too early during this summer to think about the upcoming holiday season. This is part one of a two-part series on retail crime trends. What has been the impact of the pandemic? How are violence patterns evolving? What are the profiles of the crime wave? How will inflation and a potential recession impact retail crime? If retail crime is out of control, what do we do about it?

Retail Crime Statistics

- Details

Global Retail Sales, E-Commerce, Physical Stores Trends, Challenges and Headwinds

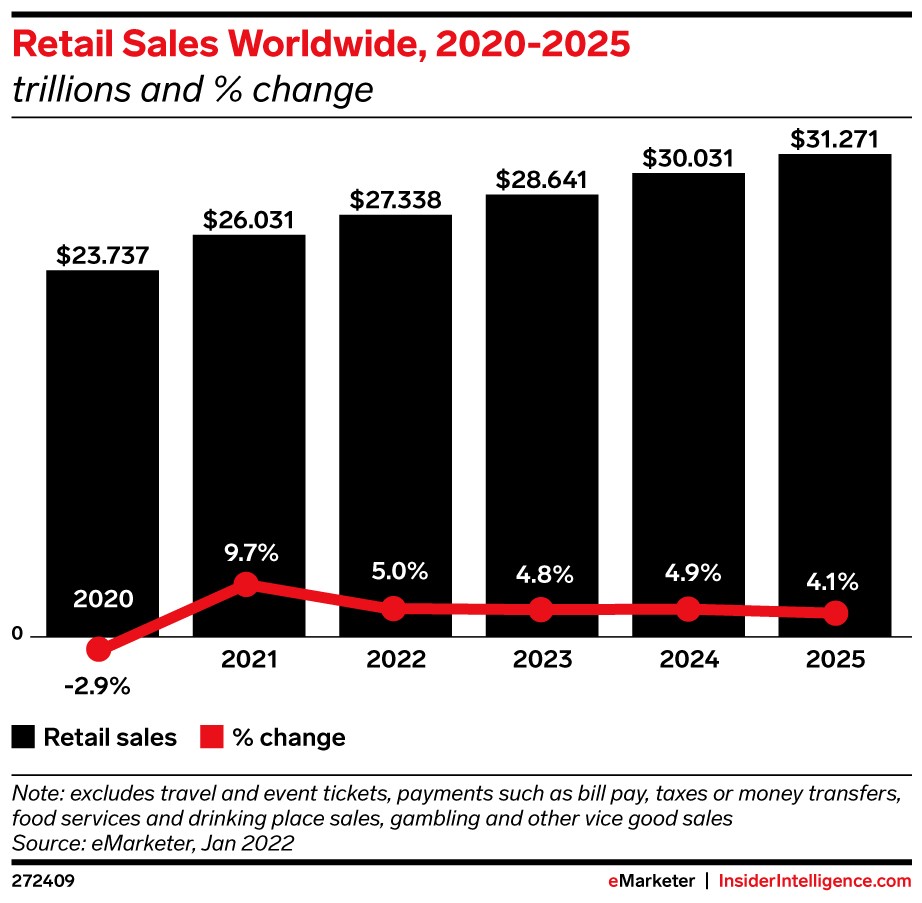

As this rockin' picture reminded me, the retail industry, even with its current negative challenging forces, remains very vibrant. 2021 confirmed that we are all resilient consumers who will continue to shop our favorite brands. In May 2021, E-marketer forecasted that retail sales globally would rise 6% to just over $25 trillion, which was a significant comeback from 2020. By the end of year, 2021 global retail sales actually grew 9.7% reaching total spending of just over $26 trillion.

2021 in-store sales grew a healthy 8.2% globally to just over $21 trillion which was more than was spent in 2019. “Pent-up demand from in-person shoppers accelerated the recovery by two full years.”

When this E-marketer research was published in January 2022, brick-and-mortar sales were projected to grow 2.6% to 3.4% for the remainder of the forecast out to 2025. More spending is expected in physical retail than ecommerce in 2022 ($702 billion versus $604 billion), despite its slower growth rate.

This article and this picture from a recent NRF trade event in Cleveland (Home of the Rock & Roll Hall of Fame) are a reminder that retail does indeed rock. It includes some of my favorite statistics on the industry and some projections on where we go from here.

Ecommerce Spikes Have Abated

- Details

With a Peek at the Top Global Technology Brands of 2022

For quite some time, I have been predicting that the future of retail will be driven by stronger branding and increased digitally influenced immersive customer experiences. COVID-19 became a major accelerator of digital transformation trends with technology often becoming the differentiator to changes in consumer loyalty.

“The pandemic ushered in an unprecedented level of channel switching and brand loyalty disruption. A whopping 75 percent of consumers tried new shopping behaviors, with many of them citing convenience and value. Fully 39 percent of them, mainly Gen Z and millennials, deserted trusted brands for new ones. That restlessness is reflected in the fact that many younger consumers say that they are still searching for brands that reflect their values.”

This article summarizes the continued importance of branding focusing on the 2022 leaders as researched in one of my favorite annual reports from Brand Directory / Brand Finance.

Strong Brands Consistently Outperform the Market

- Details

The Surprising Start of your Favorite LP Technologies

In Part 1 of this series, we explored the humble beginnings of department stores, supermarkets, and the first use of a bar code in a physical store. In Part 2, we expanded our innovation journey to discover the evolution and success of ecommerce, smartphones, and robots.

This Part 3 focuses on technologies that were originally invented to secure profit (cash register), property & high-risk areas (CCTV Camera), and consumer products (Electronic Article Surveillance or EAS).

Multiple of these originally envisioned security technologies transitioned into powerful data collection tools that optimize and increase the profitability of store operations. Great pleasure in one of my current roles to be working on next generations of multiple of the solutions in this series.

First Use of a Cash Register

It might be surprising, but the original purpose of the cash register was to stop theft. The inventor was James Ritty, a saloonkeeper in Dayton Ohio.

- Details