“The unfortunate fact is that violent incidents are increasing at our stores and across the entire industry. And when products are stolen, simply put, they are not longer available for guests who depend on them. Beyond safety concerns, worsening shrink rates are putting significant pressure on our financial results.” – Brian Cornell, Target CEO, Wall Street Journal May 21, 2023

Earlier this month Target highlighted that organized retail crime “will fuel $500 million more in stolen and lost merchandise this year compared with a year ago." Other major retailers triggering the same retail theft alarms include Home Depot, Walmart, Best Buy, Walgreens, and CVS.

The three major challenges which from discussions with technology companies and retailers have been elevated as the highest USA priorities for loss prevention are active shooter, safety, and organized retail crime. What is the latest data telling us? Is technology delivering on its solution promise? How do we ultimately solve this problem?

81% Increase in Shrink

The latest Hayes International shrink survey makes for disturbing reading on the challenges being faced by the retail industry. Among the findings from just the 26 large retailers surveyed:

- 81% of retailers reported a shrink increase in 2022.

- Total apprehensions were up 45.6% versus 2021.

- Surveyed retailers recovered over $288 million from shoplifters and dishonest employees in 2022, up 70.5% from previous year.

- The number of shoplifters apprehended was up 50.9% with recoveries totally $237 million, up 90.5%. Dollars recovered from shoplifters where no apprehension was made was $485 million which was up 44.1% in 2022.

- The number of dishonest employees caught was up 18% with over $50 million recovered, up 14.7% versus prior year.

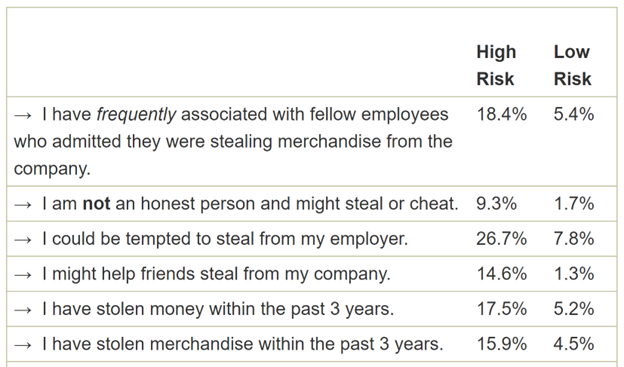

To further evaluate the severity of employee theft, every year Hayes International analyzes selected Applicant Review questionnaires (pre-employment ‘honesty tests’) given to retail job applicants which is one of my favorite sections. 64.1% of the applicants were rated ‘low risk’ and 19.3% were rated ‘high risk’ due to their admission of previous wrongdoings, and their attitudes regarding honest and dishonest behaviors.

Note the responses to some of the more interesting questions from these groups.

The average ‘high risk’ job applicant was responsible for the theft of $692.03, compared to $58.56 for the average ‘low risk’ job applicant.

Generally, the increases in theft and apprehensions reflected in the Hayes International survey are attributed to more aggressive retailer responses post the pandemic. But something has changed as reflected by the number of retail CEOs and CFOs that are now directly elevating their concerns with retail shrink.

Retail Violence Continues to Increase

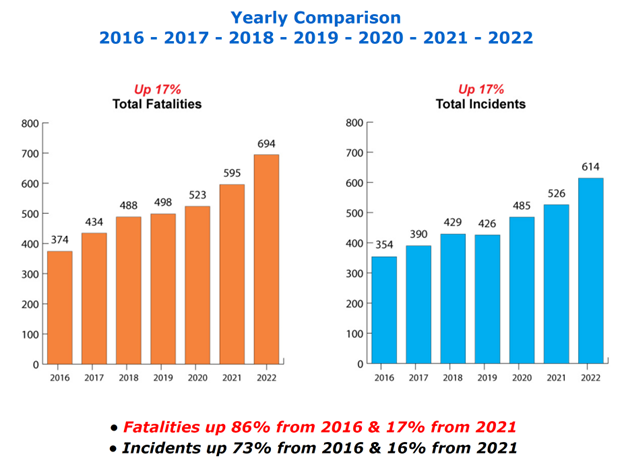

Target’s CEO is correct in stating that retail violence is increasing. The latest research summary from D&D Daily finds that retail fatalities were up 17% in 2022 and up an astounding 86% since 2016.

For 2022, 53% of those killed were in parking lots of retail stores, 43% were in-store, 3% died off premises and 1% in malls. By comparison, in 2021, 50% of the fatalities were inside a store or mall and 45% were in parking lots.

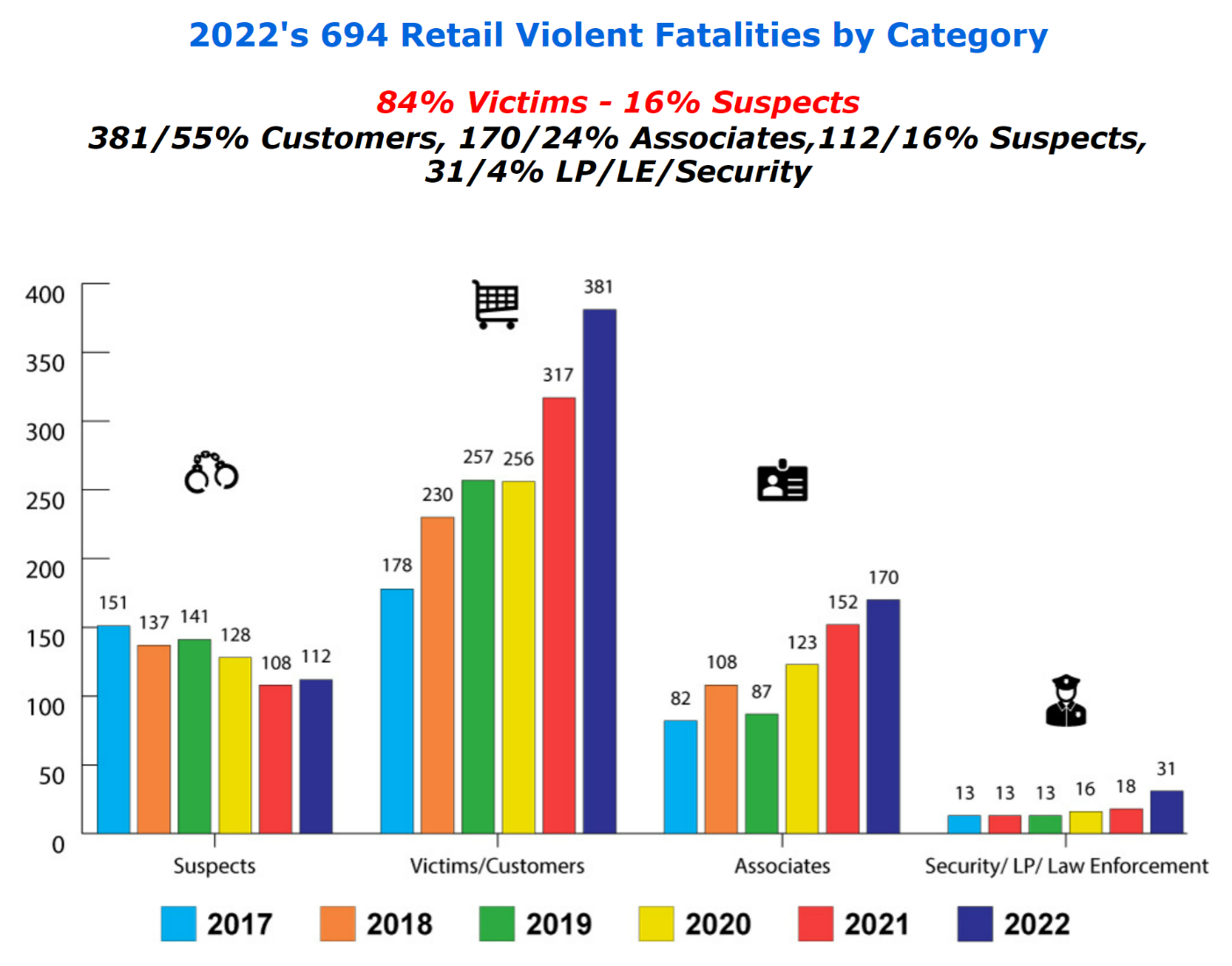

Customers or innocent victims had the highest fatalities.

For 2022, customer or innocent victims’ fatalities were up 18% and associates were up 12%. Law enforcement, loss prevention, and security personnel fatalities are up an astounding 72% compared to the previous year.

Convenience stores had 32% of the fatalities in 2022, followed by restaurants (19%), gas stations (8%), grocery (6%), and malls (5%). Same pattern in 2021 with convenience stores and restaurants being the top 2 highest risk locations.

Solving the Retail Shrink Problem

The pandemic was not kind to retail crime. In a Wall Street Journal article, a CVS spokesman indicated that the company’s drug stores experienced a 300% increase in theft, since the pandemic start.

The increase in Organized Retail Crime (ORC) compounds the problems for retail and society. Today, ORC “is leading to more brazen and more violent attacks in retail stores throughout the country. Many of the criminal rings orchestrating these thefts are also involved in other serious criminal activity such as human trafficking, narcotics trafficking, weapon trafficking, and more. Tackling this growing threat is important to the safety of store employees, customers, and communities across the country.”

Retail crime threats are real, more visible, and are getting more violent. They are also not isolated to the United States as similar patterns have emerged in other countries including the UK and Australia.

The problem is complex as are the solutions.

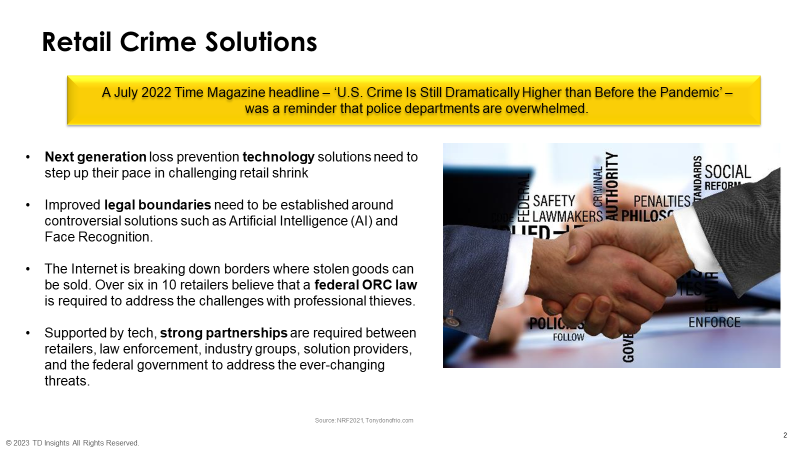

Above is a chart that I have shared in multiple public presentations across the world. Key messages:

- Retail technology solutions have not kept up with the growth of the problem. Too many silo products chasing niche opportunities, not tackling the challenges in an integrated approach which the top three priorities outlined at the beginning of this article require.

- The legal framework is stuck in the past and is not keeping pace with advancements outside the retail industry in areas that both add to the problem and help solve it.

- The Internet is both an opportunity and a curse for retail and better solutions are needed to address the challenges introduced by the World Wide Web into the retail model.

- Connectivity across interrelated frameworks is the new required normal. To effectively tackle the problem of retail shrink, strong partnerships are needed across these boundaries, especially between retailers and law enforcement. The good news, successful models are in place in various parts of the world, but it will take different more innovative thinking to evolve to broader global adoption.

Locking up merchandise to reduce shrink reduces revenue and increasingly drives consumers to alternate retail models. Safety needs to be our number one priority in whatever path we take to address the problem.

The pandemic accelerated negative trends across industries which were already underway. It is time, to reinvent retail once again to a brighter more profitable future where shrink is managed and consumers are the center of immersive, safe customer experiences.