Retail

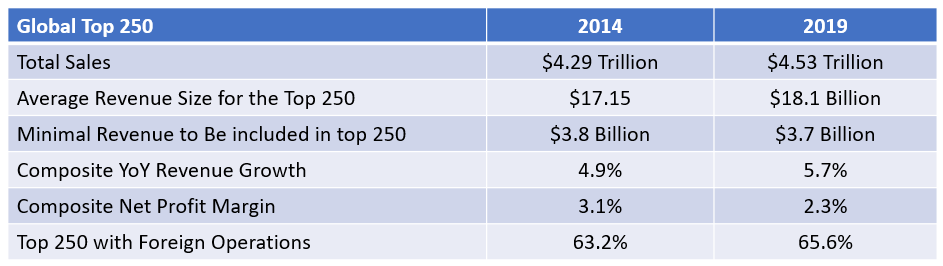

Annually I look forward to the Deloitte Global Powers of Retailing industry research which provides a detailed growth trajectory review of the global top 250 retailers. This year, in addition to summarizing my favorite insights from the 2019 edition, we will look back to the 2014 report to compare and contrast the changes in the retail industry over the last five years.

All the metrics presented in this article are from these two Deloitte industry leading reports. A thought-provoking technology disruption chart from the 2014 report is also included in this post for all of us to assess the retail industry's innovation progress.

The Global Powers of Retailing

The data in the latest report indicates that the global top 250 retailers grew roughly six percent and represented $4.53 trillion in retail revenue.

Note the slight decline in minimal revenue to be included as a top 250 retailer. The industry overall had stronger revenue growth in 2019 versus 2014, but sacrificed margin in the process. Contrary to recent popular presumptions, the percentage of retailers with global operations increased in the latest report.

The Rise of Amazon in the Global Top 10

- Details

Over the last several months I have had the pleasure of spending time with Asset Protection (AP) leaders at Macy's in New York. The visits were sparked by news articles and industry discussions on their advanced deployments of RFID and the smart integration of this Internet-of-Things (IoT) technology into the loss prevention function.

The Retail Benefits of RFID

The primary driver for the deployment of RFID is to improve inventory accuracy. Generically, across the retail industry, "RFID enables cycle counts to be completed about 25 times faster than traditional manual bar code scanning. Frequent, accurate cycle counts improve inventory accuracy, typically by 20 to 30 percent, allowing a number of retailers to achieve 99 percent inventory accuracy. This enables replenishment alerts to be reliably generated, increasing on-floor availability, and decreasing out-of-stocks (OOS), typically by 15 to 30 percent. This in turn results in sales uplift in the range of 1 to 10 percent or more for those categories."

While inventory visibility is the number one benefit of RFID, in multiple industry studies, loss prevention is always near the top as a primary application. Here is an example from the 2018 Technology Outlook in the Apparel Market research.

- Details

38,000+ Attendees, 16,000+ Retailers, 800+ Exhibitors, 100+ Sessions, 99 Countries

Let me open by sharing the video summary provided by the USA National Retail Federation (NRF) of this year's edition.

This entire week, over all my social media platforms, I am publishing multiple other NRF 2019 summary reviews. Primarily from an Expo floor perspective where billions of innovation dollars are being invested, here are my impactful retail transformational takeaways.

IoT is not Just a Buzzword

NRF 2019 confirmed that the Internet-of-Things (IoT) is moving from a buzzword to solving industry problems. Solutions were visible all over the Expo floor.

- Details

The future of retail includes digitally supported leadership branding coupled with hyper-personalized immersive consumer experiences. Of all the stores that I have visited to date around the world, the Nike House of Innovation in New York City, is the closest example that meets this critical futurist success formula.

Covering over 68,000 square feet (6,373 square meters), this new Nike flagship offers six floors of differentiated physical to digital experiences. Each floor could be a store of its own. Combined, this location is designed to meet the ever changing needs of a digitally empowered consumer.

Before taking a virtual tour of the store, let's remind ourselves of why shoppers buy in physical stores (IHL study):

The Smartphone as the Portal to the Physical Store

- Details

Welcome to an uncertain and conceivably risky 2019. Despite multiple global hints of slower growth, I remain optimistic by the potential of the New Year.

On the horizon are multiple statistical landmarks that will "concentrate our minds". In 2019, half of the world will be online, India's GDP will overtake that of the UK, Nigeria's population will reach 200 million, and in USA millennials will outnumber baby-boomers to become the country's largest generation for the first time.

Inspired by one my favorite annual Economist editions, "The World in 2019", this post summarizes important global economic forecasts and looks at a few emerging risks. Timely to the upcoming NRF 2019 in New York, we will also discuss expected technology disruption and the positive prospects for the global retail industry in the New Year.

Economic Indicators Point to Continued Global Growth

- Details

This past week had the opportunity to visit the new Amazon Four-Star physical retail store in New York City. Located in the chic Soho neighborhood, collectively the items in this store have an average rating of 4.4 stars.

This past week had the opportunity to visit the new Amazon Four-Star physical retail store in New York City. Located in the chic Soho neighborhood, collectively the items in this store have an average rating of 4.4 stars.

Visually let's walk through the store, read some early reviews, and understand why this is a worthy customer experience experiment on the road to the future of retail.

The Four-Star Reviews Are In

"It had $20 kitchen mittens resembling dog paws, $16 USB cables, a corn kernel stripper for $7.99, a $15 mug that reads “Believe in yourself.” Oh, and some Alexa stuff...sell quirky, random items - not low-price, everyday household goods - i.e. it isn't directly competing with Walmart or Target." - BuzzFeed

- Details

Five Reasons FREITAG Epitomizes the Future of Retail

Retail inspiration can be found in every corner of the world and for this blog post we visit Switzerland. FREITAG is the quiet Zurich based fashion accessory brand selling over 300,000 of its unique products across the globe every year.

"In 1993 graphic designers Markus and Daniel Freitag were looking for a functional, water-repellent and robust bag to hold their creative work. Inspired by the multicolored heavy traffic that rumbled through the Zurich transit intersection in front of their flat, they developed a messenger bag from used truck tarpaulins, discarded bicycle inner tubes and recycled car seat belts.” Their first core product became a designer bag with a conscience.

- Details

Frictionless secure commerce coupled with immersive customer experiences have been on my mind for some time. Engaging with an in-store geolocation security company and new updated data on internet connectivity, growth of smartphones, and the Internet of Things (IoT) inspired this post.

Frictionless secure commerce coupled with immersive customer experiences have been on my mind for some time. Engaging with an in-store geolocation security company and new updated data on internet connectivity, growth of smartphones, and the Internet of Things (IoT) inspired this post.

Future consumer in-store interactions will include autonomous digital conversations with physical products. As discussed in a previous post, increased digital interactions will create brand ambassadors of both consumers and store associates.

For those individuals focused on securing commerce, that same digital exchange will lead to innovative applications such as geolocation solutions that will dramatically reduce retail crime. As an example, the geolocation security company mentioned above has so far in 2018 taken nearly 600 criminals off USA streets and led to the recovery of over $5 million of in-store physical assets.

- Details

Welcome to Dubai or as CBRE calls it, the key stepping stone for international brands entering the Middle East. Over the next three years, more than 1.5 million square meters of new retail space could be delivered to the Dubai market, adding roughly 50% to existing inventory.

Being on the Board of Advisors for the upcoming Dubai Smart Stores Expo and having personally experienced the vibrancy of Middle East on multiple occasions, it is time to revisit this region and explore its global retail possibilities.

The Digital Transformation of the Middle East

- Details

The State of Retail RFID

Retail is not dying. Today's consumers are being presented by an increasing number of shopping options. Online versus in-store engagement trends are converging and technology is increasingly the differentiating element.

A recent IHL research study titled "Out-of-Stock, Out of Luck - How Retailers Alienate Customers and Lose Billions Due to Poor Inventory Practices" prompted this relook at retail RFID. The top answers as to why consumers still prefer to shop in-stores include: want / need the product immediately, desire to touch and feel the item (try it on), don't want to pay expedited delivery charges, support local retailers, and convenience / easier than online.

Fast checkouts and products being in-stock are the two most relevant components of positive instore experiences.

A Different Kind of Amazon Effect

- Details