Retail

The Surprising Start of your Favorite Retail Formats and Technologies

Can you imagine shopping in a retail store without bar codes or a cash register? In this first of a series of articles, we explore the evolution of retail -- from store formats to the continuous innovation and deployment of new technologies.

Who created the first supermarket and department store and how are these sectors performing today? From humble beginnings where are we today with technology innovations such as bar code scanning, the cash register, self-checkout, RFID, CCTV cameras, robots, drones, and much more?

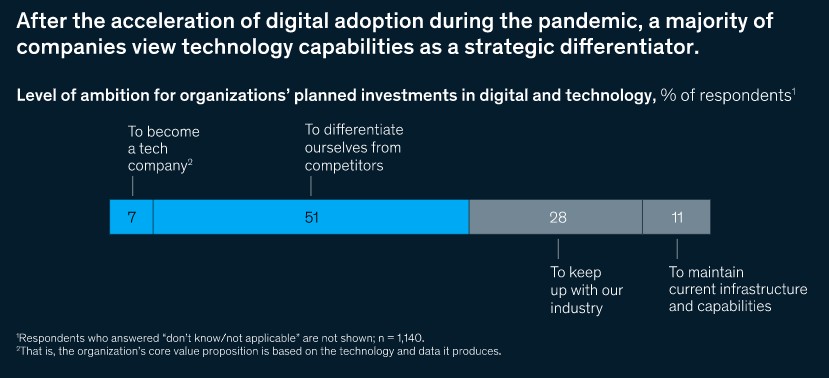

As McKinsey recently summarized, “the pandemic has dramatically increased the speed at which digital is fundamentally changing business.”

Fifty-one percent of companies are leveraging digital technologies, multiple of which are discussed in this series of articles, as strategic differentiators from competitors.

Let us start with store formats and that first consumer item scanned in a retail store.

The First Department Store

- Details

Attending NRF 2022 in New York last week on multiple levels was surreal. Three live offsite events that I attend every year were either cancelled, postponed to virtual or had last minute changes in locations due to COVID restrictions. Flights and hotels were changed three times to accommodate weather challenges in the South and the evolving customer meetings scheduled for the Big Show.

Multiple of the sessions that I attended had more people that I expected. Yet the main show floor was eerily empty of major exhibitors. Much innovation inspiration was possible by spending time in the busy innovation and start-up zones in the lower level.

Turns out fewer major booths and quality time with retailers more than offset initial COVID concerns. NRF did a great job with masks, using Clear to validate vaccinations, and providing COVID test kits to increase safety. The Big Show on some levels was actually getting too big and 2022 was a refreshing opportunity to moderately transition to the next phase of retail as we continue to emerge out of the pandemic.

Retail's Resiliency on Display in New York

- Details

Amazon 4-star - London UK

Jeff Bezos had a few amazing tricks up his sleeve as he originally wanted to name the company 'Cadabra'. Amazon's first lawyer talked him out of it as the name sounded too similar to 'cadaver', especially over the telephone. When the company was founded on July 5, 1994, Bezos settled on the name Amazon because it started with the letter A and its association with the largest South America River.

Even though the original company focused on selling books online, Bezos' vision was always to become the 'everything store.' Fast forward to June this year, Amazon is now the most visited e-commerce website in the United States, with nearly 2.5 billion monthly visits. To put it in perspective, that is more than the next six major retailers online traffic combined.

"Beginning with booksellers, the e-commerce giant has expedited the closure of many retailers and threatens to redefine the standards of shopping in a digital world. Retailers are forced to lower prices, optimize their systems and processes, and reduce profit margins in favor of competition; meanwhile, Amazon continues its trek toward dominance. First coined in 2012 by Steve Weinberg, this is the Amazon Effect."

As we enter a new year, what is the status of the Amazon Effect? Is next year the end of physical retail? What are the key strategies to win the future of retail?

The Amazon Effect is Here to Stay

- Details

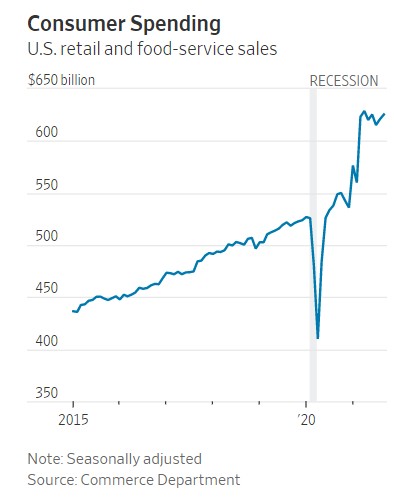

Good news this month as reported in the Wall Street Journal that USA retail sales in September increased 0.7% from the previous month and are running 13.9% ahead of same time last year. Bad news that one of the contributing factors to this growth is inflation which increased 5.4% in the same period.

On the retail sales front, we are well past the pandemic lows and growth has robustly returned. Call it "revenge spending" or pent-up demand, shoppers are once again eagerly shopping online and in-store and looking forward to a positive holiday season.

eagerly shopping online and in-store and looking forward to a positive holiday season.

Contrary to this USA trend, retail sales in Europe slowed in August rising only 0.3%, after a sharp decline in July of -2.3%. The other very important global retail economy of China had August sales rising 2.5% which a deterioration from July's 8.5% increase. For the year, China's retail sales are expected to grow 15%.

As we approach the critical 2021 retail holiday season, "uncertainty" seems to be the operative word. What are the latest holiday forecasts? Will Santa Claus arrive on time with all those presents? Will the Grinch steal Christmas?

Digital Retail Sales Influence Globally is Here to Stay

- Details

While dealing with the Delta variant and continuing to recover from the COVID-19 health crisis, the hot days of August is a good time to ponder the economic and retail predictions for the balance of 2021.

The global economy is quickly recovering from the impact of the COVID-19 pandemic, with growth likely to approach 6% in 2021 and continue at 4.6% in 2022. However, while the global economic recovery from the COVID-19 recession has shown strong rebound effects, global output is still expected to remain as much as 2% below the pre-pandemic forecast up until 2023.

Brick-and-mortar sales generated over $18.5 trillion in the United States in 2020. After the past few months, I predict that we will see similar exciting changes across the retail industry starting in advanced economies. The USA National Retail Federation (NRF) raised their 2021 forecast in June and predicted that this year will be the fastest retail growth year since 1984. On the other side of the world, in an equally important large economy, China retail sales are projected to increase 14.7% in 2021.

The Steady Recovery of the Global Economy in 2021

- Details

RFID has been around for years in the retail space — in fact, I’ve been writing about RFID in retail since as early as 2012 — with more recent articles focusing on the adoption trends at Nike and Walmart. As I discussed in January this year, the pandemic has become an accelerator of RFID adoption in retail with stores taking a central role with online orders fulfillment.

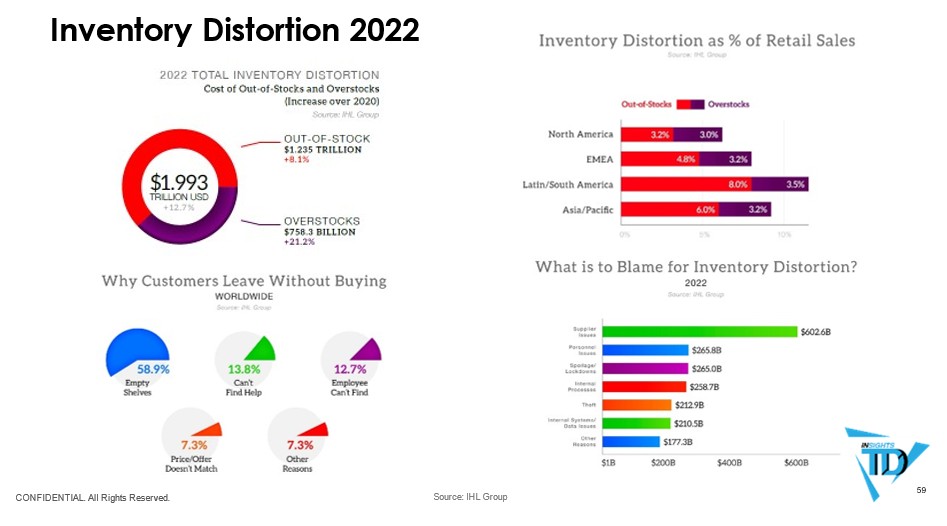

Accurate inventory has been a challenge for retailers for some time. According to a 2020 IHL Group report, inventory distortion worldwide is a $1.8 trillion problem or the equivalent of 10.3% of same store sales in retail and hospitality. “Or to put it another way, more than the annual GDP of Canada.”

the equivalent of 10.3% of same store sales in retail and hospitality. “Or to put it another way, more than the annual GDP of Canada.”

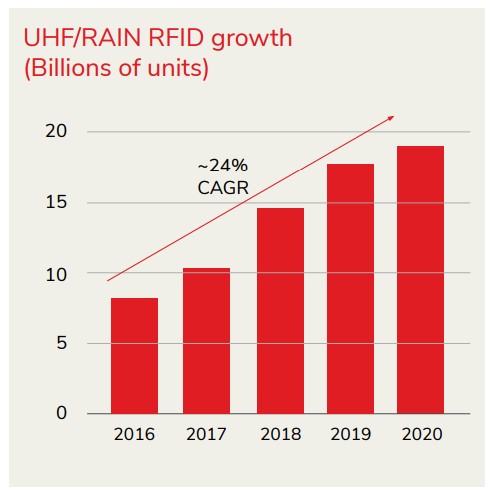

RFID is one of three very important technologies that play a key role in addressing the problem of inventory distortion. While apparel has led the charge in the adoption of RFID technology for inventory control, other retail sectors are quickly expanding their activities. As summarized by IDTechEx, note the trajectory of UHF/RAIN RFID labels in retail in the last several years.

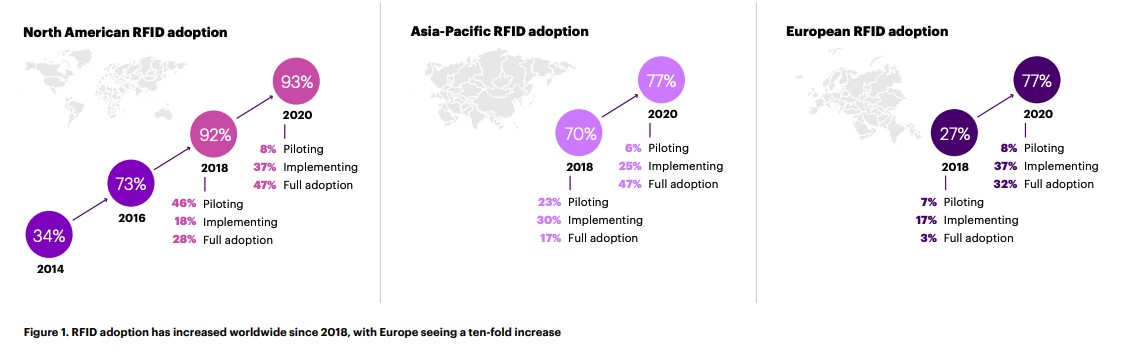

North America leads the trend of RFID adoption with 93% of retailers reporting that they use RFID in various stages of deployment. Positive to see that other markets around the world are also accelerating their deployment rates. By looking at the rate of full adoption of RFID, rather than just piloting or implementing, North America, Europe, and Asia-Pacific have all seen substantial increases in the use of RFID since 2018.

More adaptive retailers are discovering new applications of RFID, such as streamlining omnichannel offerings like BOPIS (buy online, pick up in-store) and improving supply chain visibility and self-checkout. In the past two years alone, the omnichannel options retailers offer have increased significantly, with 66% of RFID adopters and piloters offering five or more services, like BOPIS, ship from store, ship to store, reserve in-store, mobile app purchasing, and home delivery.

Why RFID is the Next (and Current) Big Thing

- Details

This past week I had the opportunity to spend quality time with a leading computer vision company headquartered in Ireland. As an advisor to this company, I have been lucky enough to see their transformation from a single application to a portfolio of retail visual innovative disruptive solutions that will enter the marketplace in the balance of this year.

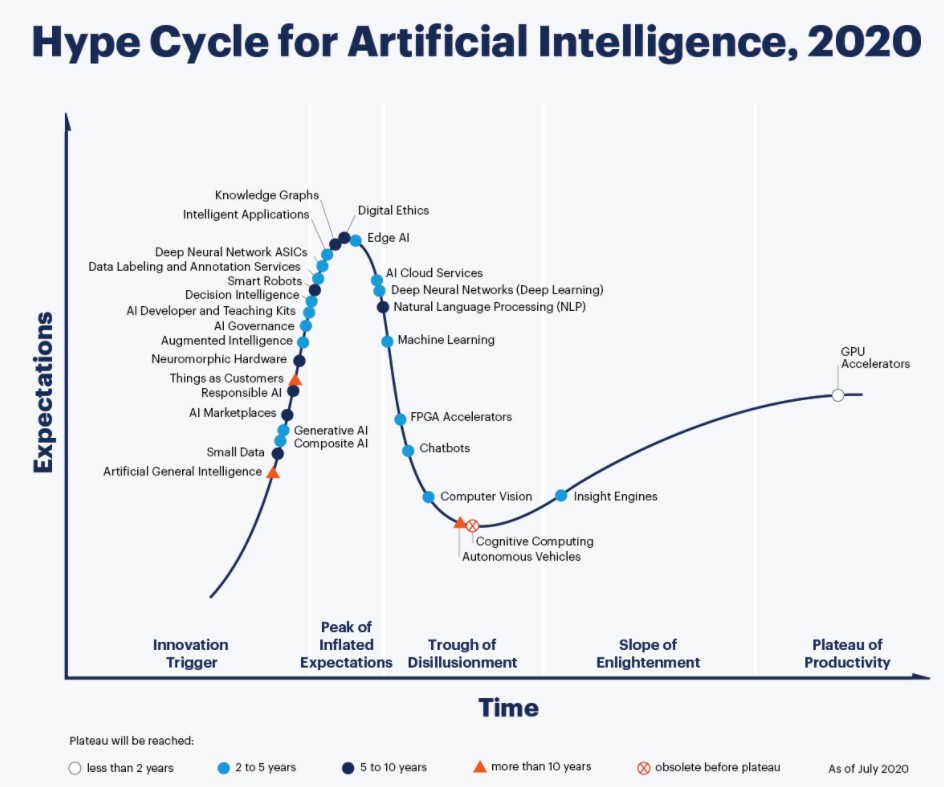

Concurrently, I remembered where Gartner placed computer vision in the Hype Cycle of Artificial Intelligence, 2020.

As you can see, Gartner has Computer Vision in the ‘Trough of Disillusionment’ reaching the ‘Plateau of Productivity’ in 2 to 5 years. Based on my retail industry observations over the last several months and this past week, powerful computer vision solutions are arriving much sooner to a store near you.

In 2021, the major milestone of over 1 billion CCTV cameras installed around the world will be reached. What started as a security technology to prevent crime, the video camera is now a major visual data gathering device that will transform all industries including retail.

All Those Cameras Have Data Eyes

- Details

On many fronts, 2020 was a challenging year for the retail industry. During the early days of strict lockdowns to slow the spread of the coronavirus, governments around the world categorized some retailers as “essential” and others as “nonessential,” leading to a $285 billion transfer of wealth from nonessential retailers to essential retailers and a $250 billion transfer of wealth from small retailers to larger companies. This created a massive shock to the worldwide economy with GDP levels initially dropping 30% or more.

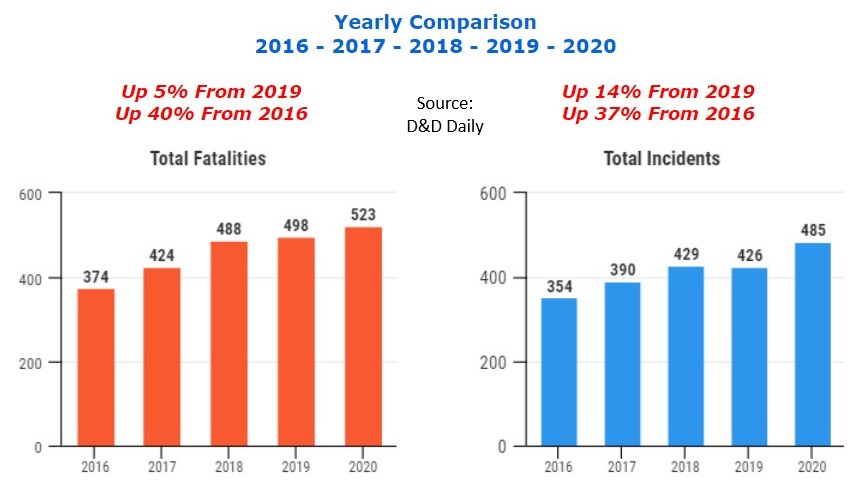

Even with widespread store closures, the United States saw an increase in retail fatalities and violent incidents in brick-and-mortar retail stores. In 2020, 485 violent incidents, up 14% from the previous year, led to 523 fatalities, up 5% from 2019. Customers, store associates, and security personnel made up 76% of the victims with the remaining 24% being suspects.

Even with widespread store closures, the United States saw an increase in retail fatalities and violent incidents in brick-and-mortar retail stores. In 2020, 485 violent incidents, up 14% from the previous year, led to 523 fatalities, up 5% from 2019. Customers, store associates, and security personnel made up 76% of the victims with the remaining 24% being suspects.

Managing new health and safety policies to fight the pandemic and violent incidents in retail stores elevated the importance of physical security in the retail industry. As with all other sectors, security was also impacted by the acceleration of digital trends that were already underway prior to COVID-19. The security “new normal” will include these top 5 physical security trends in retail to watch in 2021 and beyond.

Innovative Uses for Existing Security Technologies

- Details

Despite the coronavirus pandemic’s impact on how we work, shop, and entertain ourselves, the retail industry has managed to adapt in the face of these challenges. Although e-commerce has played a bigger role in retail sales than before the pandemic, the “retail apocalypse” has been largely overstated. In fact, with brick-and-mortar sales generating over $18.5 trillion in the United States in 2020, I anticipate that the physical store will continue to act as the epicenter of the post–COVID-19 retail experience.

The Retail Store in 2021 and Beyond

For nearly a decade, e-commerce has been seen as a threat to traditional retailers, positioning online retailers as more capable of meeting growing consumer expectations for convenience and affordability. But the retail industry is nothing if not resilient. Faced with reduced in-store shopping due to widespread social distancing and stay-at-home orders, retailers turned to newer solutions like curbside pickup and buy-online-pickup-in-store (BOPIS).

One-third of retailers also reported investing in solutions to facilitate in-store pickup and returns for online purchases, offering customers the speed of brick-and-mortar retail with the convenience of online shopping.

- Details

A Wall Street Journal article this weekend on robotics coming to a garden near you brought back memories of my office in Neuhausen am Rheinfall in Switzerland. Every afternoon, while doing the continuous string of international conference calls, I would observe a robot mower in the yard outside my window. The autonomous roamer would emerge from its electrically protected doghouse, run Swiss precision patterns across the lawn, and when finished return to its home to recharge.

This memory, plus the long string of articles below published in the last week on retail robotics inspired this article.

>> Domino's testing pizza delivery by self-driving robot car in Houston'

>> Chick-fil-A tests robot delivery in Southern California

>> Kroger is Amassing a Robot Army to Battle Amazon, Walmart

>> Save Mart kicks off pilot of shelf-scanning robots

>> Gap rushes in more robots to warehouses to solve virus disruption

>> Alibaba Group Xiomanlv delivery robots hit Chinese Universities

>> Your Drone-Delivered Coffee is (Almost) Here

Above seems to be counter to Walmart's announcement late last year that it was stopping its deployment of aisle scanning robots after installing them in hundreds of stores. Was the Walmart decision an anomaly in the growth of robots in retail? What role are robots playing in E-commerce? How has the pandemic impacted the trajectory of robotics? What's in-store for retail robotics?

Lessons from the Walmart Aisle Computer Vision Experiment

- Details