Several weeks ago I had the pleasure of participating in a Rethink Retail podcast with Bryan Gildenberg, Chief Knowledge Officer of Retail, Sales & Shopper at WPP’s Kantar Consulting and Paul Lewis, CMO of digital transformation agency Valtech. With Julia Raymond moderating, the three of us debated the growth strategies of Amazon and Walmart in their quest for global retail leadership.

The lively discussions included our musings on Amazon's announcement of one-day shipping, the value of the Amazon's Prime program, potential acquisition strategies for growth, and the looming online grocery battles. This post summarizes additional data insights not discussed in the podcast.

Amazon Strengths

Here's my short list of Amazon strengths that I had summarized in preparing for the podcast:

- Prime Program - More than 100 million people have signed up for paying the subscription to Amazon Prime. The program covers more than 60% of USA households. It is estimated that Prime members spend 4.6x more than non-Prime members. On multiple levels, subscription programs are an important component for differentiation in building brand ambassadors in the future of retail.

- Media investments - A connected world means that every company needs to think and execute like a media company. Amazon already has 26+ million USA viewers of video content on Prime.

- Voice investments - USA smart speaker owners rose 40% in 2018 to reach 66.4 million with total smart speakers in use rising to 133 million. Amazon Echo maintains a 61% market share among smart speaker owners while Google Home closed the gap by rising 5.5% to a 24% share. Voice is an important channel in the future of retail.

- E-commerce Leadership - For 2019, Amazon will retain its dominance of the USA ecommerce market, commanding 47.0% of sales this year. For 2019, Amazon's ecommerce business is projected to grow 20.4% to reach $282.52 billion. And the company now commands 5.1% of the total US retail market.

- Ad Revenue - "eMarketer, which pegs the U.S. digital ad market at $111 billion, forecasted that Amazon would surpass Microsoft in USA advertising revenues in 2018, moving into third place behind Google and Facebook."

- New Formats - The acquisition of Whole Foods, new formats such as the "4-Star" and Amazon Go cashier-less stores as extensions from click to brick retail models.

Amazon Opportunities

- Whole Foods - As partially discussed in the podcast, Amazon has not fully leveraged Whole Foods in both growing Prime memberships and also as a stronger entry point into grocery. The "4-Star" physical stores are a better attempt at linking Prime membership growth to physical stores.

- Late to key markets - India and China will continue to be key markets for the future growth of retail. Amazon entered China in 2004 with an acquisition reaching 15% market share at its pinnacle. In April 2019, it pulled out of China as its market share had dropped to 1%.

Walmart Strengths

- Physical Stores - Walmart operates over 11,700 physical stores around the world with over 5,000 of these stores are in the United States. Stores are a very valuable asset in the brick to click business mix.

- Presence in key growth markets - Walmart have over 430 retail stores in China. They also made a $16 billion ecommerce investment in acquiring Flipkart in India. Combined, India and China have over 2.7 billion people or potential shoppers.

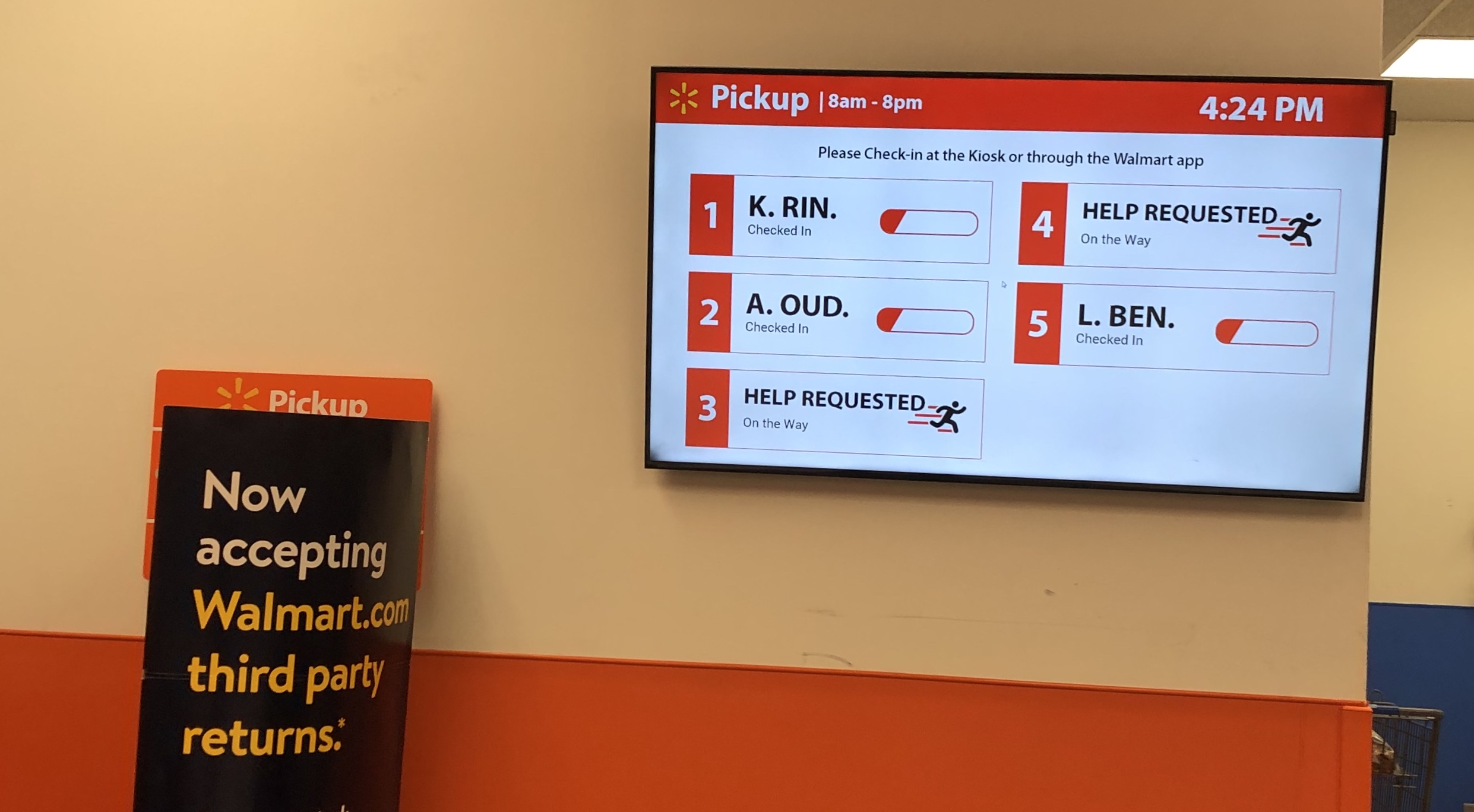

- Grocery - As discussed in the podcast, grocery is one of the most important growth sectors for online retail. Walmart now has 2,450 pickup locations and 1000 stores that deliver groceries the same day they are ordered. By the end of the year, the company expects those numbers to climb to 3,100 and 1,600 respectively. The percentage of online grocery shoppers using Walmart has grown from 25.5% last year to 37.4% in the latest survey.

The Last Mile of Free Delivery

Mentioned in the podcast, but worth restating with more data China is farther ahead in digital transformation models.

- 70% of packages in China are already delivered the same day. JD.com offers one day or half day delivery options, along with a "white glove" high end service. One day shipping from Amazon is a transitionary step.

- This month Alibaba announced a strategic alliance with Auchan Retail and Taiwanese conglomerate Ruentex Group to expand their global "New Retail" ecommerce model. Ruentex runs the biggest hypermarket chains in China. Auchan Retail operates in 17 countries with over 3700 physical stores.

- Alibaba and JD.com have nearly 84% market share of the booming China ecommerce market. Worth remembering that over 600 million people shopped online in China in 2018 versus just over 220 million in USA. It is only a matter of time before China's digital ambitions grow global.

Not to be outdone, post the Amazon one day shipping announcement, Walmart announced that it plans to make free next-day delivery available to 75% of the USA population by the end of this year.