In an article published in November, we discussed the following five ingredients driving the age of disruption: geopolitical risks ahead, need for technology speed, data as the new oil, next generation consumers, and shopping till you drop. Reverse globalization is a subplot of these trends impacting many industries including retail.

In an article published in November, we discussed the following five ingredients driving the age of disruption: geopolitical risks ahead, need for technology speed, data as the new oil, next generation consumers, and shopping till you drop. Reverse globalization is a subplot of these trends impacting many industries including retail.

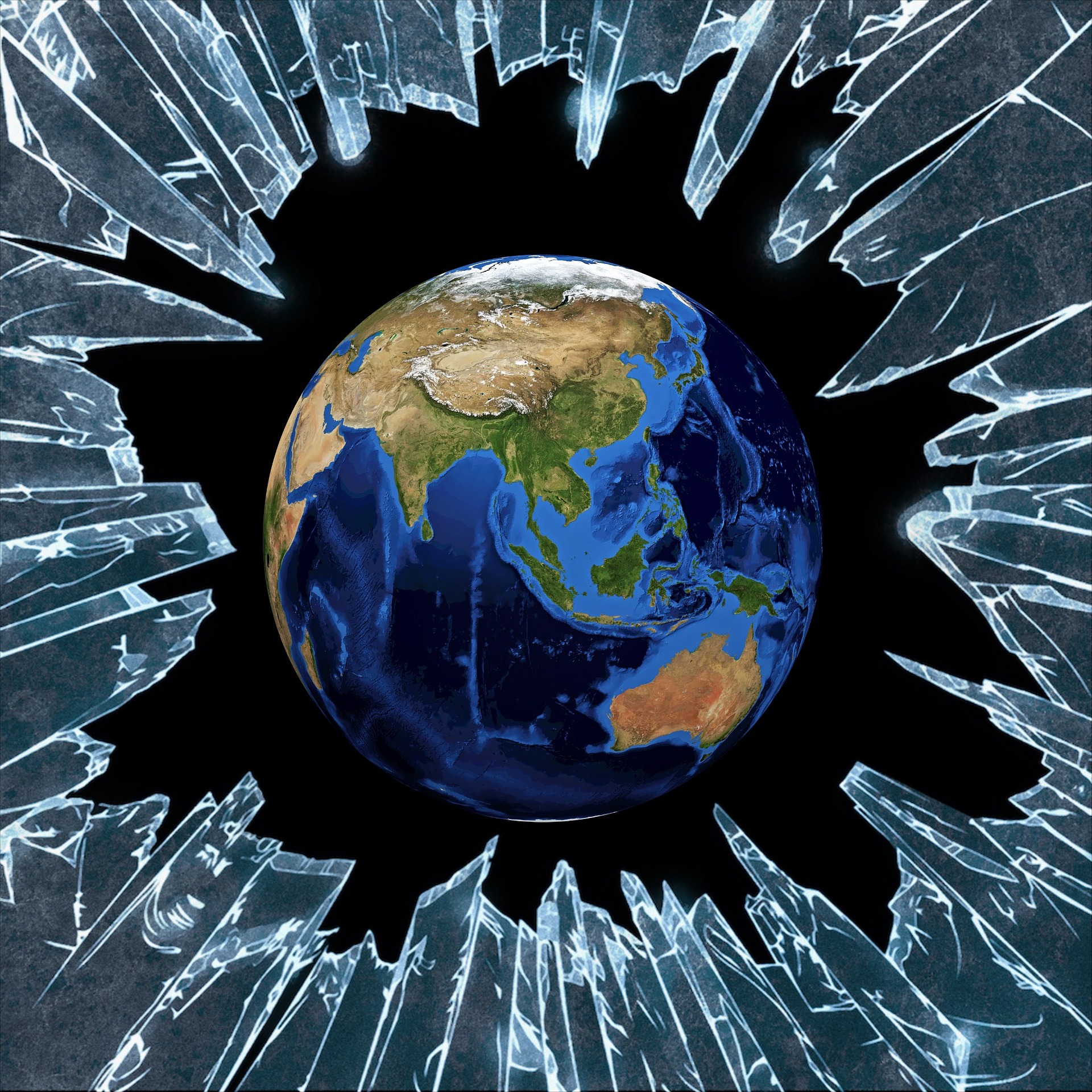

The Globalization Retreat

Recent publications highlighted the following challenges facing globalization:

-- Multinational companies employ only one in 50 workers around the world. However, a few thousand firms influence what billions of people watch, wear, and eat. These companies represent over 50% of all trade. In the past five years, the profits of multinationals have dropped by 25%. Return on capital is the lowest in two decades. About 40% of these companies have a return on equity of less than 10%.(1)

-- While multinational represent only 2% of the world's jobs, they make up 40% of the value of the West's stock markets, and they own most of the intellectual property. (1)

-- In 2016, multinational' cross border investments fell 10-15%. The proportion of Western companies' sales outside their home region has shrunk. (1)

-- For companies in OECD countries, foreign profits are down 17% over five years. USA firms suffered less with a 12% drop because of their bias towards technology companies. For non-USA companies, the drop is 20%. (1)

-- Multinational companies based in emerging markets are also challenged. Their worldwide ROE is only 8%. (1)

-- Between 2009 and 2013, only 5% or 400,000 net jobs were created by USA multinational companies in the home country. (1)

-- Between 2011 and 2015, the value of global merchandise exports contracted 10%, the largest drop over a four year period since World War II. (2)

-- A hot trend in 2016 was dismantling giant container ships with 862 taken offline. (2)

-- Global Trade Alert tracks nearly 7000 protectionist measures enacted worldwide since the recession of 2009, with half aimed at China. (2)

-- It's been 23 years since the completion of the last global trade deal with no other currently in site. (2)

The Globalization Turning Point

"Humanity spent the last 50 years globalizing." In that time span was the rise of Japan as a major export country, followed by China as the factory of the world, and the growth of mega retailers such as Walmart as logistics innovators.

The beginning of the end of globalization was the financial crisis of 2008. Renewable energy, additive manufacturing (3D printing), virtual reality, and indoor agriculture are four technologies highlighted in a recent Forbes article that are slowly reversing globalization.

Globally Dressing for Success

Apparel and accessories retailers are the retail sub-sectors with the highest level of globalization. According to Deloitte's latest "Global Powers of Retailing", foreign markets accounted for nearly one-third of the sector's composite retail revenue, compared with less than one-quarter for the Top 250 global retailers overall. The average company had a presence in 26 countries, far more than all other product sectors.

The New Retail Supply Chain Rules

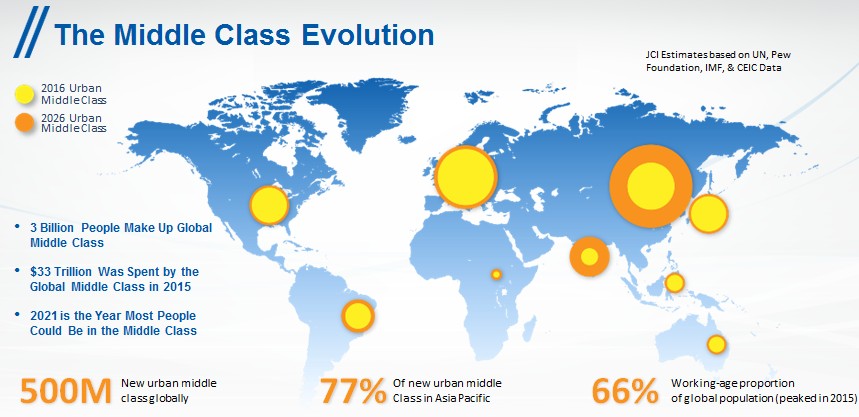

Consumer tastes, e-commerce growth with online innovators such as Alibaba and Amazon, the growth of the middle class in key regional markets, and disruptive technologies require a major re-think in global supply chains. The new rules are "make/buy it" anywhere, "move it" anywhere, and "sell it" anywhere.

The impending world order will require a "mix of hyper-localized supply chains integrated with an Omni-channel and e-commerce focus on regional and global markets."

The Reverse Globalization Growth Opportunity

Reverse globalization is both a challenge and an opportunity for retail. Centralized decision making will be still be important in continuously improving the value of the core brands.

Flexibility will be required in adapting customer experiences to regionally expanding middle class markets. Supply chains and engagements with consumers will increasingly be local.

New technologies such as robotics will make it easier to adapt supply chains to regional markets at decreased costs. The new realities will include constantly mitigating geopolitical risks, increasing new technology adoption speed, and leveraging more data to streamline shopping across a myriad of Omni-channels

Provided your particular brand has global cache, reverse globalization will not stop the new tech savvy consumers from shopping till they drop. With proper regional execution, reverse globalization can be turned into a major retail growth opportunity starting in Asia and other emerging markets.

(1) The Economist, January 28, 2017 / (2) Wall Street Journal March 30, 2017