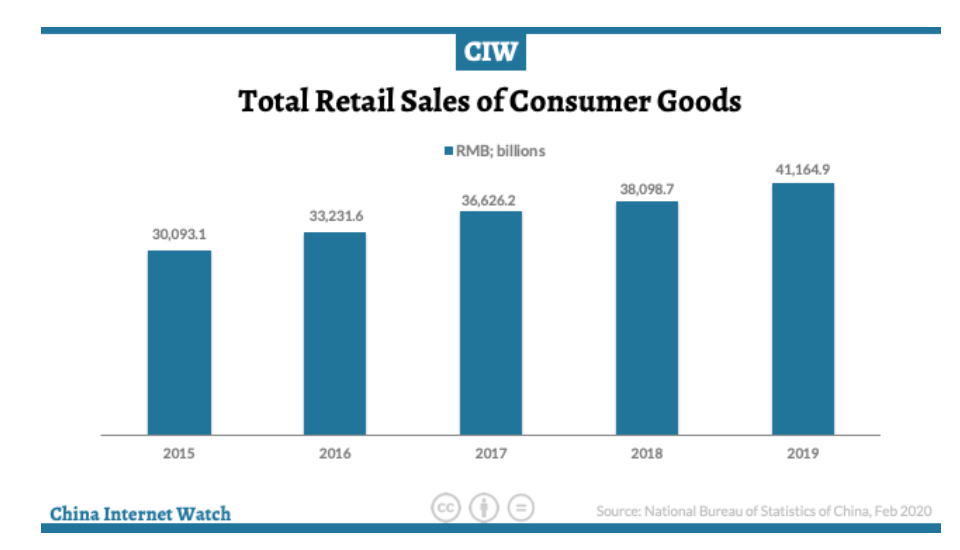

In 2019, China was projected to surpass the United States to become the world's largest retail market. On November 11, 2019, Alibaba celebrated a record $38 billion in online retail sales during the Singles' Day 24-hour shopping holiday.

Because of the USA trade wars and subsequently COVID-19, the euphoric rise of China in being THE number one country in retail has been delayed. Notwithstanding this ascension, China continues to be the digital laboratory for the future of retail.

In this article, we explore a few of the China emerging technologies deployed during the lockdown which have a direct impact on retail. Next, we look at the digital innovation steps leading to the reopening of a "new normal" retail industry.

There's an App for That Pandemic Track

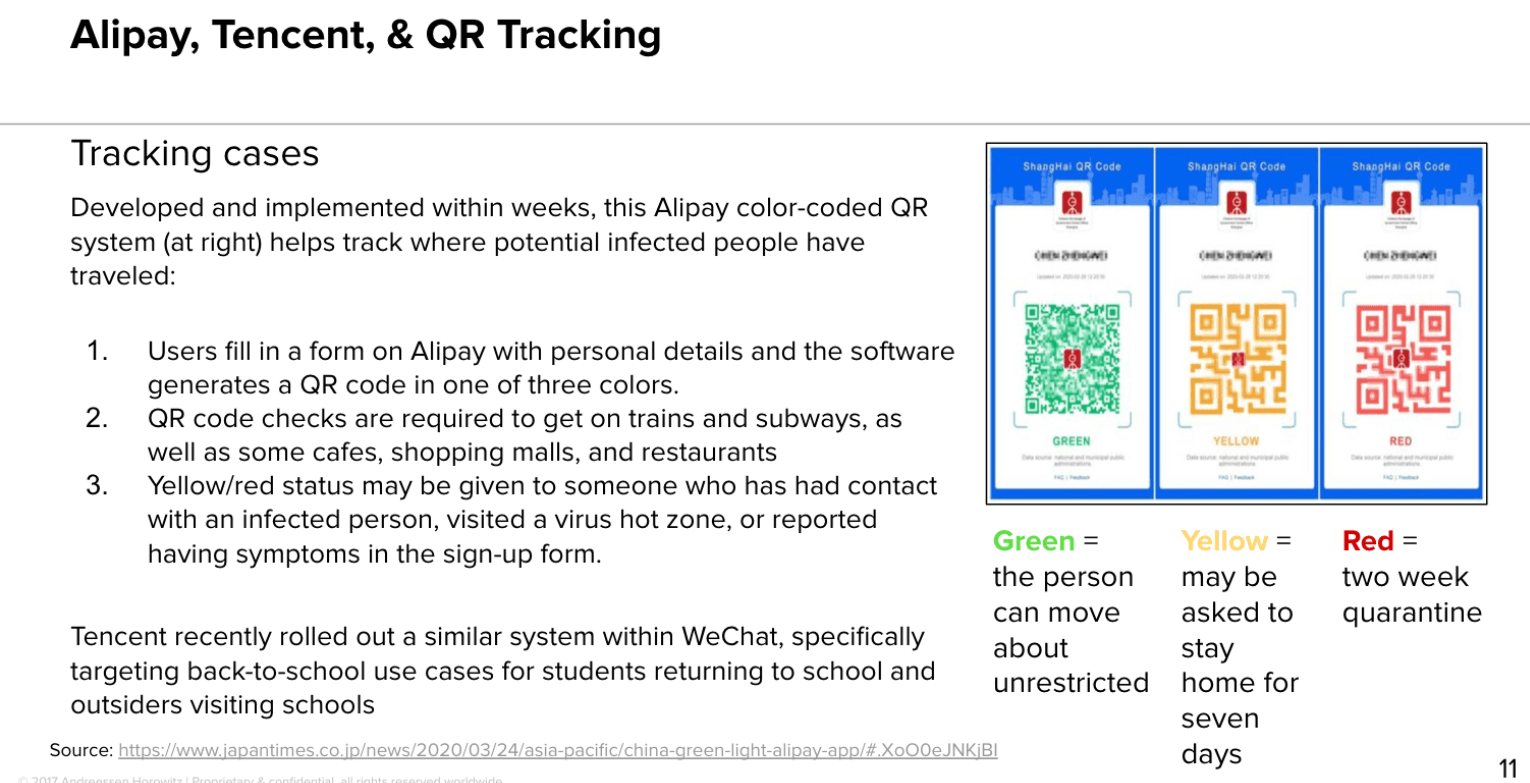

Very impressive is a recent presentation from Andreessen Horowitz on the number of apps deployed in China to fight COVID-19. Linked to the Alipay (Alibaba) mobile payment system, one of the examples apps provides a color QR code on your health.

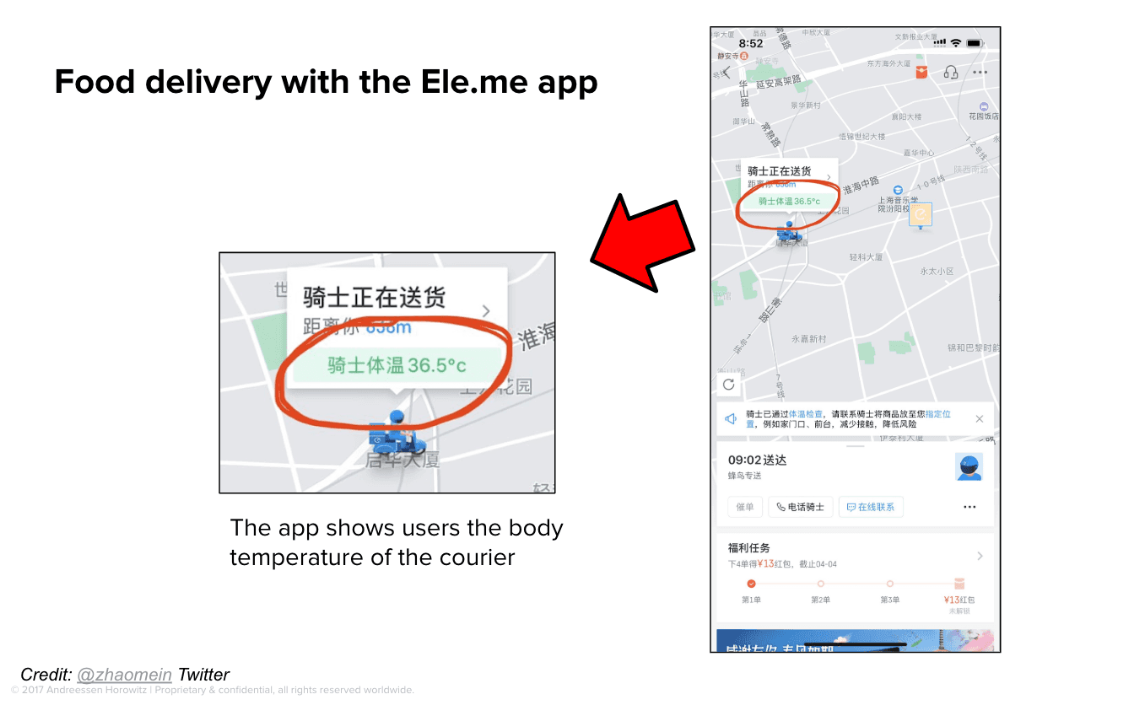

Another app used AI chatbots to help individuals' self-triage against the virus. Worried about the body temperature of your delivery person for online orders? There's app for that.

Check out the full presentation for other apps deployed in China, Taiwan, Singapore, and Israel to fight COVID-19, including one to know whether someone sitting on a plane or train within seven rows from you tested positive for COVID-19.

AI, Drones, and Robots Assemble Against COVID-19

In China Artificial Intelligence (AI) played a role in helping respond to the health crisis.

Prior to the availability of a COVID-19 vaccine, the remote temperature applications in this video are interesting, especially for retail. Drones and robots were also enlisted to assist during the pandemic. Hey you that handsome man on the street with the telephone, put on your mask on now.

Retail China Coming Back to Life

For the first two months of 2020, including during the very important Lunar New Year celebrations in February, China retail sales fell 20.5%. This followed a steady multi-year rise in retail sales with 2019 being up 8%.

Post COVID-19, Shanghai is an example city on how the retail recovery is emerging in China. For March, retail sales soared 41.3% from a month earlier. Nearly all food stores are open. Shopping malls and the catering industry are also showing recovery with their daily turnovers returning to 56% and 78% of normal levels, respectively.

Even in hardest hit Wuhan, the epicenter of COVID-19, retail is coming back to life, but with a heavy emphasis on health checks and monitoring.

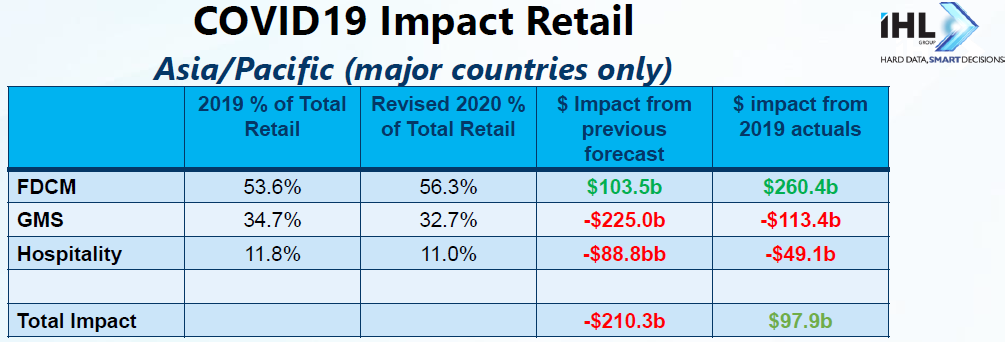

Again, interesting examples in this video on what the "new normal" life will look like in retail while we wait for a vaccine. According to the latest IHL Group post COVID-19 forecast, there is some good news for Asia as it will still see overall retail growth in 2020 when compared to 2019 actuals.

As with the rest of the world, food / drug / convenience / mass merchandisers will exceed expectations and other retail sectors will struggle.

Digital Transformation Trends Favoring China Retail

"Chinese retailers and brands have brought to life “Touchless Retail”, a new way to serve their customers, eliminating or making virtual all human contact in customer service." China was already down this path as an amazing 577+ million people are already using proximity mobile payments.

The COVID-19 lockdown accelerated attention to touchless delivery. By February this year, 66% of China's consumers adopted touchless delivery for every order. Driverless cars, automated delivery robots, intensified app tracking, and even smart refrigerated pick-up cabinets were added to the mix. All this in a country where most online products are already delivered within 24 hours of order placement.

Contactless retail in China includes an increased focus on live-streaming channels which were popular prior to the crisis. "According to Taobao (Alibaba), there were 400 million users watching its 60,000-plus livestream shopping shows in 2019. The livestream channels, hosted by brand stores or influencers, generated 200 billion yuan ($28 billion) last year."

During the live video streaming broadcasts, key opinion leaders (KOLs) and celebrities interact with the audience, offer flash discounts, and answer customer questions live. In the COVID-19 lockdown, live streaming shops in China increased by 700%. "For Nike's Air Max Day 2020, the brand live-streamed the launch of its new product via Taobao Live to over 2.78 million viewers."

A new survey completed in six countries including China indicated that consumers plan to be cautious, even when the spread of the virus subsides.

- 95% of consumers want companies to implement physical protection and distancing measures to help keep them healthy.

- 68% report the pandemic has changed the products and services they once thought were important, a phenomenon even more widespread in China (86%) and Italy (73%).

- 65% are currently postponing purchases and travel, and 52% intend changes to their buying behaviors to continue.

- 34% are postponing major life decisions, and 26% will take planning for major life decisions more seriously after the pandemic.

- 27% are currently saving more than they normally do, and 26% plan to save more in the future than normal.

The pandemic will lead to a "new normal" with accelerated digital transformation trends, multiple of which are on display in China. Welcome to the post COVID-19 "Disruptive Future of Retail".