Future of Retail with the Top 5 Apparel, Luxury, and Technology Brands

Being a firm believer that branding is a critical component to the future success of all companies, every year I look forward to the latest edition of the BrandZ Top 100 global brands report. Disruption, disintermediation, and differentiation are the three words that stood out in the nearly 300-page 2018 edition.

2018 Global Top 100 Brands Highlights

With an increase of 21% in 2018, the BrandZ global top 100 brands added a record $748 billion, to reach $4.4 trillion in total value, an increase of $2.9 trillion since 2006. 2018 set a record as the largest one-year value increase in the 12 years publishing the global report.

Every industry category had an increase with retail rising the most and for the second consecutive year in a row. The brand value of the retail sector rose 34% as e-commerce brands spiked in value and the category adjusted to disruption.

JD.com, a Chinese e-commerce company led the world in brand value growth, increasing 94%. JD.com was followed by Alibaba, another Chinese company which had 92% brand value growth.

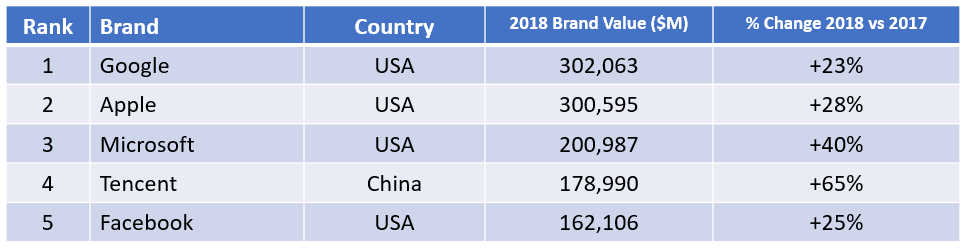

Primarily driven by Chinese brands, Asia led all regions in the rate of growth, rising 42%. Fourteen Chinese brands are now in the top 100 global. For 2018, Tencent, a leading Chinese internet portal rose to number five of the top 100.

North America still dominated the top 100 with 57 brands. Brand value increase in North America was 23%.

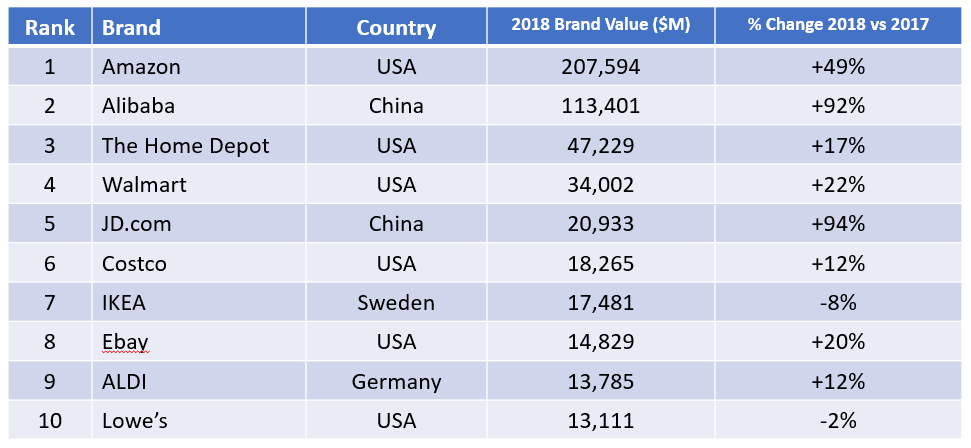

The Top 10 Global Retail Brands

"The strongest value rises came from the pairs of retail brands that aligned to enable the consumer to seamlessly transition between online and offline, while providing the brands with an unprecedented trove of data that reveals shopper behaviors at all moments along the circuitous path to purchase." For China this was JD.com and Alibaba. For North America this was Amazon and Walmart.

As I have said in multiple of my presentations and blogs, if you want to see the future of retail look to China. "If you consider mobile activity on China's Singles Day, for example, somewhere around 90% of purchases on Alibaba were made through mobile on Alibaba’s AliPay platform."

"What omnichannel retail is showing us is not that people will buy less—it’s that people will shop less. Brands must think more broadly about how technology and expectations are intersecting to create a new relationship between people’s attention span and commerce."

"Over the past 12 years, e-commerce brands grew in value from 14% to 62% of the BrandZ Retail Top 20. The increase of 1,761% quantifies the impact of brands like Amazon, Alibaba, and JD.com, and the massive disruption of the retail category. Specialists, such as The Home Depot or Ikea, fared better during this period than hypermarkets and other traditional retailers with broad product ranges."

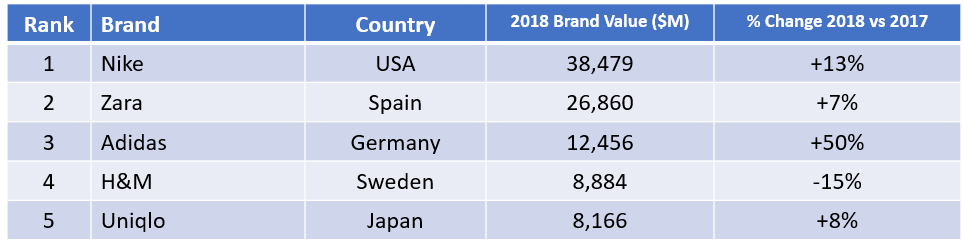

The Apparel Top 5 Most Valuable Brands

"Consumers see innovative brands as Different, and Difference is an important driver of brand equity. Innovation especially impacted the year-on-year value fluctuations of brands in the 2018 BrandZ Apparel Top 10 ranking. Brands that scored high in Innovation increased 11% on average, while brands that scored low in Innovation decreased an average of 2%."

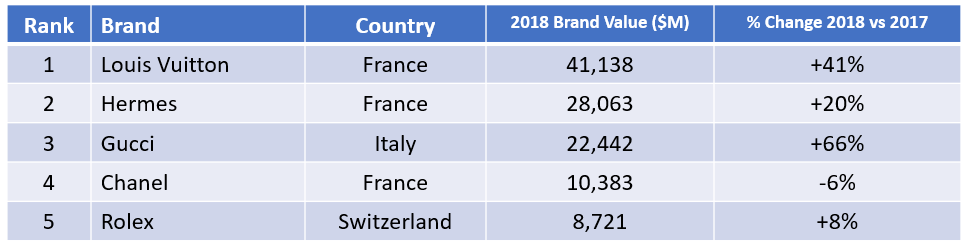

The Top Luxury Brands

"Over the past 12 years, super luxury brands that have protected exclusivity increased190% percent in brand value, more than double the growth of brands that attempted a wider appeal. Brands that successfully managed the difficult balance of exclusivity and popular appeal increased 111% percent in brand value, and achieved strong scores in Brand Experience, Desirability, and status or “Want to be seen using.”

The Top 5 Technology Brands

"The dominant proportion of BrandZ Global Technology Top 20 value shifted from business-to-business to business-to-consumer brands over the past 12 years, when B2B brands rose 163% in value compared with a rise of 568% for B2C brands. The shift reflects the scale of B2C brands like Apple and Google, and the struggle of B2B brands to transition from traditional business models to the cloud."

Five Actions for Building & Sustaining Valuable Brands

My favorite two pages in the 2018 BrandZ edition focus on the five strategies for building and sustaining the value of global brands.

- Invest in Long Term Brand Growth - "Brands that deliver consistent Meaningfully Different products and experiences, and effectively communicate about them, grow faster in value, provide greater return to shareholders, and are better able to navigate the inevitable marketplace disruptions."

- Look to the East for Inspiration - "Chinese consumers expect to shop, pay bills, order taxis, view entertainment, and engage in myriad other activities, seamlessly and with minimal friction, using their smartphones."

- Broaden Communications - "Brands - especially those with vast ecosystems - are engaging in social media with live streaming and other brand expressions that connect the consumer to the brand anywhere - before, after, and along the winding path to purchase."

- Develop the Brand Ecosystem - "In the digital age, every action adds data and insight to the brand’s understanding of its individual customer."

- Build Meaningful Difference - "Brands need to have a purpose that meets consumer needs in relevant ways that go beyond a functional benefit to form an emotional connection."

Retail, apparel, luxury, and technology sectors were purposely selected for this blog because all four are at the intersection of the successful future of retail. This crossroad was defined in one of my previous posts "The 2018 Definitive Retail Success Formulas Revisited".