Blog

On many fronts, 2020 was a challenging year for the retail industry. During the early days of strict lockdowns to slow the spread of the coronavirus, governments around the world categorized some retailers as “essential” and others as “nonessential,” leading to a $285 billion transfer of wealth from nonessential retailers to essential retailers and a $250 billion transfer of wealth from small retailers to larger companies. This created a massive shock to the worldwide economy with GDP levels initially dropping 30% or more.

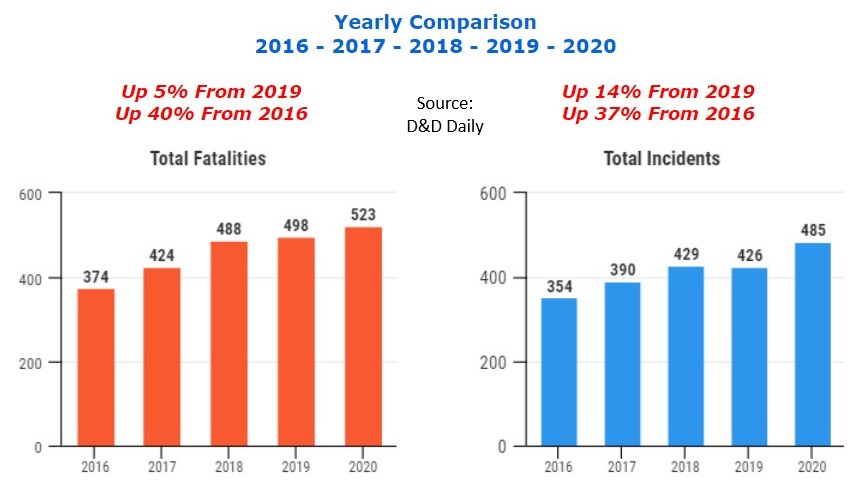

Even with widespread store closures, the United States saw an increase in retail fatalities and violent incidents in brick-and-mortar retail stores. In 2020, 485 violent incidents, up 14% from the previous year, led to 523 fatalities, up 5% from 2019. Customers, store associates, and security personnel made up 76% of the victims with the remaining 24% being suspects.

Even with widespread store closures, the United States saw an increase in retail fatalities and violent incidents in brick-and-mortar retail stores. In 2020, 485 violent incidents, up 14% from the previous year, led to 523 fatalities, up 5% from 2019. Customers, store associates, and security personnel made up 76% of the victims with the remaining 24% being suspects.

Managing new health and safety policies to fight the pandemic and violent incidents in retail stores elevated the importance of physical security in the retail industry. As with all other sectors, security was also impacted by the acceleration of digital trends that were already underway prior to COVID-19. The security “new normal” will include these top 5 physical security trends in retail to watch in 2021 and beyond.

Innovative Uses for Existing Security Technologies

- Details

Despite the coronavirus pandemic’s impact on how we work, shop, and entertain ourselves, the retail industry has managed to adapt in the face of these challenges. Although e-commerce has played a bigger role in retail sales than before the pandemic, the “retail apocalypse” has been largely overstated. In fact, with brick-and-mortar sales generating over $18.5 trillion in the United States in 2020, I anticipate that the physical store will continue to act as the epicenter of the post–COVID-19 retail experience.

The Retail Store in 2021 and Beyond

For nearly a decade, e-commerce has been seen as a threat to traditional retailers, positioning online retailers as more capable of meeting growing consumer expectations for convenience and affordability. But the retail industry is nothing if not resilient. Faced with reduced in-store shopping due to widespread social distancing and stay-at-home orders, retailers turned to newer solutions like curbside pickup and buy-online-pickup-in-store (BOPIS).

One-third of retailers also reported investing in solutions to facilitate in-store pickup and returns for online purchases, offering customers the speed of brick-and-mortar retail with the convenience of online shopping.

- Details

A Wall Street Journal article this weekend on robotics coming to a garden near you brought back memories of my office in Neuhausen am Rheinfall in Switzerland. Every afternoon, while doing the continuous string of international conference calls, I would observe a robot mower in the yard outside my window. The autonomous roamer would emerge from its electrically protected doghouse, run Swiss precision patterns across the lawn, and when finished return to its home to recharge.

This memory, plus the long string of articles below published in the last week on retail robotics inspired this article.

>> Domino's testing pizza delivery by self-driving robot car in Houston'

>> Chick-fil-A tests robot delivery in Southern California

>> Kroger is Amassing a Robot Army to Battle Amazon, Walmart

>> Save Mart kicks off pilot of shelf-scanning robots

>> Gap rushes in more robots to warehouses to solve virus disruption

>> Alibaba Group Xiomanlv delivery robots hit Chinese Universities

>> Your Drone-Delivered Coffee is (Almost) Here

Above seems to be counter to Walmart's announcement late last year that it was stopping its deployment of aisle scanning robots after installing them in hundreds of stores. Was the Walmart decision an anomaly in the growth of robots in retail? What role are robots playing in E-commerce? How has the pandemic impacted the trajectory of robotics? What's in-store for retail robotics?

Lessons from the Walmart Aisle Computer Vision Experiment

- Details

Throughout my retail career, I have closely followed the growth and progress of the grocery sector. Partially this is the result of actually having worked in a supermarket for 9+ years across many departments.

The importance of this retail segment is reinforced by Deloitte in their annual 'Global Powers of Retailing Report'. The 2020 edition found that fast moving consumer goods (FMCG) which includes grocery, drug, mass merchants, and convenience represents 66.5% of the total retail sales for the global top 250 retailers. Also interesting from that research, this sector tends to least globalize operations and recorded in 2020 the lowest composite net profit margin at 2% of sales.

The pandemic has become a brutal accelerator of digital transformation trends for all retail and grocery has not been immune from the disruption. Being classified as an essential business was a tremendous advantage for food, drug, convenience, and mass merchandise retailers. During the lockdowns, nearly $300 billion in wealth was transferred from general merchandise / hospitality to FMCG retailers.

As I stated in a recent Rethink Retail podcast, grocery sales which were only up 3% in 2019, jumped 11.5% in 2020. The sector stayed financially positive throughout the pandemic and still has substantial opportunities for additional growth. This podcast, recent grocery news from Amazon, and new research inspired this article.

Walmart versus Amazon: The Grocery Wars are Just Getting Started

- Details

"The world’s most successful companies all have one thing in common: powerful brands ... Branding strategy is one of the foundational pillars of business. Simply presenting a unified brand message can increase profits by nearly 25%." - EU Business School

From multiple sources, this article summarizes key insights from the just published Brand Finance top 500 world's most valuable brands report.

Top 10 Most Valuable Global Brands and Key Insights from Entire Study

- Details

As we continue to make progress emerging out of the COVID-19 health crisis, key trends that I have been following closely are both consumer priorities and retailers' technology focus areas. At the height of the lockdowns in 2020, consumers chased convenience and safety as primary purchasing drivers.

Forty-percent of the time in four countries (USA, UK, France, and Germany), this included switching retailers that were more responsive to their new shopping patterns. This was especially prevalent in the United States where 46% of the consumers made the switch. Subsequent research indicated that 88% plan to stick with their new shopping brand choices.

On the technology front, digital acceleration was the operative challenge that all retailers faced. "By some estimates, we (retail) have vaulted ten years ahead in consumer and business digital penetration in less than three months."

This article highlights technology focus areas that consumers are prioritizing as we enter a disrupted new normal. It also summarizes new research on the top retailer technology priorities to meet the demands of a digitally empowered consumer.

Surprising Consumer Shopping Technology Preferences

- Details

Couple weeks ago, I had the opportunity to join other loss prevention professionals in a webinar titled "The power of Teamwork: How Retail LP can work with law enforcement to combat the double problem of ORC and Violent Gangs." In this Loss Prevention Foundation hosted event, my contribution was an ORC trends update, coupled with analysis on future loss prevention technology trends.

Retail crime trends have been changing for some time. Loss prevention / asset protection have not been immune from COVID19 innovation acceleration. As recent McKinsey retail research explained, in a matter of 90 days in 2020, we vaulted forward 10 years in consumer and business digital adoption.

Post my corporate career, I spent a significant amount of time researching growth opportunities and engaging with private equity portfolio technology companies and starts-ups in Silicon Valley, Europe, and India. Based on these market intelligence activities, I can confirm that the innovation funnel in all functions including loss prevention is being filled at a higher speed.

This article summarizes and expands on some of my high-level concepts shared in the LPF webinar. The future of loss prevention is bright, especially when you consider the general technology shifts taking place across harmonious retail channels.

Organized Retail Crime Increasing and Getting More Violent

- Details

By Tony D’Onofrio – CEO, TD Insights / Marcin Pilarz – CEO, Talkin’ Things

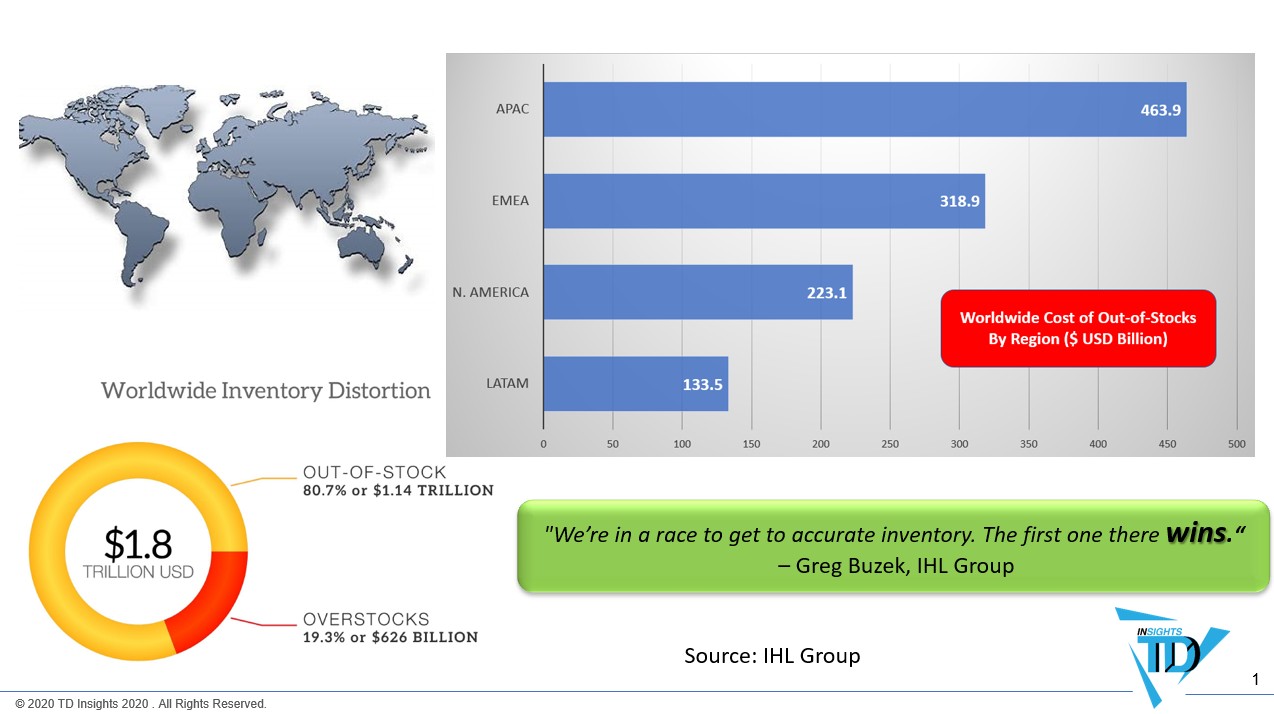

The latest retail industry research quantifies the challenge of global inventory distortion at $1.8 trillion with 81% from products being out-of-stock and 19% from overstocks. Lockdowns, misdirected inventory, and closed stores severely compounded challenges with inventory management. An estimated $570 billion in lost revenue has already been attributed to COVID-19 inventory distortion.

All industries now recognize that accurate inventory visibility is critical short term as we continue to recover from the crisis and long term to dynamically adjust product levels based on continuously changing customer purchasing patterns.

The Growth of Retail RFID

- Details

In early 2020, the retail industry was off to a very strong start. Through February USA retail sales grew 7.5%. Then March came in as a pandemic lion with a substantial part of the world hitting the pause button. We all very quickly learned the difference between essential and non-essential retailers. The financial pain for the global retail industry for all of 2020 will total over $1.6 trillion.

The good news is that key major retail markets such as China and the United States have already overall recovered to pre-pandemic levels. Here are three predictions for the new retail year.

Safety Concerns Will Be with Us into 2022

An April 2020 consumer survey found that consumers felt safest in grocery stores, followed by drug stores and big box retailers. Malls ranked lowest with only 33% of respondents saying they would feel safe shopping in these locations. Sixty-five percent of women did not feel safe trying clothes in dressing rooms, 78% felt unsafe testing beauty products, and 66% had similar concerns working with sales associates.

- Details

The impact of COVID-19 has delayed the arrival of the new roaring '20s projected at the start of the year and it is now setting up a very interesting 2021.

As the Economist asked in sharing their thoughts on the New Year, "do you feel lucky? The number 21 is connected with luck, risk, taking chances and rolling the dice. It’s the number of spots on a standard die, and the number of shillings in a guinea, the currency of wagers and horse-racing."

From a leadership point of view, I do feel lucky in 2021, primarily because I have discovered the ONE word that will make this year successful. This one word is not complicated and you do not need a dictionary to understand its meaning. See if you can spot it as you read this year-end article.

Continuous Introspection

- Details