Loss Prevention Research Council Weekly Series - Episode 94 - Amazon Logistics Costs and Retail Formats / Technology Firsts

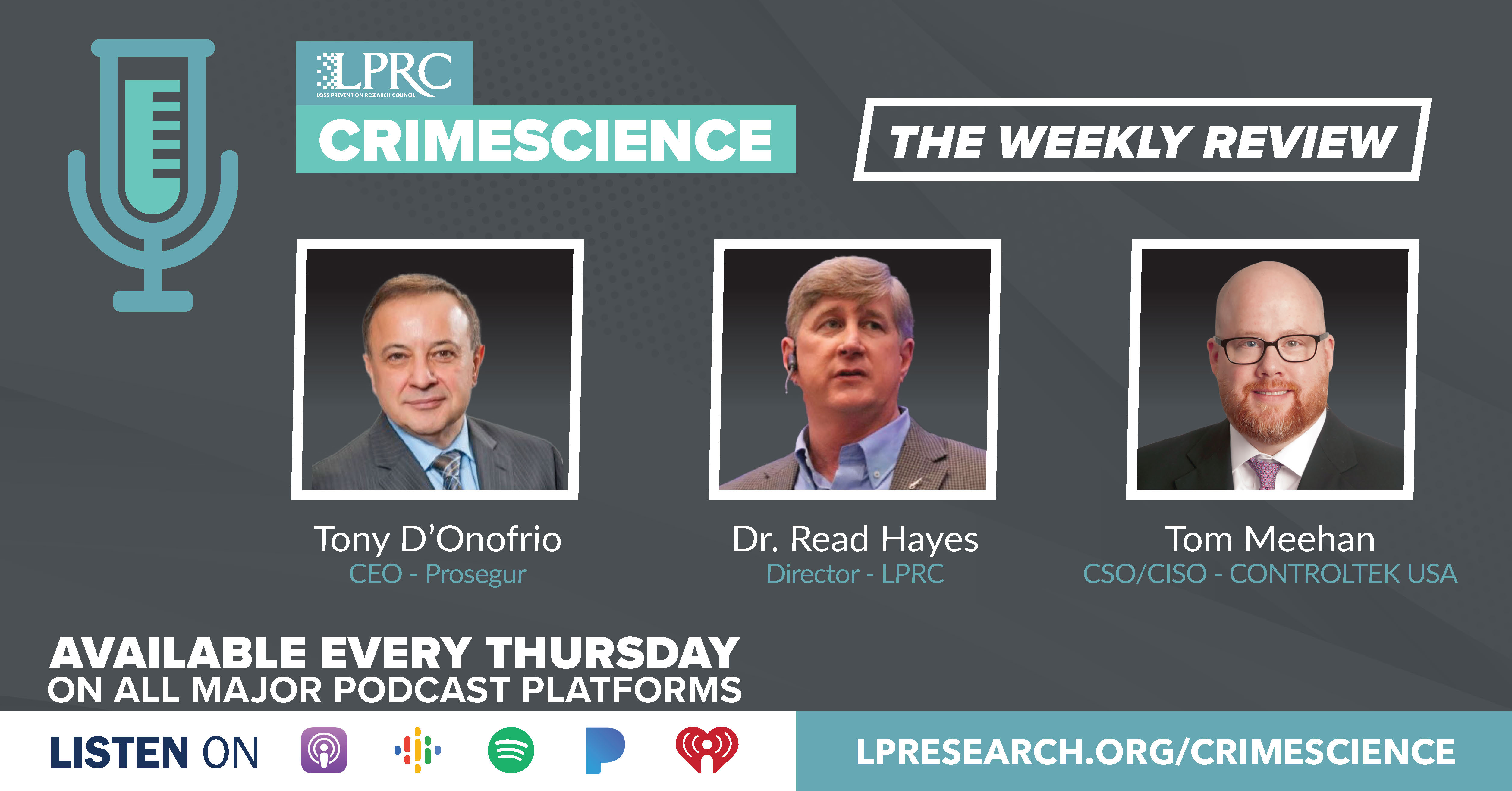

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Deloitte 2022 Retail Industry Outlook

https://www2.deloitte.com/us/en/pages/consumer-business/articles/retail-distribution-industry-outlook.html

Had a chance to re-read Deloitte’s Retail Industry Outlook for 2022 and here are a few of my favorite highlights.

54% expect growth this year to be up to 5%. 32% expect it to be above 5%. At the margin level 38% expect it to be stable, 32% expect it to be higher, and 30% expect it to be lower.

Expectations for the consumers in 2022 include:

- In 2022, consumers will be more outgoing, seeking experiences outside the home. That figure is 84% versus 21% in 2021

- Willing to spend but having to rely more on credit or buy now, pay later (64%)

- Expecting seamless experiences across channels (96%)

- Pursuing retailers with strong Environmental, Social, and Governance Initiatives (68%)

Opportunities for 2022 include favorable consumer behavior, use inflation as an opportunity to improve margins (58%), and take price / reset promotional cadence (over buying / discounting)

Challenges for 2022 include retail bifurcation, employee shortages will hamper growth (77% agree), supply chain disruption will impact growth (68% agree), and consumers expect timely delivery (64% agree).

Focus areas for investment for winning retail industry leaders include tapping higher margin revenue streams, resetting physical stores for omnichannel, expanding digital capabilities, incorporating environmental social and governance practices, engaging in M&A, enhancing data privacy and security, modernizing the supply chain, and making the workforce future ready.

In terms of new technologies winning retail leaders are optimistic that in the next five years the following will happen: voice commerce being widely adopted (55%), retailers increasingly engaging consumers through digital goods (64%), staff free cashier less stores will be common (55%) and crypto currencies will be widely used by retailers and consumers alike.

------

Visualizing Amazon’s Rising Shipping Costs

https://www.visualcapitalist.com/visualizing-amazons-rising-shipping-costs/

Great data this week from Visual Capitalist summarizing the rising shipping and logistics costs for Amazon.

In 2011, Amazon spent 18% of net sales on logistics costs. In 2021, the logistics costs reached 32% of net sales.

Don’t cry for Amazon as most investors agree that Amazon has been a winner during the COVID-19 pandemic. After all, in two short years from 2019 to 2021, sales soared to $469 billion from $280 billion and their market cap surged towards a $1.7 trillion valuation.

For 2021, shipping and fulfillment costs totaled to $151.8 billion. Shipping, which includes sortation, delivery centers, and transportation costs amounted to $76.7 billion. Fulfillment costs, which include cost of operating and staff fulfillment centers, were $75.1 billion.

The $151.8 billion in expenditures towards shipping and fulfillment is absolutely massive. On a per minute basis, this results in $288K per minute in expenses, compared to their $956K in revenue per minute.

Another way to put this gargantuan figure to scale is to remember that this business expense is greater than the equity value of about 90% of all companies in the S&P 500.

While these expenses are rising, it’s important to remember that Amazon’s profits are still healthy. They generated $33 billion in profits for 2021. One reason for this is that the majority of Amazon’s profits never came from ecommerce to begin with. Amazon Web Services (AWS) accounts for over 50% of their operating profits, but only 13% of their sales.

------

Then and Now: The surprising Start of Your Favorite Retail Formats and Technologies

https://www.tonydonofrio.com/blog/retail/then-and-now-the-surprising-start-of-your-favorite-retail-formats-and-technologies.html

Finally let me close with a new article series that I just started on the history and current state of your favorite retail formats and technologies. You can find the original content on either my website tonydonofrio.com or Linked-in.

From Part 1 here’s a brief history of the first department store and where they are today.

Several countries take credit for opening the first department store. From the UK, it’s Harding, Howell & Co’s Grand Fashionable Magazine which opened in London in 1796. The product ensemble which included furs and fans, haberdashery, jewelry, clocks, millinery or hats, resembled a department store.

Many others name Le Bon Marche which opened in France in 1852. This Parisian location evolved into a multi-product department store masterpiece with architectural input from Louis Auguste Boileau and Gustave Eiffel. Le Bon Marche was the first to introduce seasonal sales and continuously expanded the shopping experience to meet the changing social needs of sophisticated Parisians.

John Wanamaker brought the department store concept to the United States in 1875 by purchasing a rail-freight-depot in Philadelphia and populating it with a collection of specialty retailers. Among his innovations were the introduction of price tags and the development of aggressive advertising programs.

I included department stores in this series because pre-pandemic everyone was writing off the end of this retail sector. The critics were partially proven wrong as the sector had strong growth of 22% in 2021.

According to the Wall Street Journal, even Amazon is planning to open a series of large physical shopping centers this year that are comparable to department stores.

Next I summarized the history of the first supermarket.

The world’s first modern self-service supermarket was Piggly Wiggly which opened in doors in Memphis Tennessee in 1916. Before the supermarket, customers would give their shopping lists to clerks mostly in “mom & pop” stores, who picked out the goods, resulting in higher food prices to pay for the labor costs. The self-service supermarket reduced overhead costs and even consolidated specialty retail stores like butchers and bakeries into one store.

In the latest Deloitte 2022 Global Powers of Retailing report, this sector which is part of Fast Moving Consumer Goods (FMCG) represents $3,396 billion or 66% of the total revenue for all of the global top 250 retailers.

The FMCG sector contained the largest number of global retailers and ten out of thirteen new entrants in the latest Deloitte research were from this sector. The top 5 retailers make up 33% of the total retail revenue of the top 250 global retailers. Nine out of the top 10 global retailers generate major revenue from what started out in 1916 as the first supermarket.

Finally in part 1, I discussed the first item scanned in a retail store.

Today’s barcode which is printed on all consumer packages started out as a finger drawing on Miami Beach by inventor John Woodland in the late 1940s. The inspiration was a frustrated supermarket manager who pleaded with the Drexel Institute of Technology in Philadelphia “to come up with some way of getting shoppers through the store more quickly.”

Morse Code that Woodland learned as a Boy Scout created that “eureka” moment and the evolution to the final design was strongly encouraged by retailers such as Kroger. In a booklet produced by the Kroger Company in 1966, the authors signed off with a despairing wish for a better future: ‘Just dreaming a little…could an optical scanner read the price and total the sale…Faster service, more productive service is needed desperately. We solicit your help.’

While the first patent was issued in 1948, the bar code’s humble use start in a retail store was on June 26, 1974 when a pack of Wrigley Chewing Gum carrying a Universal Product Code (UPC) was scanned at a Marsh Supermarket in Troy, Ohio.

Fast forward nearly 50 years later and today more than six billion times the barcode is scanned around the world, every single day.

Team Member! Ukraine Crisis Perspectives Explored! In this week’s episode, our co-hosts discuss the impact of a new COVID variant, History is explored in a session and article named: Then and Now, Media Laws Change in Russia, 2022 Deloitte Trend Article Expanded, and the LPRC Research Direction is Explored.

Listen in to stay updated on hot topics in the industry and more!