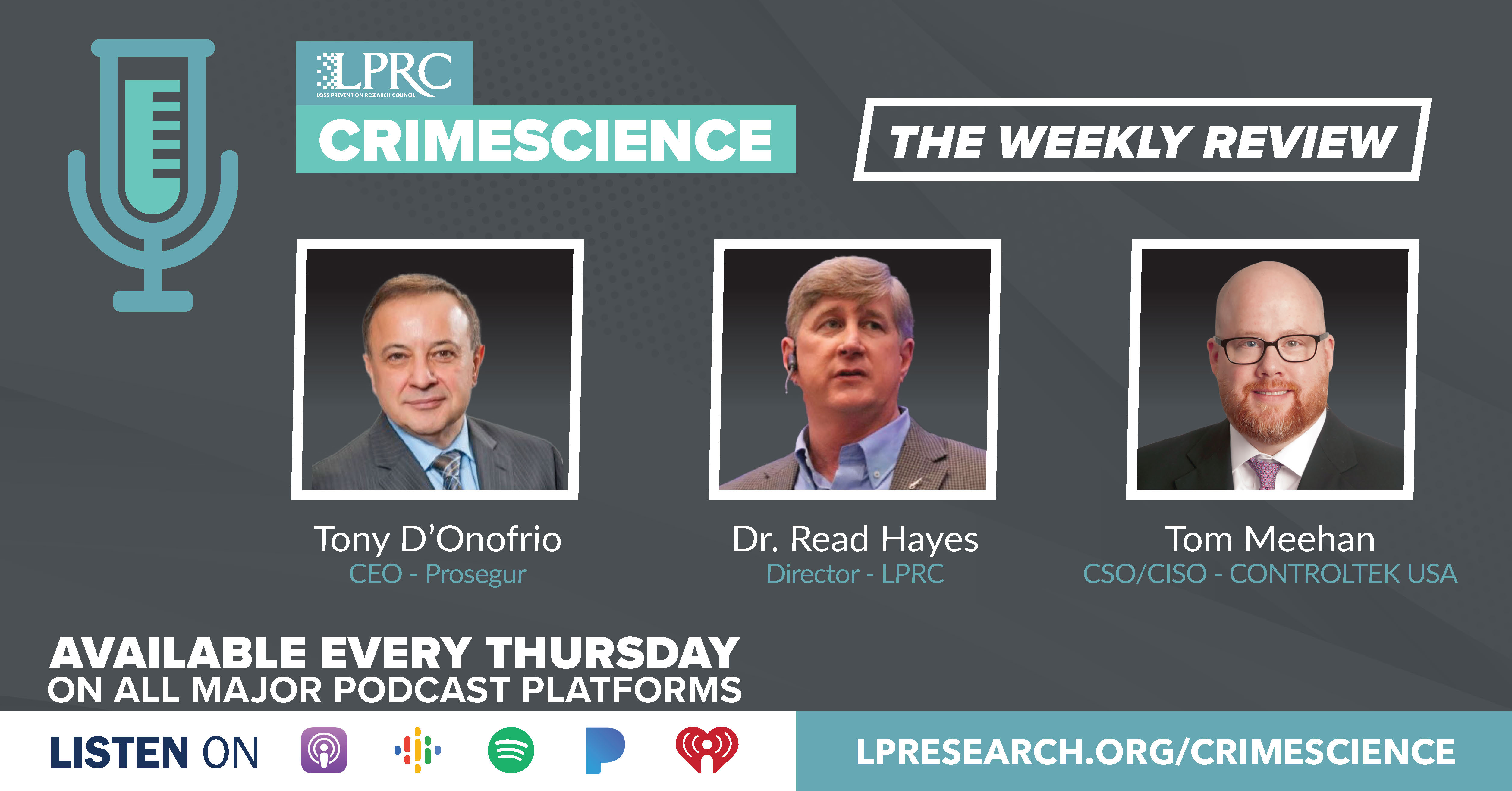

Loss Prevention Research Council Weekly Series - Episode 90 - Global Risks for 2022 and USA Retail Returns Report 2021

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

LPRC IGNITE is coming up on Feb 15th to the 16th! COVID-19 could be a Catalyst for Tech Advancement! In this week’s episode, our co-hosts discuss UF changing COVID-19’s Designation, Global Risks for 2022 and Beyond, New LPRC Team Members Coming Soon, Over $1.5 million of fake vaccine cards sold by nurses, and a new Shoplift fee is coming out in Denver.

Listen in to stay updated on hot topics in the industry and more!

Visualized: A Global Risk Assessment of 2022 and Beyond

https://www.visualcapitalist.com/visualized-a-global-risk-assessment-of-2022-and-beyond/

From the World Economic Forum and Visual Capitalist here is a summary of the latest global risks assessments for 2022 and beyond.

In the latest just published annual edition, a majority of global leaders feel worried or concerned about the outlook of the world, and only 3.7% feel optimistic.

When it comes to short-term threats which are defined as happening in the next two years, respondents identified societal risks such as “the erosion of social cohesion” and “livelihood crises” as the most immediate risks to the world.

These societal risks have worsened since the start of COVID-19. According to respondents, one problem triggered by the pandemic is rising inequality, both worldwide and within countries.

Many developed economies managed to adapt as office workers pivoted to remote and hybrid work, though many industries, such as hospitality, still face significant headwinds. Easy access to vaccines has helped these countries mitigate the worst effects of outbreaks.

Regions with low access to vaccines have not been so fortunate, and the economic divide could become more apparent as the pandemic stretches on.

A majority of respondents believe we’ll continue to struggle with pandemic-related issues for the next three years. Because of this, the medium-term risks which are defined as 2 to five years, similar risks as short term risks are identified by respondents.

The pressing issues caused by COVID-19 mean that many key governments and decision-makers are struggling to prioritize long-term planning, and no longer have the capacity to help out with global issues.

Respondents also worry about rising debt levels triggering a crisis. The debt-to-GDP ratio globally spiked by 13 percentage points in 2020, a figure that will almost certainly continue to rise in the near future.

For the long term which is defined 5 to 10 years, respondents identified climate change as the biggest threat to humanity in the next decade.

Climate inaction—essentially business as usual—could lead to a global GDP loss between 4% and 18%, with varying impacts across different regions.

Downtown Denver Business Owner to Charge 1% fee to Recover Shoplifting Losses

https://www.thedenverchannel.com/news/local-news/downtown-denver-business-owner-to-charge-1-fee-to-recover-shoplifting-losses

A friend forwarded an article from theDenverChannel.com titled “Downtown Denver Business Owner to Charge 1% fee to Recover Shoplifting Losses.”

In summary, this downtown business owner said that shoplifting at his stores has gotten so bad and he's having to charge customers a fee to make up the costs.

He called it the Denver Crime Spike Fee, which equals to a 1% transaction fee for all of the items that are purchased in our stores.

Since 2019, he says shoplifting at his downtown and Federal Boulevard stores has tripled.

"We're talking about six figures [in losses] for a really small business like us, and that is meaningful. It impacts our employees, and, more importantly, it now is going to impact our shoppers.”

Customer Returns in the USA Retail Industry in 2021

https://nrf.com/research/customer-returns-retail-industry-2021

NRF in cooperation with Appriss Retail just published a study on retail returns for last year for the USA retail industry.

- Total returns account for over $761 billion in lost sales for U.S. retailers

- For every $1 billion sales, the average retailer incurs $166 million in merchandise returns

- For every $100 in returned merchandise accepted, retailers lose $10.30 to return fraud.

- Receipted returns are a hidden risk from behaviors like shoplifting, collusion, wardrobing and more

In 2021, consumers returned $761 billion in 2021 which was 16.6% of total retail sales. Of those returns, $78.4 billion were fraudulent.

For the holidays, $158 billion dollars were returned or 17.8% of sales. Of those returns, $17 billion dollars were fraudulent.

Online returns totaled $218 billion or 20.8% of total online sales. $23.2 billion of online returns were fraudulent.

The top three example returns experienced by retailers are:

- Wardrobing (Returns of used / non-defective merchandise – 68%

- Return of shoplifted / stolen merchandise – 56%

- Employee return fraud and / or collusion with external sources – 36%

- Return of merchandise purchased on fraudulent or stolen tender -36%

What are some of the return costs?

- A return is a lost sale. Cash, profits, and margin percentage are reduced.

- Returns increase labor costs due to inspection and re-stocking time.

- Returns cause markdowns, out-of-stocks, and logistics expenses to increase.

- Returns cannot always be resold.

Good data to keep in mind as we work with LPRC to combat many of the items discussed this week.