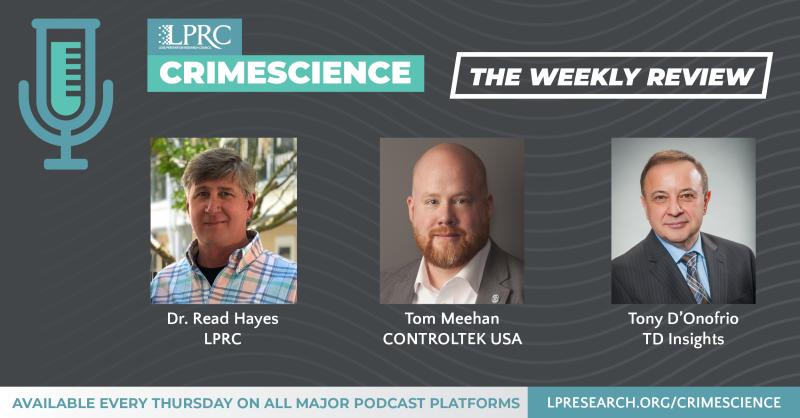

Loss Prevention Research Council Weekly Series - Episode 85 - Retail Predictions Revisited and Ten 2022 Security Megatrends

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Retail predictions from 5 years ago: What did we get right?

https://nrf.com/blog/retail-predictions-5-years-ago-what-did-we-get-right

From NRF a review of what they predicted would happen five years ago and what really happened.

- Machine learning will revolutionize retail - While it’s been five years since NRF called it out, companies are still wrestling with the capabilities of ML and AI. Recent Gartnerreports found that 85 percent of artificial intelligence and machine learning projects fail to deliver on objectives; only 53 percent make it from prototype to production. That said, the appetite for ML and AI investments remains hardy and it is imperative for retailers to build trust in data-driven decisions. Bottom line: ML and AI are not plug and play; these technologies require comprehensive corporate buy-in.

- No silos, boundaries or channels - The biggest challenge is ensuring a consistent experience. As shoppers emerge from nearly two years of drinking from a fire hose of digital commerce interactions, they are looking for retailers to deliver somewhat different experiences in their physical stores. And consumers still won’t tolerate excuses about disparate systems that don’t sync and a lack of inventory transparency — much as we said five years ago.

- Bet on bots and conversational commerce - That was a bold statement for 2017. But as it turns out, we nailed it: Conversational commerce technology has enjoyed meteoric 400 percent growth since 2017, according to Digital Information World. In addition, the percentage of customers who have daily interactions with chatbots has risen by almost 40 percent between 2018 and 2020 in the United States alone. By 2025, the chatbot market share (worth $17.7 billion in 2019) is expected to hit $102 billion.

- Out of the box collaboration - 2020 opened the door to a plethora of unlikely collaborations no one could have foreseen: Albertsons partnered with 17 companies to offer part-time employment to otherwise furloughed staff and DSW partnered with Hy-Vee to offer footwear on the supermarket’s website and provide buy online, pick up in store services for shoppers in need.

- Time to tune in TV shopping - It’s fair to say we shot ourselves in the foot when we predicted that it was time to tune into TV shopping. Live shoppingon Facebook and Instagram is gaining steam as retailers and direct-to-consumer brands look to connect with shoppers. Macy’s, Ulta Beauty and Vuori have all announced livestream sessions during the holiday season. And Walmart will host more than 30 livestreaming events before the end of the year, including one with musician Jason Derulo that kicked off Cyber Week.

- Social Commerce will gain attention and investment - Just last month, Magazinereported that social commerce generated approximately $474.8 billion in revenue in 2020, representing an almost 40 percent surge in sales. Businesses of all sizes are finding that social commerce is not a competitor to ecommerce — it’s an extension.

- One click payment nearly ready for prime time - Payment networks including American Express, Visa, Mastercard and Discover didn’t roll out click-to-pay until the end of 2019. Shop Pay, the app from Shopify that allows shoppers to check out fast and track orders post-purchase, came on the scene in a big way around the same time. Momentum continues: A recently announced deal between Adobe and relative newcomer Bolt allows Adobe’s customers to integrate Bolt’s one-click feature into their checkout screens. Given that Bolt has a network of about 10 million shoppers, that is significant. We didn’t foresee buy now, pay later installment plans bubbling up; these services provided by the likes of Afterpay, Klarna, Affirm and Zip are enjoying a meteoric rise in popularity.

Ultimately, our ability to predict what was in the cards for retail in 2017 was equivalent to a full house in poker — not four-of-a-kind and certainly not a straight flush. Yet, if one wagered a bet, they’d have done reasonably well.

SIA Security Megatrends: The 2022 Vision for the Security Industry

https://www.securityindustry.org/report/security-megatrends-the-2022-vision-for-the-security-industry/

Let me start with the ten megatrends for security as just reported by the Security Industry Association. Now in its sixth year of making these projections, here are the 10 security megatrends for 2022:

- Artificial Intelligence - AI investment from security industry companies is exploding. When we first surveyed SIA member companies in 2019 about their R&D investments into AI, less than 2% said that all R&D investments were tied to AI. In 2020, that percentage crept up to 3%. But sometime in the last year, what started as an ember is now a raging fire of investment into AI, with 13% of companies saying that all their R&D investments are tied into AI opportunities.

- Cybersecurity - In our previous year of tracking this benchmark question, SIA found that 2% of respondents said cybersecurity was never a discussion point; today, zero respondents indicate that cybersecurity is ever not discussed during customer calls. While a year ago, cybersecurity discussions were “often” part of the conversation 52% of the time, today that frequency has increased to 62% of the time.

- Supply Chain Assurance - 98% of companies in the industry have invested more time and focus on their supply chain than they did pre-pandemic, with more than half saying they’re giving their supply chain “a lot more focus.”

- Service Models and The Cloud – 50% of data now stored in the cloud according to Statista. 98% of companies that had at least one cloud data breach in the past 18 months.

- Workforce development – 37% said that worker shortages would be the factor most likely to impact their business’ ability to grow in 2022. 60% who indicated that a cybersecurity staffing shortage is placing their organization at risk.

- Increased Interoperability – In 2030, $108 billion dollars is the predicted market value of the smart building IoT endpoint electronics and communications market, up from $55 billion dollars in 2020.

- Data Privacy - A year ago, only 53% said that they “often” had data privacy conversations with customers. Unfortunately, the growth in those conversations “often” occurring may be coming at the expense of those who previously said they “always” had such conversations, with that number dipping from 33% in the 2021 report to just 21% today.

- Security as Proptech – Loosely defined, proptech is any technology related to how buildings are managed or used, or even bought, sold or rented. $9.7 billion dollars is the amount of new funding the Proptech sector attracted in the first half 2021.

- Expanded Intelligence Monitoring - Expanding intelligence monitoring of public data sources on the surface web is already common, but companies and service providers are more regularly exploring reaches of the deep web and dark web to identify emerging threats or investigate stolen data.

- Health & Sustainability – The pandemic left an indelible imprint upon the security and safety industry, and while the initial response may have been to install security solutions that limited the need for touch or which could detect fevers, the conversation has expanded greatly from those early days. The security industry’s role is the safety and security for people and places, so part of keeping people safe is being mindful of their health. And the second part of the conversation is whether these spaces and built environments able to sustain these occupants and if the components, devices and solutions going into these built environments are fundamentally sustainable themselves, including from an energy efficiency level.