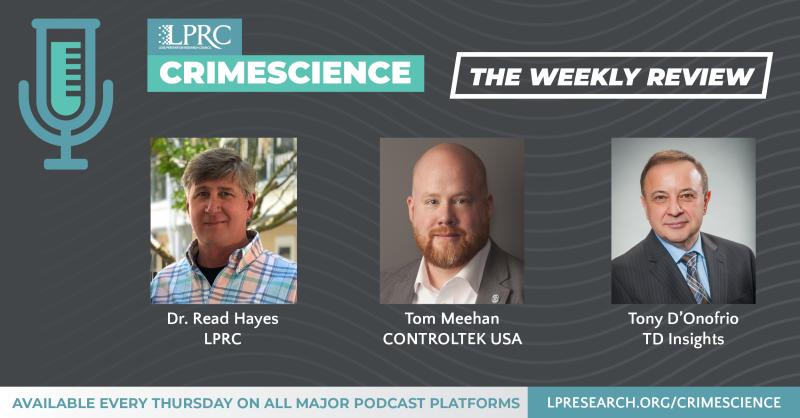

Loss Prevention Research Council Weekly Series - Episode 84 - Retail Crime Waves and Latest ORC Survey

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Happy Holidays from the LPRC Podcast Team! LPRC Kickoff is January 19th in NYC Bloomingdales Flagship Store! In this week’s episode, our co-hosts discuss Pills to combat symptoms of Covid variants are produced, Retail Flash Mobs Continue to plague the US, Recapping NRF survey information on ORC, and a recent Cyber Breach has been designated the highest threat level. Listen in to stay updated on hot topics in the industry and more!

CEOs from Target, CVS and Walgreens ask Congress for help amid retail crime surge

https://www.marketwatch.com/story/ceos-from-target-cvs-and-walgreens-ask-congress-for-help-amid-retail-crime-surge-11639158462

Market Watch reported on a letter sent by CEOs to Congress.

The CEOs from 20 major retail brands, including Target, CVS and Walgreens have jointly penned a letter to Congress over concerns of increasing crime in their stores.

“As millions of Americans have undoubtedly seen on the news in recent weeks and months, retail establishments of all kinds have seen a significant uptick in organized crime in communities across the nation,” the letter reads.

“While we constantly invest in people, policies, and innovative technology to deter theft, criminals are capitalizing on the anonymity of the Internet and the failure of certain marketplaces to verify their sellers,” it continues. “This trend has made retail businesses a target for increasing theft, hurt legitimate businesses who are forced to compete against unscrupulous sellers, and has greatly increased consumer exposure to unsafe and dangerous counterfeit products.”

69.4% of retailers say they have experienced a rise in retail-related crimes over the past year, according to data from the 2021 Retail Security Survey. The surveyed companies cited issues surrounding COVID-19, policing, changes to sentencing and the huge growth of online marketplaces.

How Law Enforcement is trying to stop mob retail thefts

https://www.cnn.com/2021/11/30/us/smash-grab-crimes-organized-retail-thefts/index.html

From CNN a summary of how law enforcement is trying to stop mob retail thefts.

In Chicago, Los Angeles and other major cities, police departments are increasing patrols at retailers targeted by mobs of thieves in brazen raids. In Northern California, district attorneys formed an alliance to prosecute organized theft rings. At the federal level, the FBI said it is in "close contact" with local law enforcement investigating such cases and prepared to take further action.

NRF Retail Security Survey 2021

https://nrf.com/research/national-retail-security-survey-2021

Let me summarize again what is happening with Organized Retail Crime from the NRF Retail Security Survey published last fall.

According to these highlights from the 2021 Retail Security Survey, participating retailers said the pandemic resulted in an increase in overall risk to their organizations. It also brought new areas of prominence, as consumers had to find new ways of getting products — and criminals new channels to exploit: Buy online, pick up in store and other multichannel methods became ripe targets.

This comes as the average loss per shoplifting and robbery incident has increased. The increasingly risky environment has repercussions that extend well beyond a company’s bottom line into actual threats against employees and customers. It is increasingly clear that greater support is needed from lawmakers and law enforcement.

Yet despite the growing dangers from organized retail crime, no federal law prevents this type of activity. That leaves prosecutions — if they do occur — in a patchwork of local jurisdictions, even though the crimes are typically multi-jurisdictional and multi-state.

LP professionals and retailers are not sitting idly by while these changes occur. They have brought attention to the continuing increase in ORC, cybercrimes, and shootings and other violent incidents in malls and stores. They continue to invest in multiple resources: Half of respondents said their organization was adding technology resources and capital. And, compared with last year, there is more of a focus on hiring additional personnel.

As the long-term impacts of the COVID-19 pandemic continue to evolve, one thing is clear: The retail risk environment is more complex and more costly than ever.

One potential driver behind the increases in robberies and shoplifting incidences is the growth in organized retail crime reported by retailers. About 69% of retailers said they had seen an increase in ORC activity over the past year. They cited reasons such as COVID-19, policing, changes to sentencing guidelines and the growth of online marketplaces for the increase in ORC activity.

Most alarming: Retailers report these gangs are more aggressive and violent than in years past. Some 65% of respondents noted the increase in violence, while 37% said ORC gangs were much more aggressive than in the past. For comparison, in 2019, only 57% said ORC gangs were more aggressive with 31% saying they were much more aggressive.

One area of strong agreement, buoyed no doubt by the increase in aggressive tactics, is the need for a federal ORC law. Some 78% of respondents felt it would effectively combat these issues in part because ORC is a multi-jurisdictional issue that crosses state lines. It is growing in its use and because of the broad range of activities, it would be more productive to bring charges at the federal level versus a series of small local cases.

LP professionals are proactively investing in tools to combat the rise in crime as well as new risk areas. When compared with previous years, respondents were more likely to say their company was allocating additional resources to address risks this year. Half reported their organization was allocating additional technology resources and another 50% said they were allocating additional capital specifically to LP equipment. In a shift from the last few years, there was a significant increase in those reporting that they would dedicate additional staffing resources.