Loss Prevention Research Council Weekly Series - Episode 170 - LPRC NY Kickoff and Young Shoppers Technology Preferences

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

LPRC Events are growing to new levels, this week our hosts discuss the continued growth of the LPRC! On this episode, our hosts discuss LPRC Kickoff in NYC, online vs physical shopping, and the evolution of the shopping technology. The hosts also go into a recap of the latest AP/LP news and the NRF Big Show.

Innovation Scrimmage for the Next Retail Generation

https://www.tonydonofrio.com/blog/retail/innovation-scrimmage-for-the-next-retail-generation-4.html

Are we becoming more physical stores or online digital shopper consumers? Prior to the pandemic, a topic that was popular in general media was the “retail apocalypse”. This Armageddon industry ending realization was being driven by rising retail bankruptcies and store closures.

The opposite force was the rise of digital commerce. Back in the year 2000, less than 1% of USA retail sales came from ecommerce. Fast forward to 2018 and it reached nearly 10% and by 2027 it is projected to reach 20.4% of total retail sales.

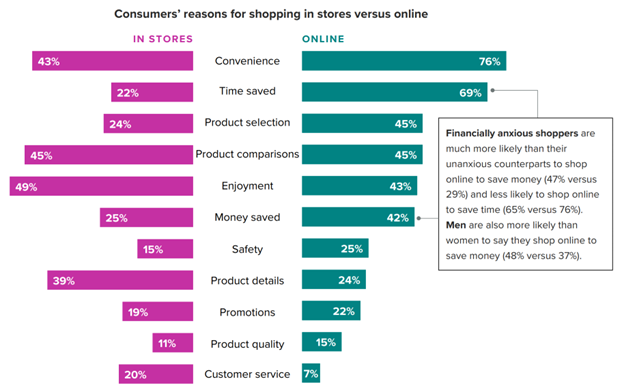

The digital revolution of the retail industry is here to stay. For the first half of 2023, according to Morning Consult, these are the reasons for shopping online versus instore.

Above chart is important as it points to the drivers of the digital versus physical instore model. This is a general view across the shopping population. As I pointed out in a previous article, leading retailers have realized the digital and physical are blending into phygital strategies. It’s no longer one versus the other, but the growing intentional strategy to combine the business models to drive higher consumer engagement across channels.

Just as interesting, if not more important, are technology adoption trends for the younger consumers and the innovation they would to see introduced into shopping journeys. As a new research study from Tata Consultancy Services pointed out, “consumers of all ages want new technologies, based on their preferences, to enhance their shopping experiences, instore and online, today and in the future.”

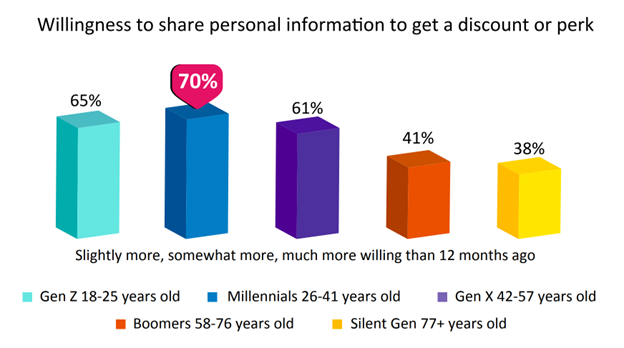

Privacy is Less of Concern for Younger Generations

Combining physical and digital strategies can help build trust in the retail model as consumers will experience less friction, if they are able to shop across harmonized channels. For many, privacy can be a concern, but winning retailers understand that value delivery is the counter force. The greater the value delivered; the more consumers will be willing to give up some of their privacy.

The differences in the privacy to value formula are generational.

According to Tata Consulting Services, key to remember as you reflect on this consumer data:

- Millennials are the largest group of consumers, but Gen X spends the most money annually, and Baby Boomers have the largest buying power.

- Gen Z’s spending power is on the rise.

- As Millennials age and their incomes grow, their spending power will only continue to increase.

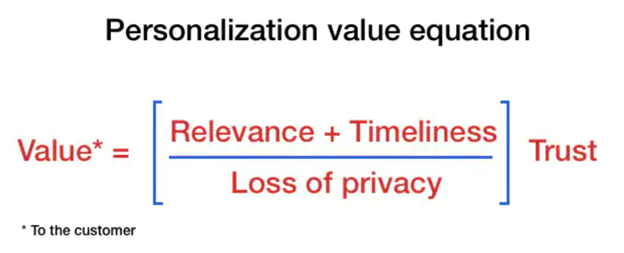

If value drivers help mitigate privacy concerns, is there a formula that can help us understand the relevant elements. For this we turn to McKinsey which published a consumer value formula in 2017.

As McKinsey said, “this formula shouldn’t imply an exact science when it comes to personalization. But it does highlight the key issues that executives need to address. Customers see value as a function of how relevant and timely a message is in relation to how much it costs, meaning how much personal information has to be shared and how much personal effort it takes to get it. Importantly, trust in the brand will boost overall value, though that can grow or recede over time, depending on the customer’s satisfaction with various interactions with the brand.”

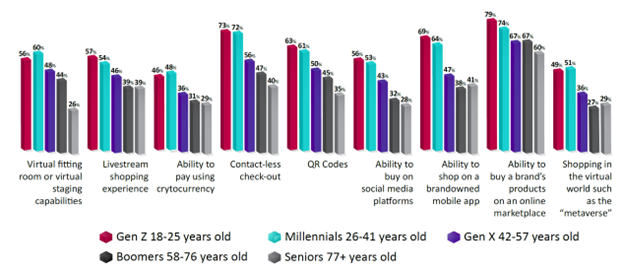

Younger Consumers Are Open to More Disruptive Innovation

Technology will continue to differentiate retail business models. Understanding how specific target consumers for individual brands want to leverage innovation in their shopping journeys will deliver strategic advantages.

In the following futuristic innovation scenarios, note the differences in technology preferences between younger and older consumers.

Note the high preference from both Gen Z and millennials generations for frictionless checkout. Interesting the differences in smart fitting rooms between GenZ and millennials. Livestreaming, which is already popular in China, has an opportunity in the United States with younger generations. The survey results in using cryptocurrency and the metaverse are also insightful.

As Tata Consulting Services summarized:

- Retailers must continually seek new ways to retain the loyalty of existing customers while attracting new ones. At the same time, they also need to anticipate the expectations of the customer of the future.

- To thrive during an unpredictable economy, retailers need the tools and technologies to identify micro-opportunities, capture new market share and deepen customer loyalty.

- The time is ripe for retailers to capitalize on the consumer appetite for new and better customer experiences.

- Investing in the right technologies, delivered to the right customers using a cost-effective, integrated digital strategy, will be essential to compete in 2023 and beyond.

The future of retail will include both physical stores and online, both with increasingly digitally influenced experiences. Brick-n-mortar stores will remain a critical element to the formula. As the data that opened this article pointed out, in 2027, 20% of retail sales will online while 80% will remain in physical stores.

The digital disruptive scrimmage for the heart of the next generation shopper will accelerate. Younger generations will demand more innovation in their shopping experiences. Pay attention to why consumers choose either physical or digital channels as they engage your brand. Build differentiated technology bridges to the areas that deliver the highest value and ROI for your strategy.