Loss Prevention Research Council Weekly Series - Episode 149 - Retail Shrink Challenges, Retailers' Earnings 5 Takeaways, Apple Market Share

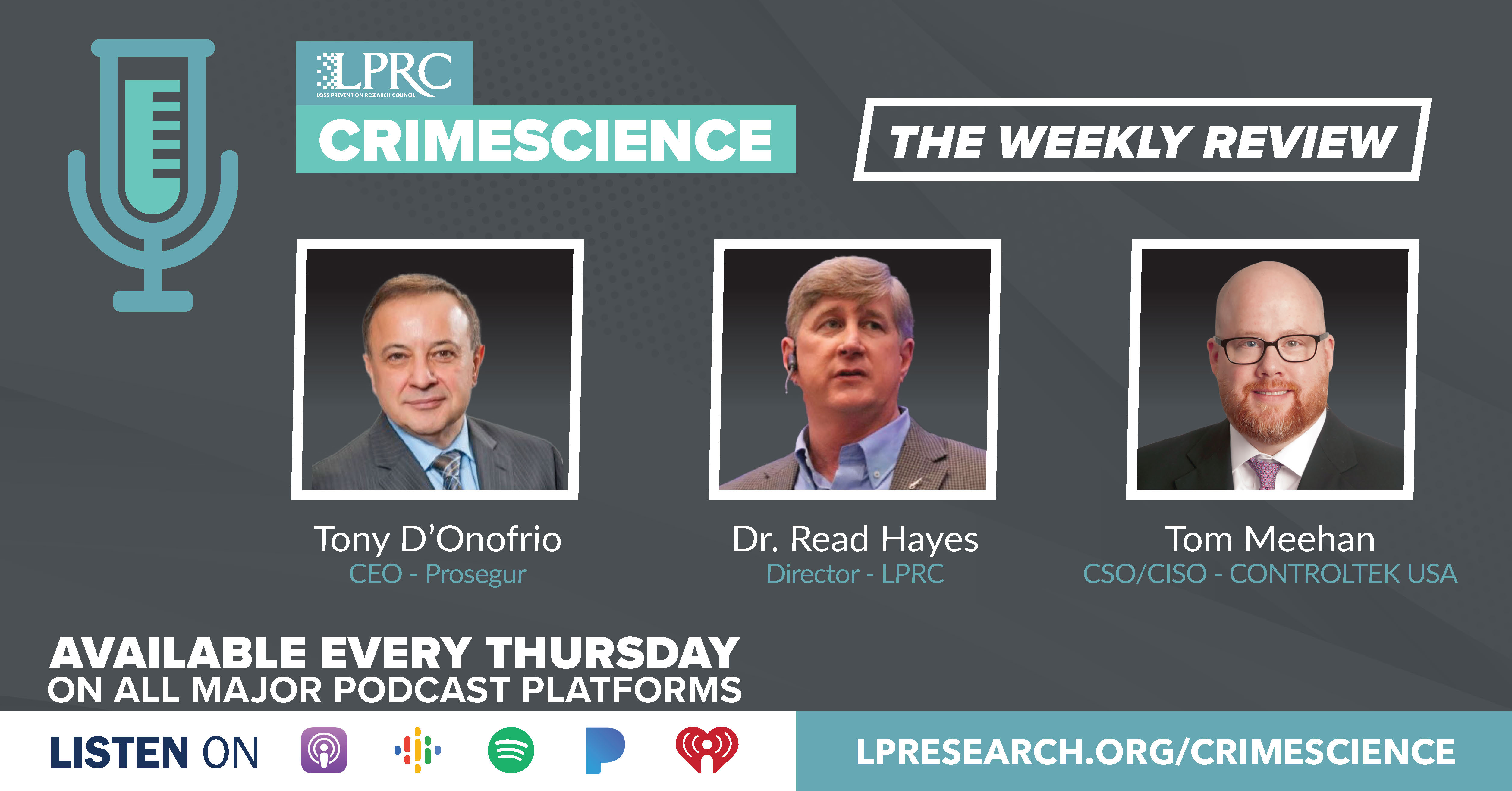

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

This week on CrimeScience, our hosts discuss unprecedented store closures among retailers and some of the potential causes and ramifications of that, the LPRC Eastside initiative and how that may enhance our understanding of community level safety, retail fraud and AI news, and sales trends in retail getting worse, especially with inflation.

We Can and Do Need to Solve the Problem of Retail Shrink

https://www.linkedin.com/pulse/we-can-do-need-solve-problem-retail-shrink-tony-d-onofrio/

Let me start this week with a summary of a new article I just published titled “We Can and Do Need to Solve the Problem of Retail Shrink”.

I opened that article with a Wall Street Journal statement from the CEO of Target when he said, quote ““The unfortunate fact is that violent incidents are increasing at our stores and across the entire industry. And when products are stolen, simply put, they are not longer available for guests who depend on them. Beyond safety concerns, worsening shrink rates are putting significant pressure on our financial results.” Unquote.

Earlier this month Target highlighted that organized retail crime “will fuel $500 million more in stolen and lost merchandise this year compared with a year ago. Other major retailers triggering the same retail theft alarms include Home Depot, Walmart, Best Buy, Walgreens, and CVS.

The three major challenges which from discussions with technology companies and retailers have been elevated as the highest USA priorities for loss prevention are active shooter, safety, and organized retail crime. The questions that I answered in the article, How did we get here? What is the latest data telling us? Is technology delivering on its solution promise? How do we ultimately solve this problem?

As I summarized in that article, the pandemic was not kind to retail crime. In a different Wall Street Journal article earlier this year, a CVS spokesman indicated that the company’s drug stores experienced a 300% increase in theft, since the pandemic start.

The increase in Organized Retail Crime compounds the problems for retail and society. Today, Organized Retail Crime (ORC) “is leading to more brazen and more violent attacks in retail stores throughout the country. Many of the criminal rings orchestrating these thefts are also involved in other serious criminal activity such as human trafficking, narcotics trafficking, weapon trafficking, and more. Tackling this growing threat is important to the safety of store employees, customers, and communities across the country.”

In my view, retail crime threats are real, more visible, and are getting more violent. They are also not isolated to the United States as similar patterns have emerged in the UK and Australia.

The problem is complex as are the solutions. Key messages that I summarized with:

- Retail technology solutions have not kept up with the growth of the problem. Too many silo products chasing niche opportunities, not tackling the challenges in an integrated approach which the top three priorities now require.

- The legal framework is stuck in the past and is not keeping pace with advancements outside the retail industry in areas that both add to the problem and help solve it.

- The Internet is both an opportunity and a curse for retail and better solutions are needed to address the challenges introduced by the World Wide Web into the retail model.

- Connectivity across interrelated frameworks is the new required normal. To effectively tackle the problem of retail shrink, strong partnerships are needed across multiple boundaries, especially between retailers and law enforcement. The good news, successful models are in place in various parts of the world, but it will take different more innovative thinking to evolve to broader global adoption.

Locking up merchandise to reduce shrink reduces revenue and increasingly drives consumers to alternate retail models. Safety needs to be our number one priority in whatever path we take to address the problem.

The pandemic accelerated negative trends across industries which were already underway. It is time, to reinvent retail once again to a brighter more profitable future where shrink is managed and consumers once again are the center of immersive, safe customer experiences.

Lots more in the article which you can find on social media.

Five takeaways about the consumer from Walmart, other retailers after a big week of earnings

https://www.cnbc.com/2023/05/19/us-economy-consumer-takeaways-from-wmt-tgt-hd-retail-earnings.html

Switching topics let me go to CNBC and their summary of five takeaways from the recent earnings release from Walmart and other retailers.

- Sales trends have weakened in the retail industry. - So far, at least five retailers — Target, Walmart, Tapestry, Bath & Body Worksand Foot Locker— have spoken about sales trends across the country getting worse.

- Inflation is still a key factor. - Inflationis easing, according to a Labor Department report this month. Yet, that’s cold comfort for shoppers who are still paying a lot more at the grocery store than they were a few years ago.

- Consumers are spending on needs, not wants. - Target, Home Depot and Walmart all saw a noticeable pattern: fewer pricey and fun items in shopping carts.

- Weather lowered demand. - Weather has not worked in retailers’ favor, at least not yet. Home Depot said cooler and wetter weather in California and parts of the western U.S. hit its sales, contributing to its biggest revenue miss in more than 20 years. Walmart is eager for warmer weather too.

- Shoppers have become more last minute. – Retailers are seeing people wait a little bit later into the season. No more stocking up early as in the past.

Apple in the Smartphone Market: Win Where it Matters

https://www.statista.com/chart/29925/apples-share-of-the-global-smartphone-market/

Finally this week, let me go to Statista for an interesting update on the power of Apple.

Earlier this month Apple reported their second fiscal quarter earnings which included $24.2 billion in net profit on revenue of $94.8 billion for the three months ending April 1, 2023.

Those results translated into a a global market share of 21 percent for Apple on smartphones, second only to Samsung.

But if you look beyond market share, Apple is winning on a lot more fronts. Thanks to its high average selling price and its healthy profit margins, Apple captured 50 percent of global smartphone revenues and more than 80 percent of the industry’s profits in the first three months of 2023.

Wow on Apple’s continued performance.