Loss Prevention Research Council Weekly Series - Episode 146 - ChatGPT, Retail Tech Priorities and Australia Retail Shrink

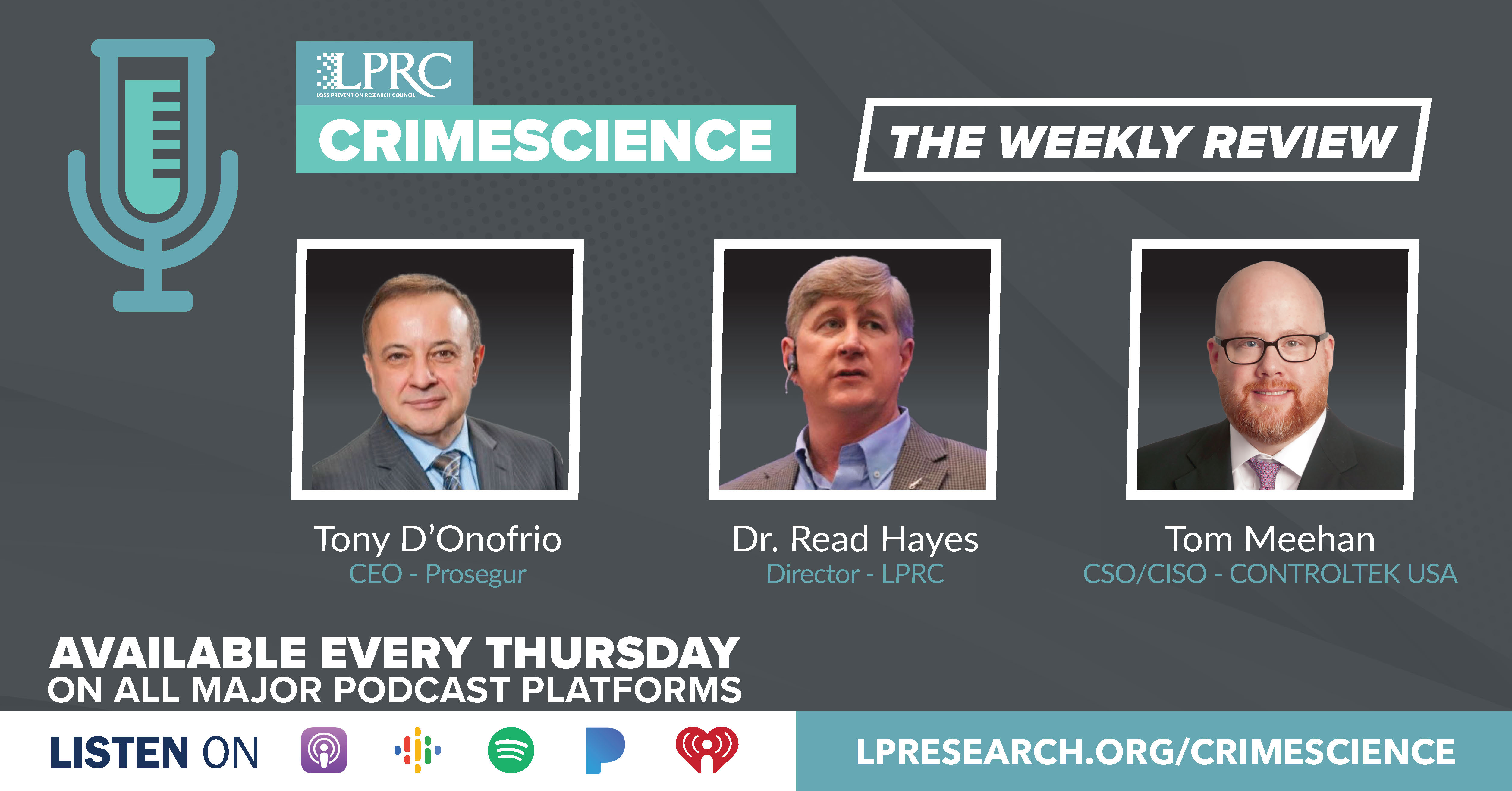

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

ChatGPT Gets 1 Million Users in Just Five Days

https://rankingroyals.com/infographics/chatgpt-gets-1-million-users-in-just-five-days/

Let me start this week with some interesting data on the fast rise of ChatGPT which has been in the news a lot. This information is from Ranking Royals .com.

As they stated, The conversational AI chatbot is heralded as a record moment in the history of technology, “ChatGPT” has become one of the year’s most ubiquitous buzzwords. Within five days of its release to the public in November 2022, ChatGPT had amassed a user base of over a million people. Let’s compare this to other setected popular online services. It took popular Netflix to reach a million users 3 and half years, Airbnb 2 and half years, Twitter 2 years, Facebook, 10 months, Spotify 5 months, and Instagram 2 and half months.

Bill Gates called ChatGDT a Gutenberg world changing moment. It’s amazing that in just 5 days 1 millions users were on board and it’s impact is just getting started.

RIS News 2023 Retail Technology Study: Return Profits and Growth

https://risnews.com/retail-tech-study-2023

Switching topics, let me summarize the latest Retail Technology Study from RIS News just published. This study focuses on IT investments in retail stores, many of which support loss prevention solutions.

For 2023, 74% of USA retailers say they will increase or maintain their IT budget compared to the lofty 84% last year — a figure that was boosted by pent-up demand unleashed after the pandemic ended. It is worth noting that while the percentage of retailers who plan to increase or maintain current IT budget levels has dropped year-over-year, the size of the IT budget (as a share of overall budget), has increased to 14% in 2023 from last year’s 12%.

When asked for one word to describe the current state of the retail industry, retailers overwhelmingly chose the concept of “evolving” and such related terms as “changing, dynamic, advancing, and fluid.” The takeaway from this insight is that in an uncertain environment, retailers need to build resilient systems and business models that can quickly adapt to changes.

The top 5 tech driven strategies for retailers for the next 18 months are improving network and IT security (28%), new payment tech / capabilities (27%), advanced analytic tools and capabilities (25%), recruiting / retaining frontline employees (24%), and advancing mobile commerce for consumers (22%).

The top challenges over the next five years for retailers are employee engagement and wages (56%), retiring legacy systems (31%), upgrading store bandwidth and infrastructure (31%), change management (resistance to change) (25%), and application integration (ongoing, new, maintaining) (23%).

As we recently completed the LPRC Supply Chain summit, from a technology point of view the top 3 investments for supply chain technology for 2023 are real-time inventory visibility, fulfillment, and returns management.

40% of retailers are currently upgrading or will upgrade digital devices (signage, kiosks, magic mirrors) over the next 24 months.

29% of retailers plan to implement checkout and payment on customer’s devices in the next 24 months.

67% of respondents have no plans to implement grab and go or cashier less checkout.

The top 3 retail growth tech over the next three years are AI / Machine learning, personalization / precision marketing, and optimizing E-commerce.

Again, multiple of these technologies both help and also add risk for loss prevention and we can discuss more in future podcasts. For example, larger network bandwidths which are and IT priority this year allow for video to be centralized and managed. We are not going to see soon more Amazon Go type stores, but we will see consumers checking out on their devices which increases risk.

Panic Buying, shoplifting, and Aggression: How Covid changed the face of retail

https://inqld.com.au/business/2023/04/11/panic-buying-aggression-and-shoplifting-how-covid-changed-the-shopping-experience/

Let me end this week by going to Australia and speak to the latest retail shrink information, just published by Griffith University and summarized by In Queensland.

The retail sector in Australia and New Zealand lost about $4.3 billion a year through theft, a 28 per cent increase on four years ago when the last study was done.

Customers stole more than half of the total while employee took about a quarter. Staff also tended to steal more expensive items. The impact of robbery, however, was lower and there appeared to be a shift away from armed robbery.

Customer theft was on average worth about $415 while employee theft averaged $1200.

Retailers reported an increase in customer aggression and violent incidents during the height of COVID-19 and since verbal abuse and violence without injury are likely to go unreported, the increase is likely higher than official statistics suggest.

The types of items most targeted for theft which include things such as fresh meat, make-up, sports-related clothing, batteries, and connection devices.

I guess I am not surprised that Australia is matching retail crime patterns found in the United States, Canada, and the UK. I am surprised however by the increased violence.