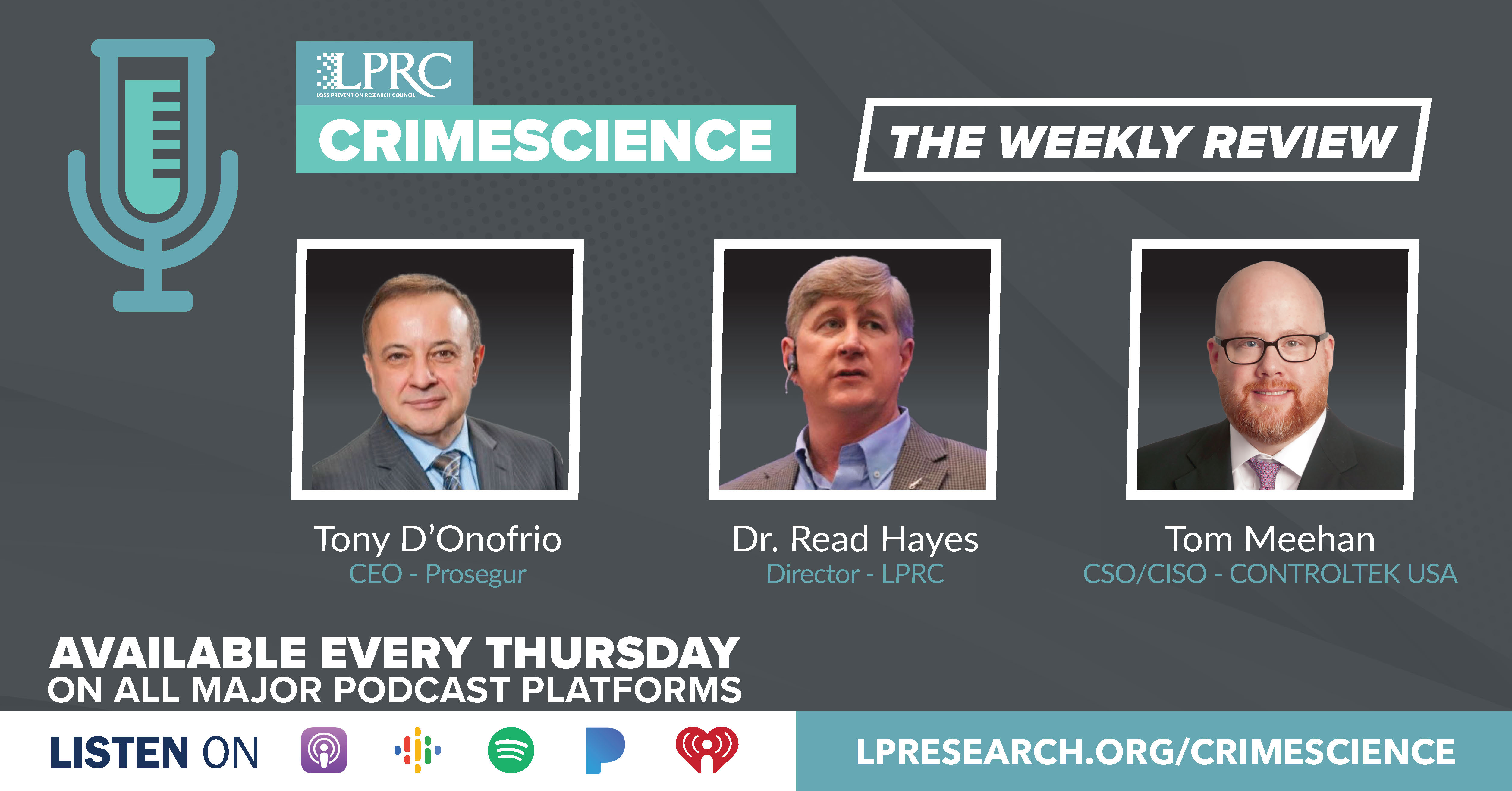

Loss Prevention Research Council Weekly Series - Episode 143 - Inflation, Retailer Returns, and More Shoplifting News

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Welcome back to CrimeScience! This week, our hosts discuss inflation in the UK, latest retailer returns in 2022, and Former President Trump’s arrest. Monitor these developments on the coming episodes!

Inflation Hits the English Breakfast Hard

https://www.statista.com/chart/29616/inflation-and-the-english-breakfast/

Let me start this week with one of my favorite inflation indicators, the UK English Breakfast indicator as published by Statista.

For February 2023, UK registered one of the highest inflation rates for Western countries at 10.4% and it was in increase from the previous month.

The UK English Breakfast was up an astounding 22%. Making up the largest increases were milk which was up nearly 43%, white bread was up 33%, eggs also up nearly 33%, and butter up 29%. The two lowest cost increases were instant coffee up just over 7% and mushrooms up nearly 7%.

I do enjoy having a traditional English breakfast every time I am in the UK, but that sounds very expensive right now.

Retailers Get Religion on Returns

https://www.ihlservices.com/product/retailers-get-religion-on-returns/

Switching topics, let me summarize some new research summarized by the IHL group on retailer returns.

Worldwide retailer returns have grown from $643 billion in 2015 to an amazing $1.8 trillion in 2022. For North America, returns totaled nearly $1 trillion for 2022.

91% of retailers report that return rates are outpacing revenue growth.

Online apparel sales generally see more than a 50% return rate. (Women’s dresses purchased online have a return rate as high as 90%). Over 52 billion dollars in apparel is returned annual. This is more that the combined revenue of Kohl’s and Macy’s.

Return fraud ranges from 8-11% of total returns depending on the retail or hospitality segment.

76% of consumers indicate they would be more inclied to shop a retailer that has more sustainable practices.

Up to 75% of margin loss from returns can be recaptured through optimized processes and complete reverse logistics process.

86% of consumers look for easy returns. 81% of consumer will switch to competitors if they have had a bad return experience.

Self service return kiosks can cut instore returns related labor costs by 94%.

Retailers Get Religion on Returns

https://www.ihlservices.com/product/retailers-get-religion-on-returns/

Continuing with information from the latest very interesting webinar also from the IHL group.

In February 2023, while inflation was up 10.4% in the UK, it was actually down for the rest of the European Union. In Europe food, alcohol, and tobacco had the highest inflation percentage increase at 15%, followed by energy at nearly 14%.

For the United States, the top three products with highest inflation are eggs at over 55%, butter and margarine at nearly 27%, and airfare at 26.5%. The first two remind me of that expensive English breakfast.

The good news is that shipping products from China is now dramatically cheaper from the peak in April 2022.

For the United States, when you factor inflation, for the month of February retail sales for food stores are down over 5% and specialty hard goods are down nearly 3%. The good news all the other sectors are up with the highest growth in restaurants up nearly 11%, followed by convenience and gas up 3.5% and online up just over 3%.

According to the IHL Group, focus right now for retailers is on:

- Reducing labor / improving store operations

- Improving margins on digital journeys

- Improving inventor visibility and accuracy

- Reducing returns

- Loss prevention in all aspects

- Monetizing customer insights

- Artificial intelligence and Machine Learning with ChatGPT having a Gutenberg moment in race to be added to existing products.

Retailers are relying on loss prevention tech to curb shoplifting

https://www.retailbrew.com/stories/2023/03/28/retailers-are-relying-on-loss-prevention-tech-to-curb-shoplifting

Finally this week, let me end on an article published in Retail Brew on loss prevention.

As the articles states, while some companies like Target and Walmart have closed stores because of shoplifting, others are meeting the problem head-on by integrating technology-based preventative measures. But while tech across the board—from license-plate recognition systems and perimeter surveillance to facial recognition and multi-sensor parking lot surveillance towers/units—slowly becomes more commonplace in stores, in some instances, it’s also raising concerns regarding consumer privacy.

“I would assume that at the top of every retailer’s mind is a positive customer experience…that is safe, that is secure, and that is as unobtrusive as possible and easy for the consumer,” David Johnston, vice president of asset protection and retail operations at NRF, told us. “But if there are no preventative methods being used, it allows the thieves to walk right in and take what they want.”

Johnston said retailers must weigh loss-prevention measures against customer experience as they experiment with new technologies. Retailers need to make sure products are readily available to purchase, but stores also don’t want to continue losing dollars to theft.

Lowe’s is one company at the forefront of integrating loss-prevention technology. At the end of last year, the company introduced Project Unlock, which uses RFID chips and IoT sensors to activate power tools after they’re purchased. We all saw this at the LPRC kickoff in January this year.

The Home Depot has been locking up more of its products over the past year, as it searches for more consumer-friendly solutions to preventing theft, the company told the Wall Street Journal.

“It’s a triage-type scenario. It’s to stop the bleeding and give yourself some time,” Scott Glenn, vice president of asset protection at The Home Depot, told the Wall Street Journal.

Summarizing this week, inflation is getting lower, but it is still too high. That English breakfast has a long way to go. Retail is recovering nicely in the United States in most sectors. Loss prevention is in the news a lot lately and the LPRC is one of the key places to work on solutions.