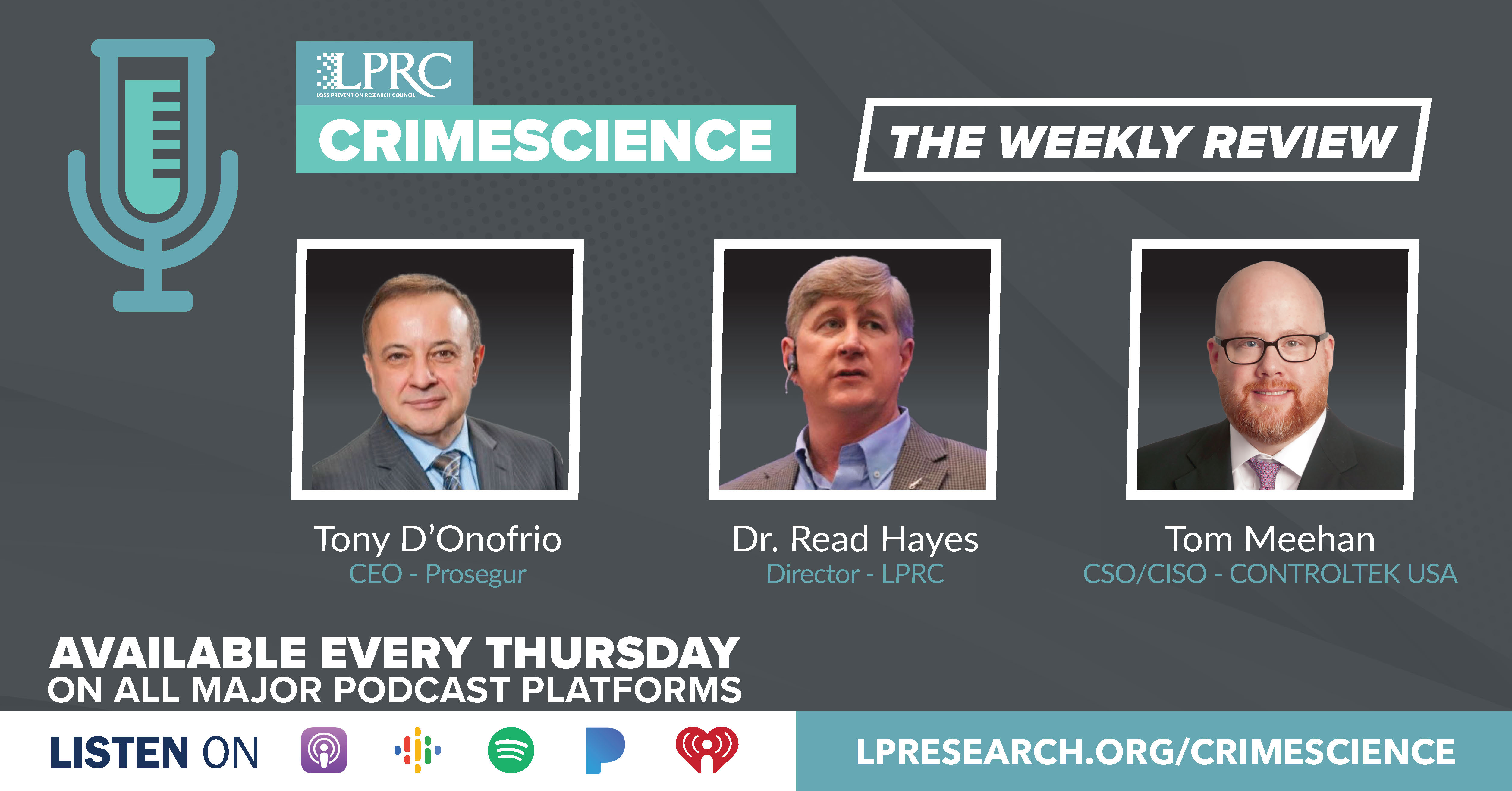

Loss Prevention Research Council Weekly Series Episode 138 - USA Economic Signals and Growth of RFID

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

First congratulations to you Read and the entire LPRC team on a great IGNITE meeting this past week in Florida. Heard lots of positive comments from attendees on both INTEGRATE and the progress being made with LPRC.

Can’t figure out this economy? Walmart, Home Depot are having trouble too

https://www.cnbc.com/2023/02/26/cant-figure-out-economy-walmart-home-depot-are-having-trouble-too.html

Let me start this week with an update on the nebulous state of the USA economy.

As reported by CNBC, if you think the economy is confusing right now, consider how baffling it must look to Home Depot and Walmart.

Last week, the two big retailers sent cautious signals about the health of the U.S. consumer. In a nutshell: Walmart said U.S. consumer spending started the year strong, but that it expect households to back off through the year, producing weak fiscal-year 2024 U.S. sales growth of 2 to 2.5 percent. Home Depot said consumer spending is holding up, but that it expects a flat sales-growth year overall, with declining profits.

Indeed, the latest inflation read from last Friday’s core personal consumption expenditures index was hotter than expected. Friday’s numbers showed consumer spending rose more than expected as prices increased, jumping 1.8% for the month compared to the estimate of 1.4%.

From the big-box retail earnings to declining hopes that disinflation would be a straight line down in 2023, the latest news from the markets and economy highlight just how hard a job the Federal Reserve has in cooling the economy without causing a recession.

Predicting where rates end in 2023 is no easy task. This year started with the bond market confident the Fed was nearing the end of rate increases and increasing its odds that the Fed would cut before year end as inflation slowed and it started to look more likely the economy achieved a “soft landing.” But after two straight hotter-than-expected consumer inflation reads in recent weeks, there is now talk of the Fed potentially raising 50 basis points at the next meeting, and the “higher for longer” view of where rates end of the year (over 5%) is suddenly back in the driver’s seat among Fed watchers.

The Ever Growing Omnipresence of Retail RFID

https://www.linkedin.com/pulse/ever-growing-omnipresence-retail-rfid-tony-d-onofrio/

Second, let me focus on a new article that I published titled “The Ever Growing Omnipresence of Retail RFID”.

The history of RFID is long and interesting. As I wrote in a previous article, the technology has its roots in World War II. For the retail industry, the adoption fuse has been slow to burn. Multiple times, I have asked the question myself, are we there yet?

In my view, we are closer than ever to making RFID one of the key standards to address inventory visibility whose importance was accelerated by the COVID-19 pandemic. In 2022, the problem of inventory distortion worldwide totaled an astounding $1.993 trillion.

The same IHL research confirms that the number 1 reason, why customers leave your store without buying are empty shelves or out-of-stocks. "This occurred 62.2% of the time consumers didn’t buy, and panic buying in 2020 was a significant driver for this reason. In 2022, this issue overall dropped to 58.9% of the problem in the minds of consumers." By comparison the next reason for leaving the store without buying was "can't find help" at only 13.8%.

The most dramatic insight from the IHL research is inventory distortion lowers consumers trust with the retailer. In the last two year, trust in Amazon has been over 4X versus other retail industry sectors. If they are not happy with you, they go to Amazon.

In 2021, I wrote an article titled "What's Driving the 93% Retail RFID Adoption Rate in North America." Accenture research cited in that post had 47% of responding North American retailers in full adoption, 37% in implementation stages, and 10% piloting RFID in 2020. High adoption rates were also cited in Europe and Asia.

The number one RFID application discussed as most important in that 2021 article was accurate inventory visibility. Fast forward another year to 2022, and new research confirms that inventory visibility is now the number one retailer technology priority.

Full disclosure, RFID is not the only technology that can address inventory visibility. I am also a major proponent of computer vision and its evolution in addressing this challenge, especially in some hard goods sectors.

The latest just published RIS News Store Experience Study also lists RFID as the second most important emerging technology identified by retailers.

As this study points out, "RFID gives retailers keen insight into inventory visibility, enabling store-based fulfillment. Fifty-four percent of those that have RFID deployed are GMS retailers. Those that have deployed RFID place a higher priority on inventory visibility (7.8% higher) and optimizing the digital journey for store fulfillment (16.7% higher)."

Interesting also that IHL reported that for retailers already using RFID in 2022, 83% had higher sales growth and 80% had higher profits.

The omnipresence of RFID in retail is further exemplified by the latest NRF 2022 Security Survey. RFID systems are listed as the number 1 technology where nearly 39% of retailer are either implementing it or are planning to implement it for loss prevention.

As the NRF study researchers pointed out, multiple of "these technological changes represent a shift toward more intelligence based loss prevention practices, as many of the technologies provide more data, and richer data, about offenders and loss events at stores and other facilities. This intelligence is necessary for investigating crimes, but it is also necessary for detecting where problems are occurring and addressing those problems."

Interesting that RFID is number one, but in my view, this Internet-of-Things technology is just getting started with the potential it can deliver in smarter security solutions to attack changing and escalating crime patterns in retail. Incidentally, above table has a computer vision application as the number 2 important loss prevention technology.

I have been privileged to have been part and even influenced the direction of both computer vision and RFID. I can confirm that their omnipresence and importance across harmonized retail channels will dramatically increase in the future.