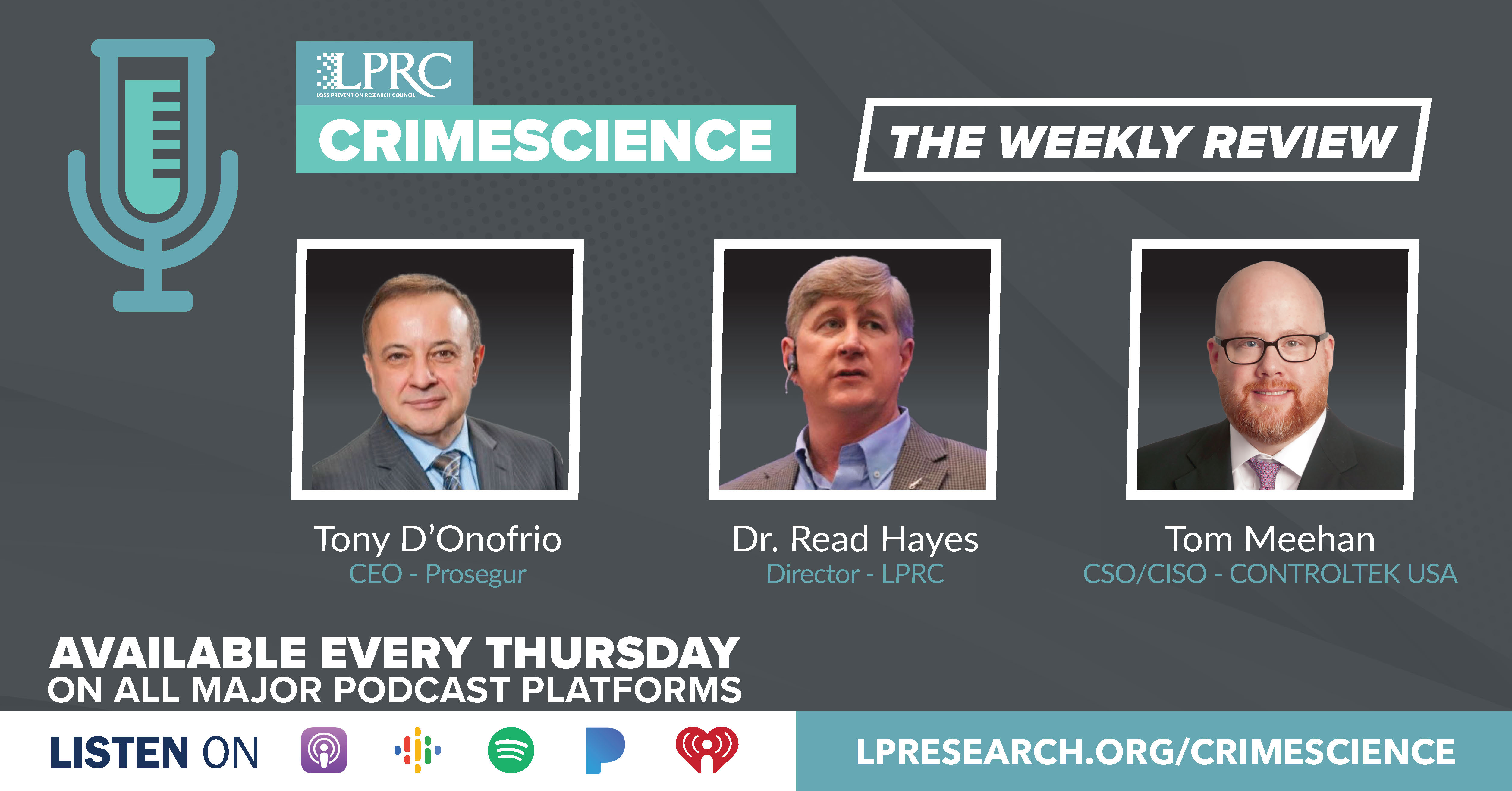

Loss Prevention Research Council Weekly Series - Episode 125 - More Holiday Forecasts and Five Terrifying Retail Trends

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

2022 Deloitte Holiday Survey

https://www2.deloitte.com/us/en/insights/industry/retail-distribution/holiday-retail-sales-consumer-survey.html

Let me start this week with a couple more forecasts on what will happen this holiday season for the retail industry.

The four key findings in the Deloitte forecast include:

- Consumers make celebrating a priority – Household finances may be at the weakest level in a decade, but spending stays steady as consumers cut non-essentials to give gifts and socialize

- Low-income regaining holiday cheer – After pulling back last year, low-income shoppers are feeling more confident and plan to spend 25% more this year.

- Inflation shrinks the shopping window – Given the economic environment, consumers plan to buyer fewer gifts, reducing the shopping duration to 5.8 weeks versus 6.4 weeks.

- Shoppers off to an early start – Inflation and stockout concerns prompt shoppers to get a jump on the holiday shopping season with 23% of budgets already spend by the end of October.

Other interesting findings:

- In terms of spend for this holiday season, 37% report their financial outlook as worse when compared to last year. 74% say they will spend more or the same on the holidays than last year. 73% expect higher prices this year due to inflation.

- Roughly 4 in 10 shoppers looking to buy sustainable holiday gifts

- 32% plan to buy resale items as a way to offset rising prices

- 49% plan to shop on key shopping event days, with Black Friday (29%) and Cyber Monday (30%) being the most popular

- Shopping online takes home a 63% share, on par with the last two years

- In-store shopping continues to rebound, growing from 28% in 2020 to 35% in 2022

- Online retailers and mass merchants are the preferred holiday destinations

- 34% plan to use social media as part of their holiday journey (vs. 28% in 2021)

Online Holiday Sales to Grow 6.1% in 2022

https://www.digitalcommerce360.com/article/online-holiday-sales/

Switching to more detail on what is expected with retail holiday sales online, let me summarize from Digital Commerce 360 their projections.

As they stated, online retailers again will have a tough go of it this season, trying to convince shoppers who are contending with inflation and recession fears not to skimp on their gift lists. In 2022, U.S. consumers’ digital spending in November-December will grow a modest 6.1% year over year, Digital Commerce 360 projects.

Digital Commerce 360 projects ecommerce revenue will reach $224.31 billion during the holidays this year, up from $211.41 billion for the same two months in 2021. That means online sales growth would be in the single-digit range for the first time dating back to pre-2015, the first year for which revised Digital Commerce 360 seasonal data is available. That’s a drop-off from 2021’s 10% online sales increase, which already was less than a quarter of the 40.8% surge in online seasonal sales during a COVID-19-fueled 2020.

Retail sales through all channels — including physical stores — are likely to rise 4.0% for the season, Digital Commerce 360 estimates. Shoppers will spend $916.42 billion overall with online and offline combined, up from $881.17 billion last year. That growth would also be a significant slowdown from 2021, when total retail grew 13.4% over the holiday period but is still higher than the median 3.2% in the five years before the pandemic.

As Digital Commerce 360 summarized, inflation will magnify consumer price-consciousness and leave many online shoppers less willing to spend as much on holiday gifts as in the past. Shoppers expect deeper discounts and will rely more on comparison shopping and price matching.

Five Terrifying Retail Trends

https://www.flooid.com/uk/blog/five-terrifying-retail-trends/

From the UK company Flooid, an interesting blog on their five terrifying retail trends which they published on Halloween this week.

1) Shrink – the $100bn bogeyman

The menacing blob of retail shrink continues to grow and grow – threatening not just profits but future investments and even the very nature of the way we shop. Theft, organised crime and inefficiencies are painting previously pristine white balance sheets an unfortunate shade of red. But don’t just take our word for it — here’s the National Retail Federation research showing shrink is now a near $100bn problem for US retailers.

2) Afraid of the dark

A worldwide energy crisis doesn’t bode well for retailers looking to stay connected. In the UK the rumour mill has been hinting at mid-winter blackouts for weeks, while in North America retailers face the ominous threat of further rises in energy costs. Could your store estate cope without power or a missing WiFi connection? What would happen if the lights went out?

3) The cost of living crisis

The undead have it difficult but only the living have to cope with today’s horrifying cost of living. In the US, Canada and UK inflation has hit 40-year-highs. North American consumers are struggling with rising interest rates and soaring healthcare costs, while European mortgage rates and energy bills only ever seem to creep up. Globally, retailers face a devilishly difficult choice this Fall. Pass additional costs onto consumers by raising prices, or freeze prices and suffer dwindling profits? And don’t forget the looming threat of reputational damage too – as this article on Canadian ‘greedflation’ shows.

4) Labour shortages

Normal Halloweens see bodies everywhere, but retail is suffering from a shortage of souls willing, able and available to staff shops and other industry positions. Last month BRC suggested UK retailers have 100,000 positions vacant, while figures reveal US retail – itself suffering an acute labor shortage – had a high quit rate of around 4% over the summer. Canadian retailers are also struggling to fill retail roles. Can your retail operation cope with skeleton staff?

5) Dwindling loyalty

Abundant choice and multichannel competition means customers are less likely to remain loyal to brands – unless they are given additional reasons to stay faithful. Personalisation, a sharper brand purpose and an improved customer experience can stop the churn. But many retailers live in fear their monolithic systems can’t cope with additional capabilities or pressure

Interesting perspective from the UK. Now over to Tom.