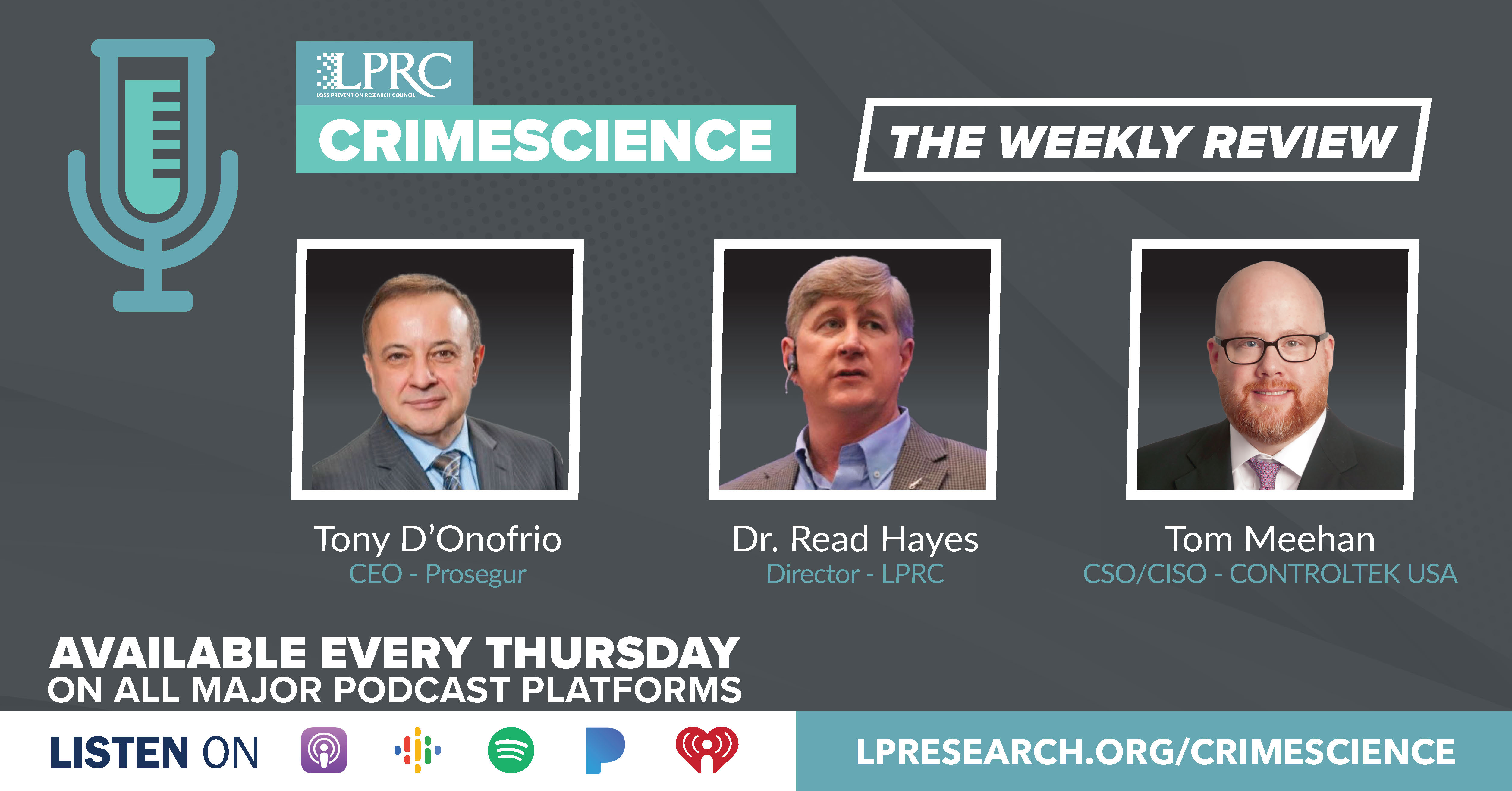

Loss Prevention Research Council Weekly Series - Episode 113 - Retail Crime Trends and Violence

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Let me summarize this week a new article that I am publishing this week where I ask the question, is retail crime out of control?

In today’s podcast I will cover part 1 of 2 of this article.

Late last year sensational ‘flash rob’ pre-holiday events elevated concerns with retail crime. “On Black Friday alone, a crew of eight made off with $400 worth of sledgehammers, crowbars and hammers from a Home Depot in Lakewood, Calif.; a group ransacked a Bottega Veneta boutique in Los Angeles; and roughly 30 people swarmed a Best Buy near Minneapolis, grabbing electronics.”

In the era of social media, these events and more led to riveting television coverage

It’s not too early during this summer to think about the upcoming holiday season. This is part one of a two-part series on retail crime trends. What has been the impact of pandemic on retail statistics? How are violence patterns evolving? What are the profiles of the crime wave? How will inflation and a potential recession impact retail crime? If retail crime is out of control, what do we do about it?

Let me summarize some key Retail Crime Statistics

A November 2021 Retail Industry Leaders Association (RILA) published study summarized the following:

- Nearly $69 billion worth of products were stolen from retailers in 2019 (pre-COVID).

- USA retail crime results in $125.7 billion in lost economic activity and 658,375 fewer jobs, paying almost $39.3 billion in wages and benefits to workers.

- Retail theft costs federal and state governments nearly $15 billion in personal and business tax revenues, not including the lost sales taxes

- Nearly 67 percent of asset protection managers at leading retailers surveyed report a moderate to considerable increase in organized retail crime, and 80 percent believe it will only get worse in the future.

- Academic research has suggested that most retail theft represent crimes of opportunity. In other words, people steal when it is easy to do so. Other causes include poor economic conditions, and dissatisfaction among workers. However, professional criminals identify the availability of anonymous on-line marketplaces as ways to easily fence goods, and prosecutorial changes as being major factors contributing to the growth in Organized Retail Crime (ORC).

- The growth in on-line marketplaces is highly correlated (61 percent) to the number of shoplifting events reported each year. In addition, those retail categories most subject to shoplifting activities are also the ones most sought after through on-line marketplaces.

According to the National Retail Federation (NRF), ORC costs retailers an average of $720,000 for every $1 billion in sales as of 2020, up from $450,000 five years earlier.

ORC highlights from the 2021 NRF Retail Security Survey include which on some levels corroborate the findings in the RILA survey:

- About 69 percent of retailers said they had seen an increase in ORC activity over the past year. They cited reasons such as COVID-19, policing, changes to sentencing guidelines and the growth of online marketplaces for the increase in ORC activity.

- Retailers report these gangs are more aggressive and violent than in years past. Sixty-five percent of respondents noted the increase in violence, while 37 percent said ORC gangs were much more aggressive than in the past. For comparison, in 2019, only 57 percent said ORC gangs were more aggressive with 31 percent saying they were much more aggressive.

Let me know speak about Retail Crime During the Pandemic

The latest retail theft survey from Hayes International concluded that in 2021 retailers moved away from apprehensions and focused more on recoveries. Shoplifting apprehensions were down just over 16 percent, while overall shoplifting recoveries were up a near staggering 31 percent.

Per incident case values were substantially higher in 2021.

On average, the amount of theft by an unchecked dishonest employee will increase by 58 percent every month.

Interesting the continued focus on technology to combat theft and the dramatic change in investment in people resources between 2020 and 2021.

In the 2021 NRF Security Survey, retailers reported new risks and threats that are now a priority which include mall/store violence/shooting incidents (82%), cyber-related incidents (76%), internal theft (53%), gift card fraud (47%), and return fraud (43%).

All those new services that expanded during the pandemic also carry risk. “In terms of fraud, retailers reported the most significant increase in fraud from multichannel sales like BOPIS, with 39 percent indicating it as a concern in 2021 compared to 19 percent in 2020. In-store sales fraud dropped from 49 percent to 28 percent from 2020 to 2021, while online-only sales fraud remained steady at 26 percent.”

Finally in this section, retail crime is not isolated to large chains. Fifty-four percent of small business owners said they experienced increased shoplifting in 2021.

To end Part 1 let me now summarize how violence and Retail Crime were changed by the pandemic

As briefly indicated in the ORC above data, violence is an increasing factor with retail crime. From the 2021 RILA study, here are some of other violence trends:

- 86 percent said that an ORC criminal has verbally threatened an associate with bodily harm,

- Nearly 76 percent reported that an organized retail criminal has physically assaulted an associate (e.g., punched, kicked, etc.).

- Nearly 76 percent surveyed said that a criminal has threatened the use of a weapon against an associate.

- Over 40 percent of APMs said that an organized retail criminal has used a weapon to harm an associate.

2021 was another violent retail year in USA retail with incidents up 9 percent and fatalities up 14 percent from the previous year.

Of the 595 fatalities in 2021, 18 percent were suspects, 53 percent were customers, 26% were store associates and 3 percent were LE/LP/Security. Alarmingly, both customer and associate deaths were up 24 percent each in 2021 when compared to 2020.

Fifty percent of the retail fatalities were inside the store or mall, 45 percent were in parking lots, and 5 percent died off premises. 2021 was a reversal from 2020 when parking lots had the highest number of fatalities.

The negative impact of this violence is reflected in employee surveys. Eighty percent of workers experienced or witnessed hostile behavior from customers when staff tried enforcing COVID-19 safety measures. Thirty-nine percent of workers were leaving, or already left their job because of concerns with “hostility and harassment from customers.” The survey was conducted between October 2020 and May 2021.

Safety is a critical ingredient to a successful retail deployment model. The alternatives can be costly on multiple levels. Starbucks recently announced that they will close 16 USA stores, mostly on the West Coast, by the end of July because of safety concerns.

Part 2 of this summary soon.