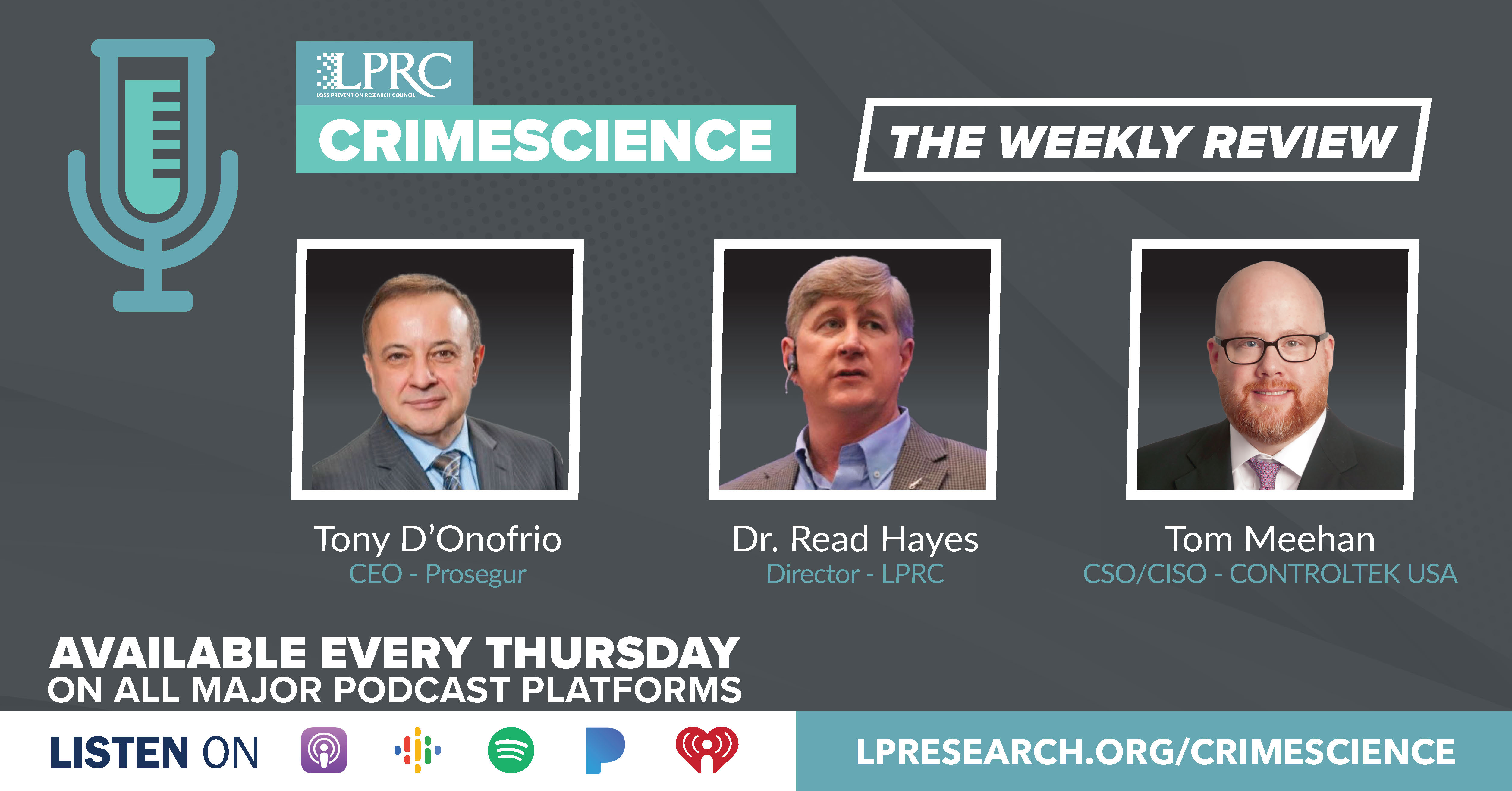

Loss Prevention Research Council Weekly Series - Episode 110 - The Latest Retail Statistics Including Headwinds

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Keep on Rockin’ in the Retail World

https://www.tonydonofrio.com/blog/retail/keep-on-rockin-in-the-retail-world.html

As a follow up to the just completed NRF Protect in Cleveland, let me summarize this week the latest data on global retail sales, e-commerce, physical stores trends, consumer challenges and headwinds. This information is from my latest article just published on my personal website tonydonofrio.com.

I opened the article with a picture of me standing in front of guitar that included the words ‘Retail Rocks’. The picture reminded me that even with all the current headwinds, retail remains very vibrant.

2021 confirmed that we are all resilient consumers who will continue to shop our favorite brands. In May 2021, E-marketer forecasted that retail sales globally would rise 6% to just over $25 trillion, which was a significant comeback from 2020. By the end of year, 2021 global retail sales actually grew 9.7% reaching total spending of just over $26 trillion.

2021 in-store sales grew a healthy 8.2% globally to just over $21 trillion which was more than was spent in 2019. “Pent-up demand from in-person shoppers accelerated the recovery by two full years.”

When this E-marketer research was published in January 2022, brick-and-mortar sales were projected to grow 2.6% to 3.4% for the remainder of the forecast out to 2025. More spending is expected in physical retail than ecommerce in 2022 ($702 billion versus $604 billion), despite its slower growth rate.

When it comes to online sales, 2022 will mark a major milestone worldwide with e-commerce sales crossing $5 trillion for the first time.

The spike seen in 2020 of over 26% growth is abating, but the sector will still enjoy double digit growth through 2024. By 2025, ecommerce will represent nearly 24% of total global retail sales.

Some interesting statistics about ecommerce:

- There are 7.1 million online retailers operating globally with 25% of these in the United States.

- 87% of U.S. consumers now start their shopping experience online with product searches. Of that percentage, a massive 74% of consumers begin their product searches on Amazon.

- Gen Z has the greatest online shopping preference of any generation, with 87.6% of shoppers preferring it. As a comparison only 41% of baby boomers prefer to shop online.

- 73% of businesses are currently selling via social media, with that number expected to rise to 79% in the next three years.

- 73% of shoppers are more likely to decide to buy an item if the shipping is free.

The latest data confirms that having e-commerce as the only sales strategy is not a recipe for success. Retailers that have both successful physical and online strategies will rule the successful future of the industry.

“When it comes to year-over-year growth in omnichannel sales (merchants with an online and brick and mortar presence), 61% of omni retailers in the US, 58% in the UK, and 56% in Canada reported higher sales growth with a whopping 21% of omnichannel merchants in the US reporting “significantly higher” revenue —far more than the overall average.”

Physical stores are back and rocking once again. On multiple levels, as humans, we enjoy the interaction with products.

- 62% of consumers want to “see, touch, feel, and try out” items and hence choose to buy from physical stores.

- 61% of customers want to try products in person before making a purchase.

- 76% of people prefer to go to a physical store for holiday shopping.

We also are increasingly leveraging technology to enhance our shopping experience. For in-store purchases, 82% of smartphone users consult their phones.

Those new services that accelerated during the pandemic are growing and are here to stay.

- 68% of U.S. consumers now use BOPIS (buy online pickup in-store).

- From the pandemic’s start through 2021, the share of retailers offering curbside pickup has risen to 44%.

These new services, however, can be very expensive and detract from profitability without technology optimization.

The good news, each month, customers spend 69% of their discretionary income in-store. However, to stay relevant, physical stores will need to continue to evolve to keep up with less patient consumers. Globally and in the United States, 60% of consumers are impatient.

The top 3 issues that retailers are challenged with are hiring and keeping people, rising supply chain costs, and inventory / supply chain challenges.

Inflation does not look like it will be subsiding any time soon. USA inflation has almost quadrupled over the past two years, but in many of the world, it has risen even higher. The Ukraine war is adding additional global uncertainty to the stability of global markets.

Retail is vibrant, resilient, and will continue to rock into the future, but in the near term the clouds of uncertainty will increase. USA consumers have already started cutting back. The biggest reductions are in driving (52%), large purchases (47%), travel (46%), entertainment (50%) and clothing or other goods (42%).

Technology will remain a key driver and differentiator where retail goes next.

A recession is probably ahead in 2023, but it’s worth reminding ourselves that a digitally empowered consumer experiencing more immersive customer experiences with strong brands are what will deliver a brighter future of retail.

An Active Shooter During July 4th Parade Examined! Stay Connected with the LPRC with the Connect Newsletter! In this week’s episode, our co-hosts discuss an LPRC Body Worn Camera Project, a Discussion on Consumer E-Commerce Shopping Habits, a discussion of TikTok User Privacy, Retail Habits in 2021 vs 2022, and the separation of work vs personal technology for security.