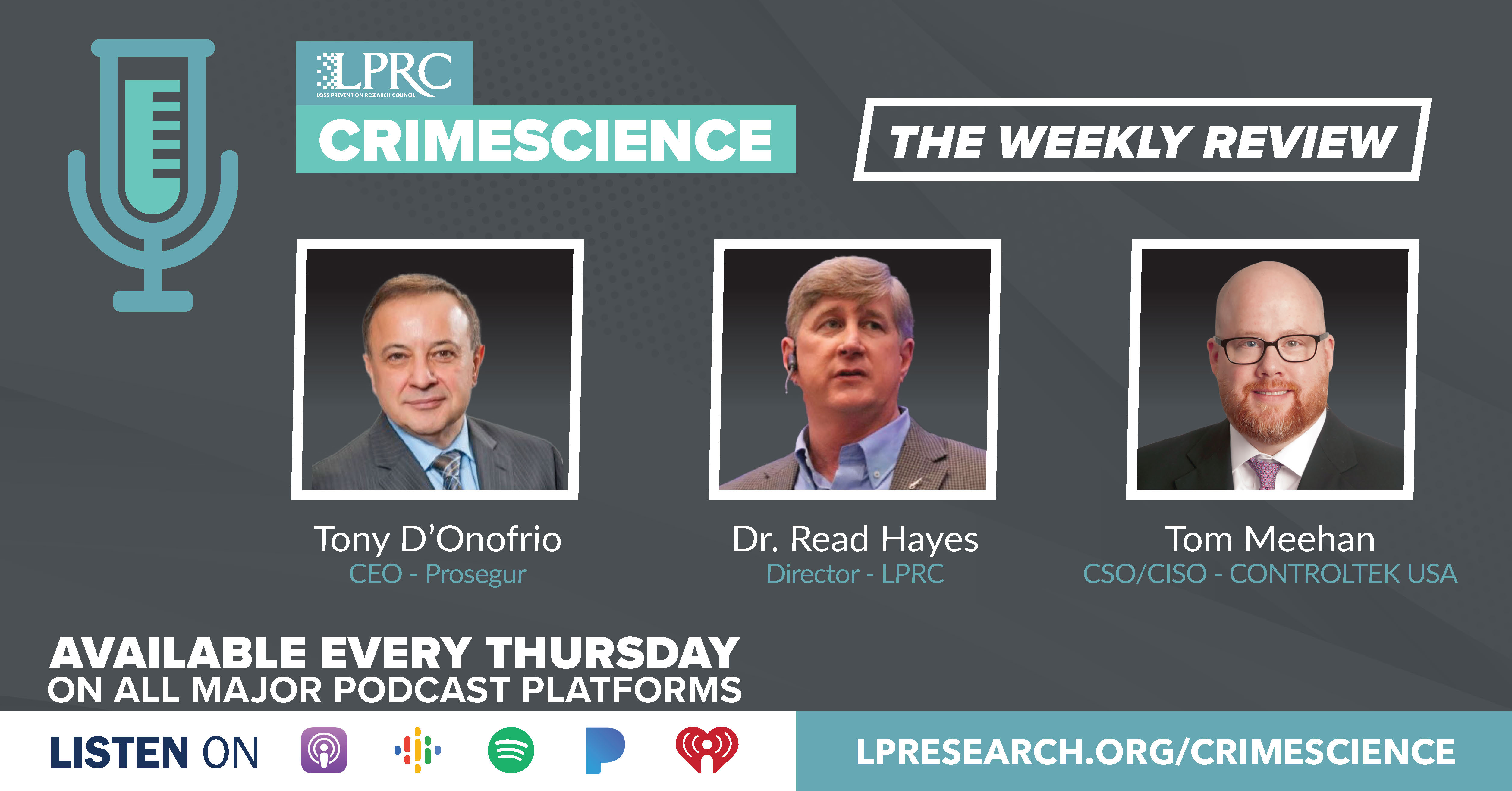

Loss Prevention Research Council Weekly Series - Episode 107 - Global Economic Forecasts And The Success of LP Technologies

With Dr. Read Hayes, Tony D'Onofrio, and Tom Meehan

Global Economic Forecast: Q2 2022

https://go.euromonitor.com/report-extract-Economy-Finance-Trade-220607-Global-Economic-Forecasts-Q2.html

Let’s start this week with the latest forecast for Q2 2022 from Euromonitor.

The global economic outlook has worsened substantially since February 2022, with lower expected growth and higher uncertainty. Global real GDP growth is expected to decline to 1.8-3.6% in 2022 and to 1.8-4% in 2023, after 6% growth in 2021.

Global inflation is expected to increase to 6.8-9% in 2022, before declining to 3.8-6.3% in 2023. Global supply constraints have tightened substantially since the Russia invasion of Ukraine with big increases in energy and commodity prices, worsened by stronger pandemic restrictions in China. At same time, global demand reductions due to the same pandemic restrictions in China and Asia more generally and due to higher global uncertainty can alleviate tightness of supply constraints.

The US economic outlook has worsened significantly since the start of war in Ukraine. In the baseline scenario, US real GDP is expected to increase by 1.8-3.6% in 2022 and by 0.5-2.8% in 2023. Several positive factors continue to support the US economy. Economic activity levels are still below the pre-pandemic forecast, providing ongoing recovery potential. The labor market remains strong with a low unemployment rate and employment rate approaching the pre-COVID-19 pandemic level. The US’ large oil and gas production partly offsets the negative economic effects of higher global energy prices.

However, negative forecast drivers have become more dominant. Energy and food prices have increased sharply due to lower supplies from Russia and Ukraine. The rise in uncertainty and increase in financial market risks is reducing both domestic and global demand. Consumer confidence is now lower than in the beginning of the COVID-19 pandemic. Tighter monetary policy is expected to cause a large increase in borrowing costs, further reducing consumer spending and business investment.

Spillovers from the war in Ukraine have led to a sharp deterioration in the Eurozone’s economic outlook. The Eurozone economy is extremely vulnerable to the rise in energy and food prices due to cuts in supply from Russia and Ukraine. It is also highly sensitive to rising geopolitical risks from the war, and to a general increase in global uncertainty and worsening global exports demand.

After a fast 5.4% recovery in 2021, Eurozone real GDP growth is expected to decline to 1.7-3.5% in 2022 and to 0.8-3.2% in 2023.

Then and Now: Cash Registers, CCTV Cameras, and Electronic Article Surveillance

https://www.tonydonofrio.com/blog/retail/then-and-now-the-surprising-start-and-success-of-your-favorite-lp-technologies.html

On multiple platforms I have been running a series of articles looking back on how technology started and where it is today. For today’s podcast let me summarize the surprising start and current state of three loss prevention technologies.

Let’s start with the cash register. It might be surprising, but the original purpose of the cash register was to stop theft. The inventor was James Ritty, a saloonkeeper in Dayton Ohio.

Watching his employees in 1879 taking cash from patrons, Ritty began to wonder how they separated what belonged to the business versus what they were potentially stealing for their own profits. Having observed counters on a steamship that kept track of the number of propeller revolutions, with the help of his brother, he patented the first cash register in 1883.

John H. Patterson, a store keeper, bought the rights to Ritty's patent for $6,500 in 1884 and founded the National Cash Register (NCR) company. His interest in the technology was sparked by losses from one of his oldest retail clerks that was favoring friends by selling goods below regular prices.

Patterson was also a master salesman and to NCR he brought highly professional sales training (later even adopted by IBM) that included loss prevention concepts that are still in use today.

Foremost in selling process of the cash register was the theft triangle which focused at the balance of risk, opportunity and need / rationalization. The cash register decreased the opportunity to steal by accurately counting transactions and the loud noise (by design and later with a bell) that it made during a transaction increased the risk of getting caught.

In 1973, IBM developed the first computer-powered cash register. It was also the first networked POS solution allowing for the consolidation of data from 128 cash registers.

Later decades introduced touchscreens, customized variations in industries such as fast food, and by the early 2000s Cloud POS made an appearance. Today you can check out on your smartphones in multiple retailers, but the ultimate evolution of the cash register was delivered by Amazon when opened their first fully automated checkout store to the public in 2018.

Over 40 Amazon Go stores are now open in the United States and the United Kingdom.

Next let’s look at CCTV cameras.

The first recorded use of CCTV technology was in Germany in 1942. “The system was designed by the engineer Walter Bruch and was set up for the monitoring of V-2 rockets, the world’s first long-range ballistic missiles that were launched from mobile platforms during World War II. The German military used the cameras to observe rocket launches from inside a bunker at a safe distance.”

Commercial usage of CCTV cameras for basic live public and home security monitoring emerged in 1949. In 1953, CCTV systems were used during the crowning of Queen Elisabeth II in the United Kingdom.

Cameras also started appearing on the streets of London and New York during this time. London is now the number 2 most CCTV surveilled city in the world with 1,138.48 cameras per square mile.

Fast forward 72 years since they first appeared, in 2021, the world crossed over 1 billion CCTV cameras installed worldwide. Through computer vision, the CCTV camera has become one of most powerful data collection and solution execution solutions.

Finally, let’s summarize EAS and its innovation journey.

EAS had its origin in 1964 when Ron Assaf (later the founder of Sensormatic), a store manager in Ohio, became frustrated with the ongoing problem of shoplifting. The idea of a technology to address it was sparked by the unsuccessful or one might say cautious chase of a shoplifter of spirits. With the aid of his cousin, weeks later the first cardboard mockup of a tag that alarmed was brought to the store.

“Fast forward two years and the official honor of inventing EAS security tags actually goes to Arthur J. Minasy. He is the inventor credited with creating and patenting a security device that could be attached to items for sale. Manasy’s system was based on Radio Frequency (RF) technology and became the basis for his company Knogo. By the end of that year, security tags were widely marketed to retailers.”

On multiple levels EAS was really the first item level technology applied to consumer products. As with CCTV video, it was a foundational technology whose evolution to greater intelligence still continues today. Billions of EAS tags continue to be applied today worldwide.

We come full circle in this loss prevention edition of LP technologies as at core of the success of EAS is the theft triangle first introduced with the cash register. People will steal consumer items if the opportunity is available and if they rationalize, they need it. That EAS alarm at the exit through multiple variations of EAS technologies increases the risk that you will get caught.