In a year where consumers still fretted about inflation, Santa Claus delivered a solid holiday shopping season. According to a Mastercard Spending Pulse report, total spending this holiday season increased 3.8% over 2023, surpassing the previously forecasted rise of 3.2% and beating last year's increase of 3.1%. For the shopping period between November 1 to December 24, online grew 6.7% while in-store sales grew 2.9%.

On some levels, 2024 was a challenging year for the USA retail industry. According to Coresight, through November 2024, retailers were projected to close over 7,100 stores, a 69% increase over the same period in 2023. Somewhat surprisingly, the top 5 retail chains with the highest number of physical stores closures were Family Dollar, CVS Health, Big Lots, Conn's, and Rue21.

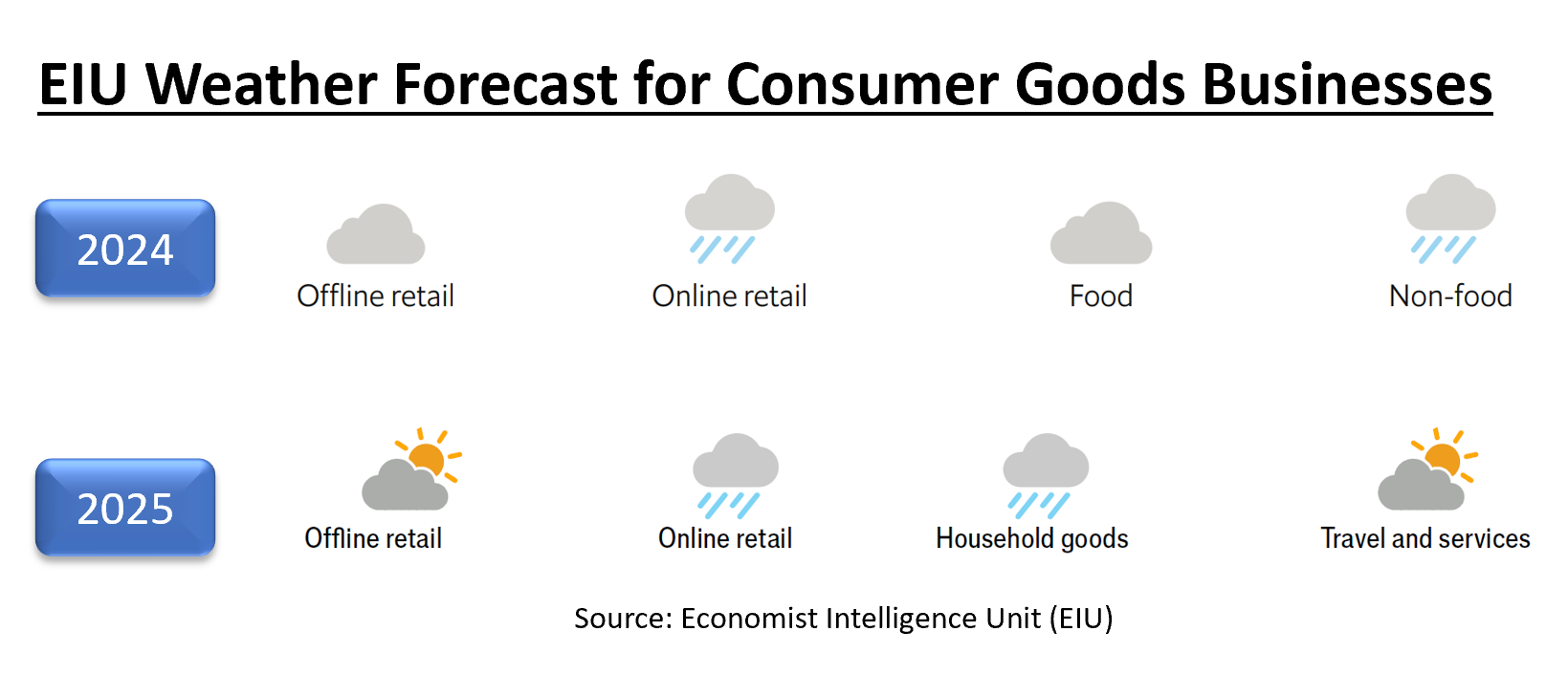

The mixed results fulfill the prophecy by the Economic Intelligence Unit which in 2024 forecast offline retail as cloudy, online retail as stormy, food as cloudy, and non-food also stormy. In December 2024, three other major chains announced either bankruptcy proceedings or liquidation sales: The Container Store, Big Lots, and Party City.

Is another retail apocalypse for physical stores in the 2025 retail horizon? What are the latest growth forecasts for global retail in 2025? What are the top 5 disruptive retail predictions for 2025?

The 2025 Global Retail Forecasts

According the latest Economist Intelligence Unit consumer businesses weather forecast, the sun will shine for multiple important retail sectors.

Physical stores will continue to make a comeback in 2025. A brighter year for travel & services implies increased shopping tourism.

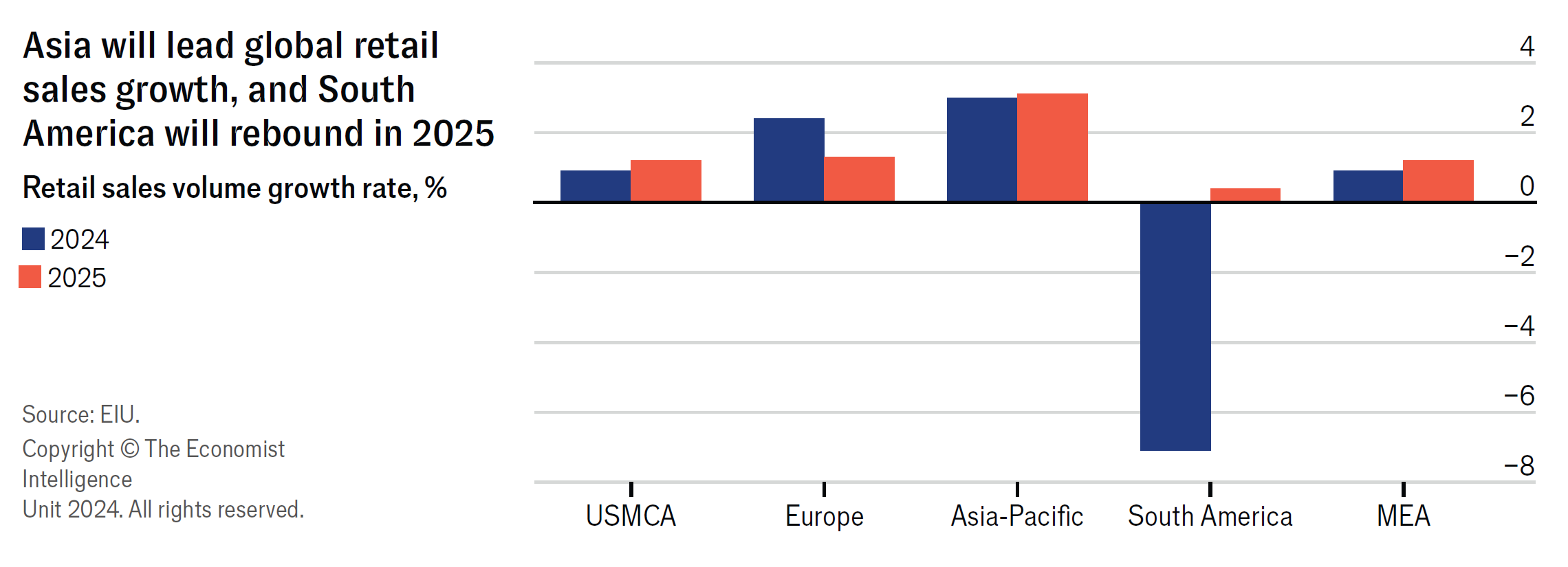

For the new year, global retail sales are projected to grow 2.2% in real (or volume) terms, the fastest since 2021. Contributing is slower inflation which will reach the lowest levels since 2020. The partly sunny retail forecast reflects the EIU consumer confidence concerns with household savings remaining below pre-pandemic levels.

Asia will once again lead global retail growth. In 2025, China's consumer market is projected to grow 4%, the slowest since 2022 (down from average of 7% in 2015-19). The star country in Asia is India at 5% projected growth (down from 5.3% in 2015-19). USMCA (North America) is projected to grow below 2%, Europe will see declining retail sales, and South America will have a meager positive recovery.

The Top 5 for 2025 Retail Disruptive Predictions

In doing the research for this article, it was not easy narrowing the list to just the top 5 predictions for 2025. Making my top 10, but then discarded were the increased usage of drones to speed up retail deliveries, the growth of retail media networks, sustainability trends, gamification of loyalty programs, and the decline of self-checkouts.

The final top 5 reflects a year of positive transformational opportunities for retail industry.

1. Artificial Intelligence (AI) as the Retail Industry Co-Pilot

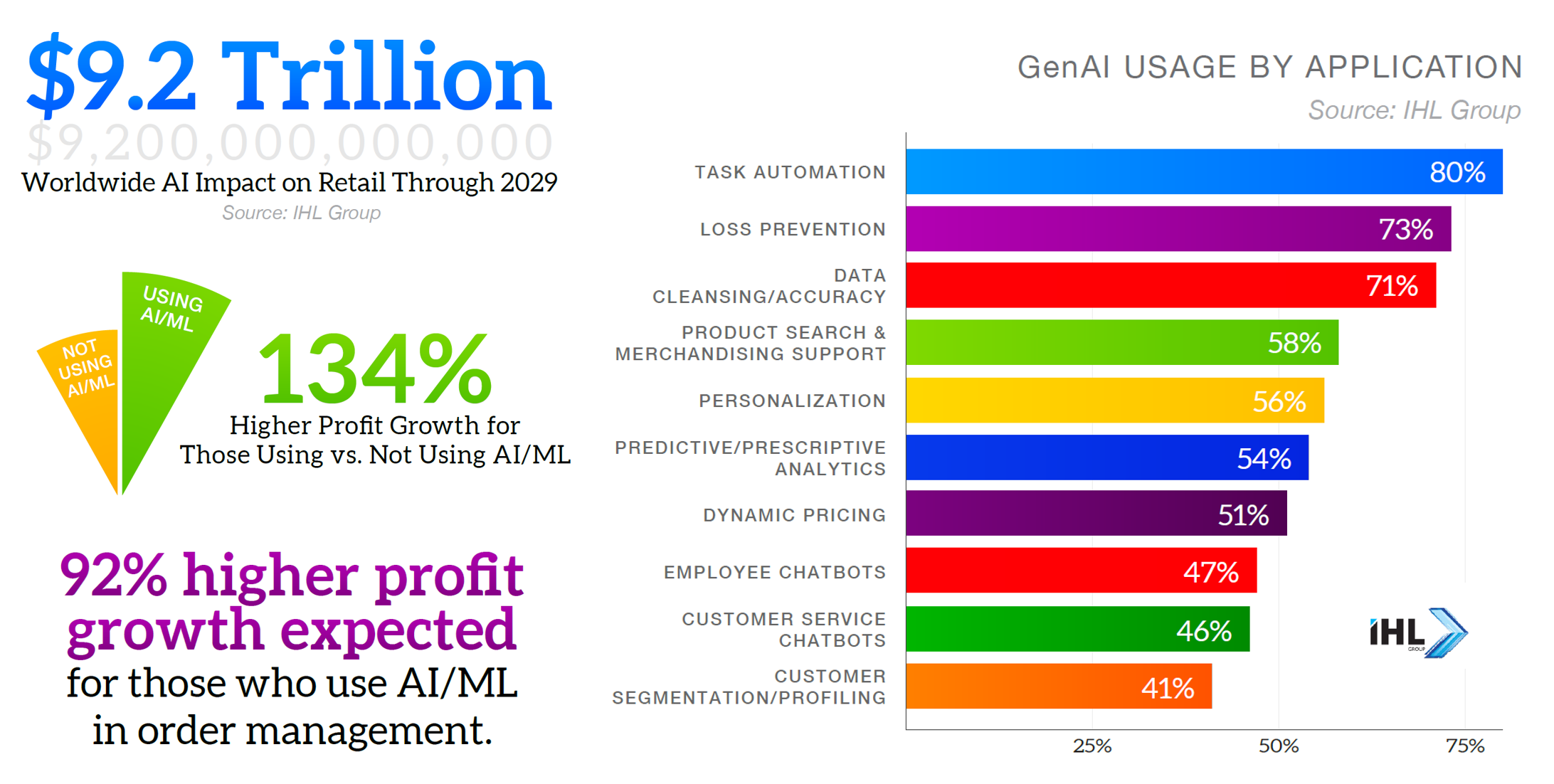

The IHL Group projects that by the end of this decade, AI will represent a $9.2 trillion worldwide opportunity to enhance retail sales, improve gross margins, and lower the cost of operations. In 2024, retailers using AI experienced 16% higher sales growth and 134% higher profit growth that those not using these technologies.

The top 3 Generative AI retail applications by a wide margin are Task Automation at 80%, Loss Prevention at 73%, and Data Cleansing / Accuracy at 71%. As I spend a lot of time in this industry sector, loss prevention was a pleasant positive sector.

In 2024, more than 70% of brands said AI will play an important role in personalization and delivering tailored shopping experiences. "AI is taking personalized shopping to a new level, from curating tailored product recommendations to optimizing customer service interactions. In fact, 92% of brands have incorporated it into their selling strategies, and we’re seeing it power everything from conversational AI for instant customer support to predictive analytics that anticipate what a customer might want next."

2. Supply Chain Chaos Anyone?

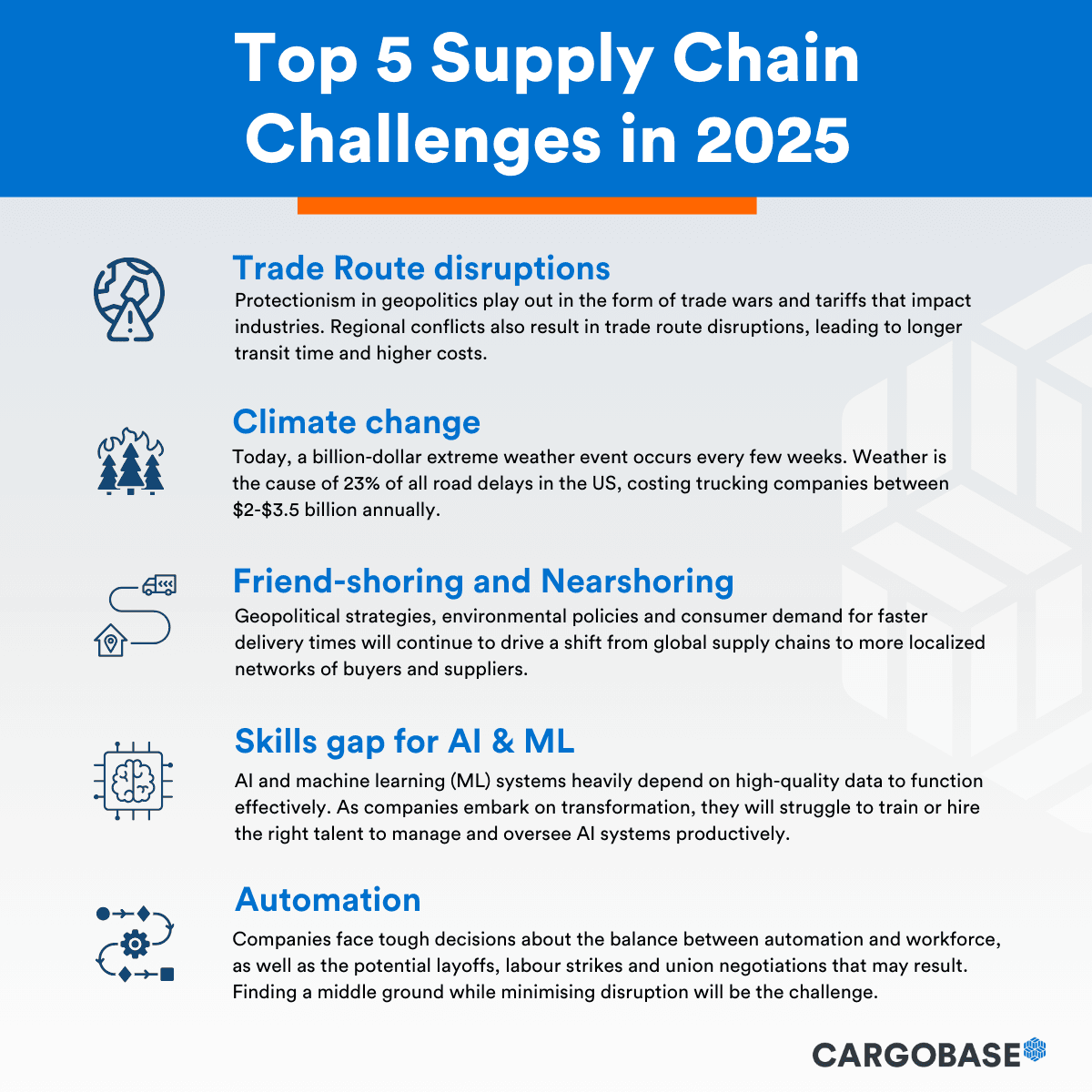

Potential increased tariffs are only one of the latest headwinds facing retail supply chains in 2025.

Eight out of ten companies (79%) are diversifying their supplier base, with 71% actively investing in regionalization and localization. In addition, 83% of organizations are actively investing in friend-shoring, a growing practice in which supply chain networks focus on countries considered political and economic allies to further reduce risk exposure. All industries and especially retail will see greater disruption in supply chains in 2025.

3. VIP Treatment Please

A 2014 Harvard Business Review article pointed out that acquiring a new customer is five to 25 times more expensive than retaining an existing one. Placing the focus on increasing customer retention by 5% augments profitability by 25% to 95%.

An emerging trend that will grow in 2025 is providing greater VIP treatment to the most loyal customers. Salesforce predicted that 2 out of 5 purchases made over this holiday season were from repeat shoppers.

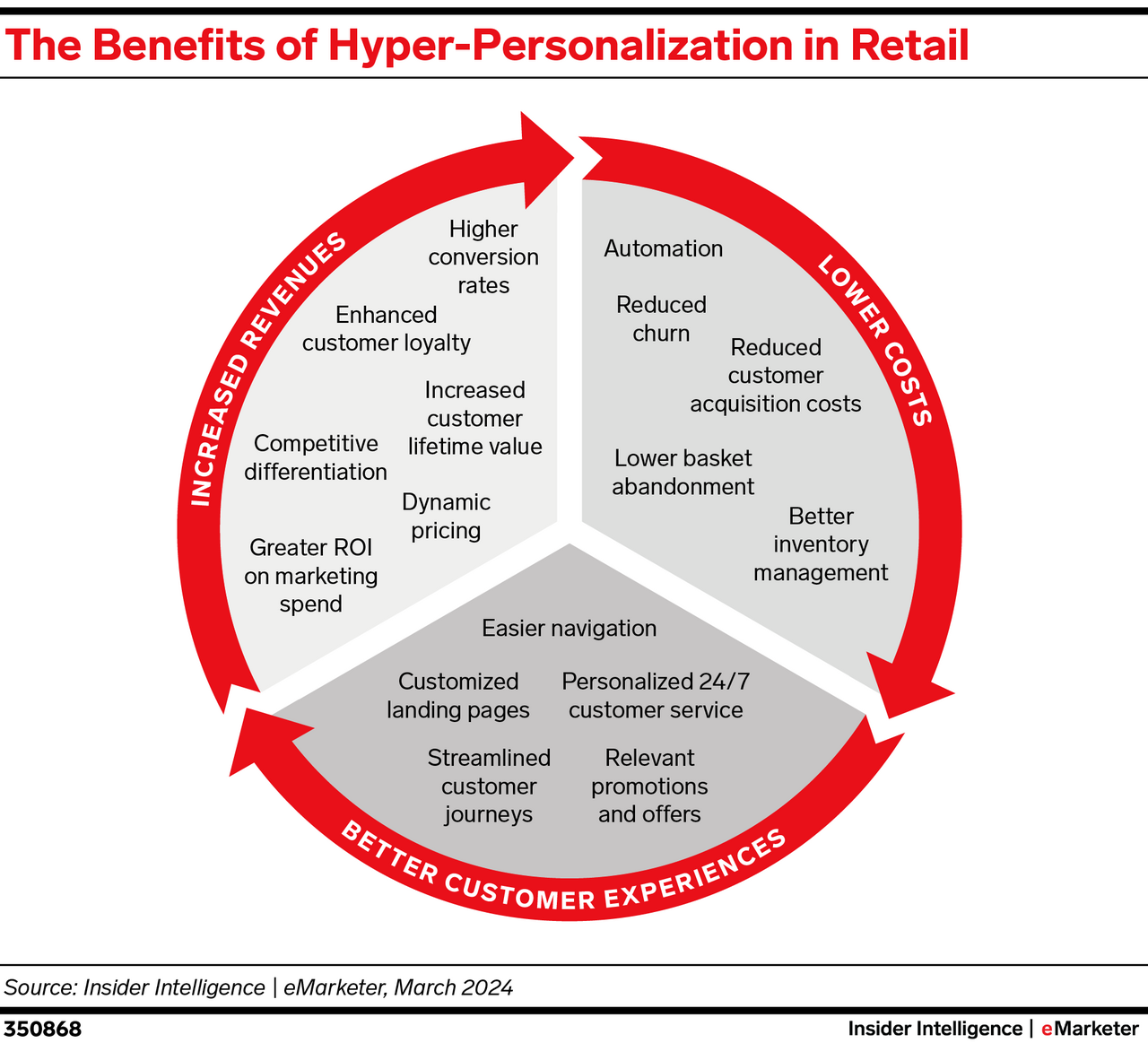

Globally, 80% of consumers think personalized product recommendations are "cool." Hyper-Personalization for VIP retail customers will intensify in 2025.

Building on the 2025 partly sunny forecast for travel & services, let's revisit the parallel success story of Delta Airlines which inspired this retail trend. In their annual investor day presentation, Delta said higher-income households, which comprise 75% of overall travel spending, have about 40% more household wealth than they did in 2019. By placing greater focus on these VIP travelers, Delta now expects that more profitable premium revenue will surpass lower margin main-cabin revenue by 2027.

4. Greater Harmonized Hybrid Retail is on the Way

The lines between physical store and online retail continue to be blurred. It starts with what I described in a previous article with creating phygital experiences which is a deliberate focused operational strategy to combine digital and physical experiences across channels.

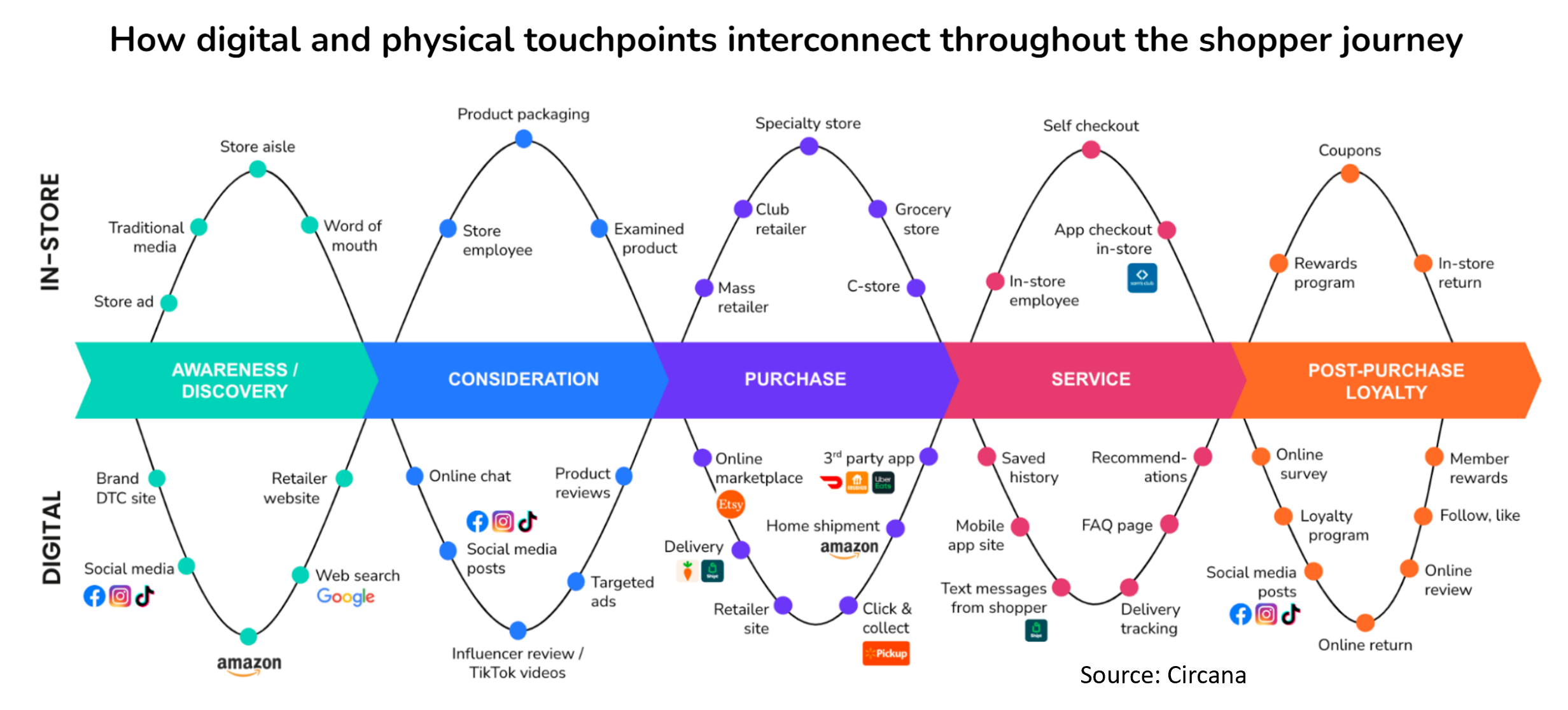

As visualized by Circana, in a phygital world, there are substantial interconnections between digital and physical retail:

Globally, 56% of shoppers research products online before completing purchases in-store. Options on where to shop will continue to increase. GenZ lead the charge with influencers and social commerce. In the past three months, 37% have bought a product based on an influencer's recommendation and a further 43% bought a product through TikTok.

As the Wall Street Journal reported, the latest trend has luxury brands such as LVMH, Coach, and Armani adding high-end restaurant selections in their stores, feeding the free publicity 'food porn' on TikTok and Instagram. Consumer food brands are in reverse looking to retail to elevate their brands. "Trendy tinned seafood brand Fishwife teamed up with fashion boutique Lisa Says Gah to produce a $60 necklace. Coca-Cola and Diet Coke secured their own co-branded shoes from footwear brand HeyDude. And salad-bar chain Sweetgreen last month dropped a nine-piece apparel collection featuring a tote bag, hoodie and even socks in the manner of a streetwear brand."

Retailers in 2025 will adopt increased strategies to harmonize existing and new hybrid channels to reach target consumers. How we shop will continue to evolve and greater creativity is the only barrier to new immersive memorable experiences.

5. Retail Security Redefined

Frictionless commerce which is a growing trend is adding to the crime problem. Take self-checkout, where 15% of users have purposely stolen an item and 44% of self-checkout thieves plan to do it again. Younger generations steal at even higher levels with 31% of GenZs and 21% of millennials purposely taking an item without scanning it at self-checkout.

2024 Lending Tree research found that over one in four Americans admitted to shoplifting in retail stores. Favorite targets to steal were grocery (46%), department (36%), and convenience stores (26%).

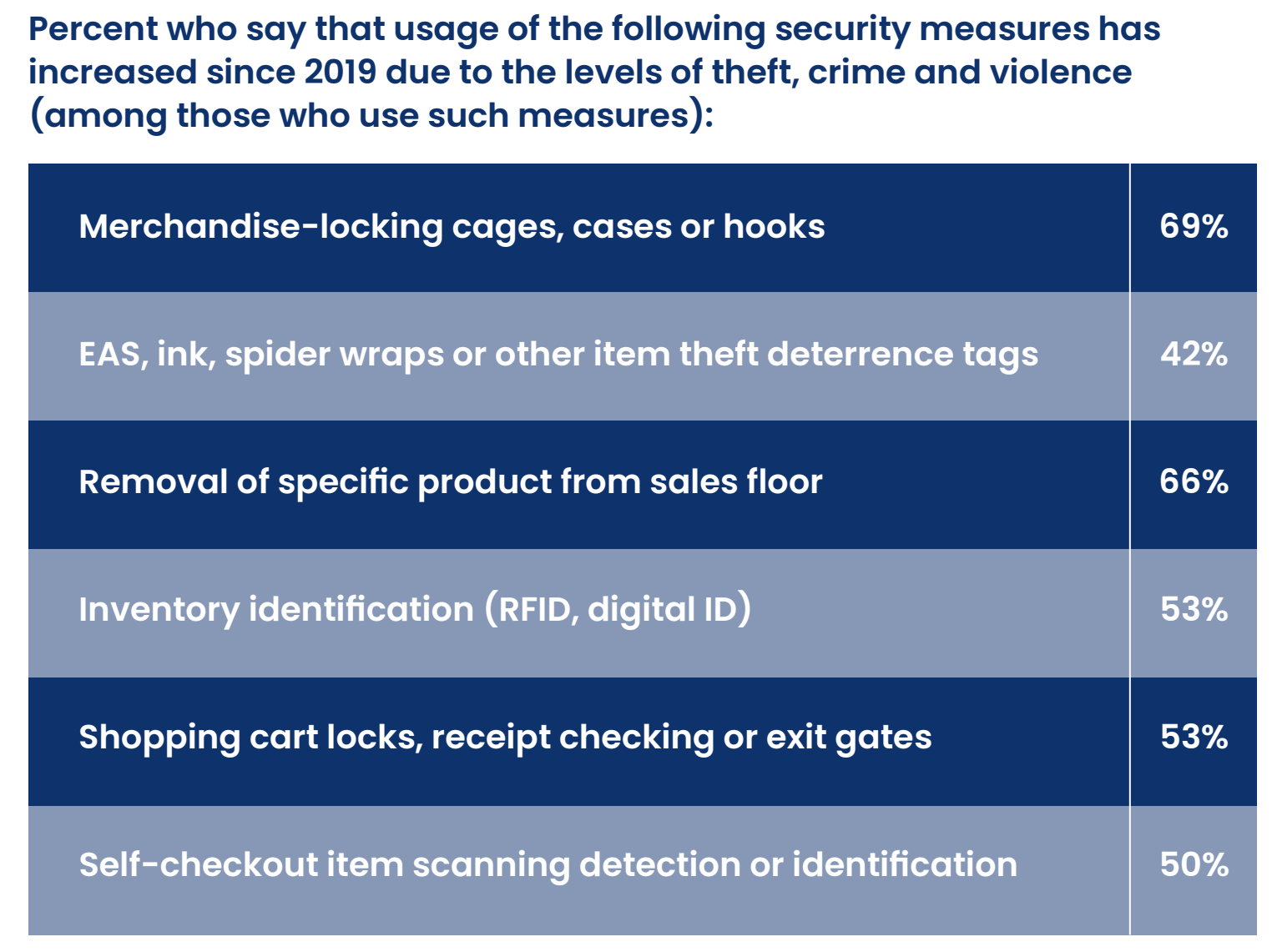

Alarmingly, the latest National Retail Federation Security Survey indicates that 73% of retailers say that shoplifters are exhibiting more violence & aggression than they were a year ago and 91% say that shoplifters are exhibiting more violence and aggression when compared with 2019.

Outside of RFID and AI at self-checkout, the technologies being adopted to respond are not revolutionary.

Multiple of above theft prevention strategies increase friction which is counter to how the retail industry is evolving towards greater frictionless commerce. In 2025, new security technologies need to step it up, along with greater partnership between government, law enforcement, and industry groups.

Happy New Retail Year

2025 will not see the return of the pre-pandemic retail apocalypse. Quite the opposite as I agree with the EIU weather forecast that the new year is brighter, especially for brick-and-mortar physical stores.

By 2028, Forrester's research finds that 72% of total USA retail sales will occur in brick-and-mortar stores in 2028. Partially this is driven by a surprising majority (64%) of tech-savvy GenZ consumers who prefer shopping in physical stores.

The creative integration of physical to digital solutions will differentiate the fastest growing retailers. Strong brands will continue to thrive and new ones will emerge to engage digital savvy consumers wanting more immersive experiences. Concurrently, many online only brands are now opening physical stores.

Privacy and retail shrink will get also greater attention and solutions in 2025. We are all consumers. Where retail goes next is up to all of us to innovate and execute a brighter future for the industry.