Every National Retail Federation (NRF) Big Show, Deloitte publishes updated research on the top 250 global retailers. This favorite annual retail report summarizes industry / economic global trends and dissects the shifting sands of the world's largest retailers. This post summarizes my favorite insights from the 2018 edition.

Transformative Change, Reinvigorated Commerce

The rules of retailing "are being rewritten in this time of transformative change. Innovation, collaboration, consolidation, integration, and automation will be required to reinvigorate commerce, profoundly impacting the way retailers do business now, and in the future."

The 2018 retail industry trends identified by Deloitte include:

Building top notch digital capabilities - Digital interactions influence 56 cents of every dollar spent in brick-and-mortar stores, up from 36 cents just three years ago. Amazon debuted in this report in the year 2000 at No. 186 and has risen to No.6 in 2018.

Combining bricks and clicks make up for lost time - A recent study finds that global grocery sales through e-commerce channels jumped 30 percent in the past year. Countries leading the growth charge were China (+52%), South Korea (+41%), the UK (+8%), France (+7%), and Japan and the US (both +5%). China is the world’s dominant e-commerce—and mobile—market. Two of the top three fastest-growing retailers in 2016 are China-based e-commerce retailers Vipshop and JD.com.

Creating unique and competitive in-store experiences - Physical retail stores are not going away; 90 percent of worldwide retail sales are still done in physical stores. Fast fashion retailers continue to disrupt the apparel sector. Spain’s Inditex (Zara), Sweden’s H&M, and Japan’s Fast Retailing (Uniqlo) have each grown sales at a double-digit annual pace, on average during the last five years.

Reinventing retail with the latest technologies - While the industry is buzzing about Amazon’s physical store trial, retailers around the globe—like China’s electronics retailer Suning in Shanghai and supermarket Coop Danmark in Denmark—are grabbing attention with their own unmanned store pilots as well. In what could be the biggest trial of automated stores to date, Auchan is readying the rollout of “hundreds” of unmanned Minute micro-convenience stores in China.

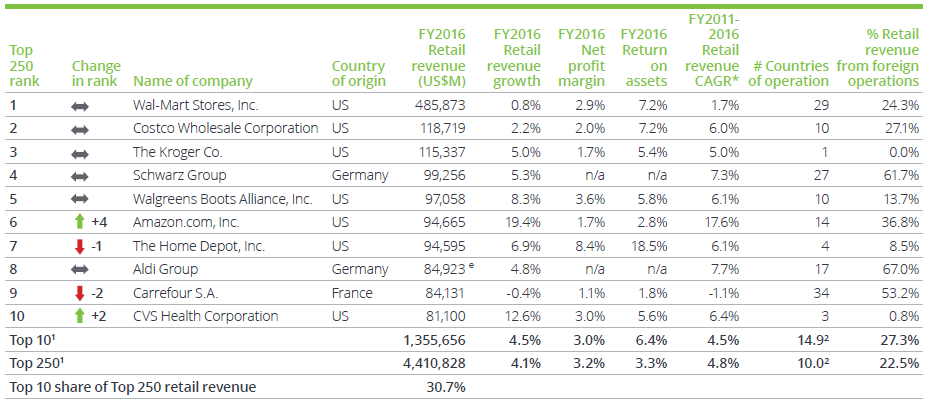

The Global Top 10 Retailers

The world’s Top 10 retailers continue to compose a bigger share of industry sales, capturing 30.7% of the overall Top 250’s retail revenue in FY2016. Notable shifts: Amazon up four notches while Carrefour down 2; CVS joins the top 10 and Tesco exits.

Top three highest sales CAGR FY2011-2016: Amazon +17.6%; Aldi +7.7%; Schwarz Group (Lidl) +7.3%. Carrefour was the only retailers with a negative CAGR in the top 10.

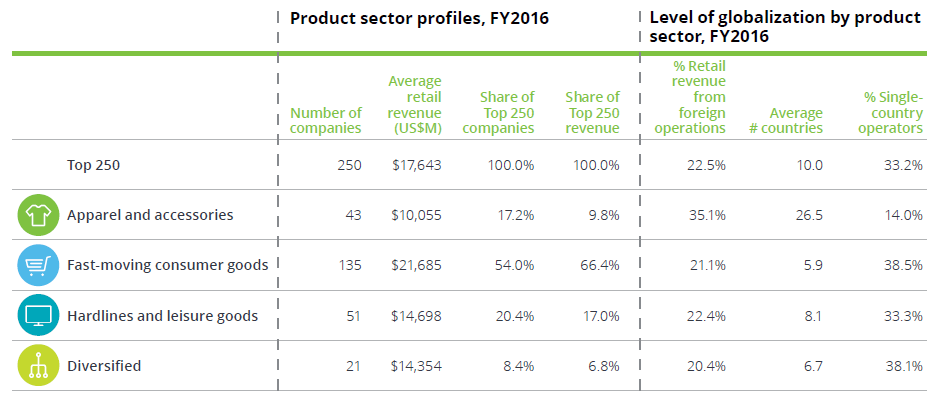

Retail Performance by Product Sector

Retailers of hardlines and leisure goods have enjoyed fairly strong growth since 2010 when the economy emerged from the global economic crisis. The sector’s exceptionally robust retail revenue growth composite of 7.6% in FY2016—vis-à-vis other product sectors—helped prop up the Top 250 group’s 4.1% composite growth rate. Amazon and JD.com are in this group.

Retailers of hardlines and leisure goods have enjoyed fairly strong growth since 2010 when the economy emerged from the global economic crisis. The sector’s exceptionally robust retail revenue growth composite of 7.6% in FY2016—vis-à-vis other product sectors—helped prop up the Top 250 group’s 4.1% composite growth rate. Amazon and JD.com are in this group.

Composite retail revenue growth for the 43 apparel and accessories retailers declined from 7.7% in FY2015 to 4.4% in FY2016. The sector was not the clear growth leader for the first time in four years. Still, retailers of apparel and accessories remained the most profitable of the sectors represented in the Top 250.

Compared with the hardlines and apparel sectors, the fast moving consumer goods group grew its top line more modestly, generating composite revenue growth of 3.8% in FY2016, down from 5% growth the previous year. On the bottom line, the composite net profit margin of 2.4% was typical of this historically low-margin sector.

As a whole, the diversified group persistently has experienced slow to no growth. Composite retail revenue for the 21 companies in this group remained fundamentally flat, nudging up just 0.6% on a compound annual basis from FY2011 to FY2016.

The Fastest Growing Retailers

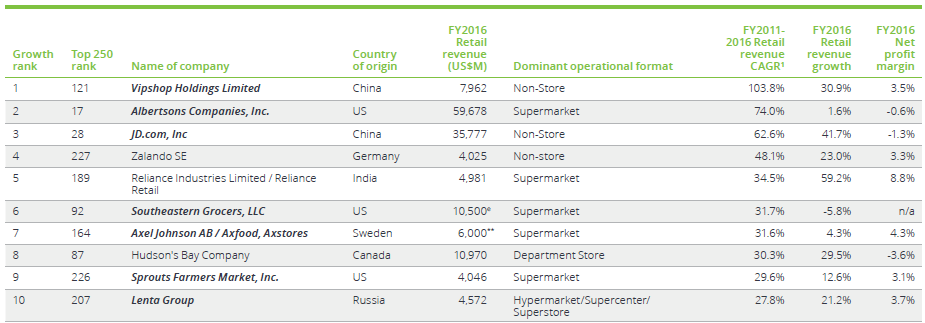

The 50 fastest-growing retailers grew revenue, on average, four times faster than the Top 250 group as a whole, recording a

20.9% composite compound annual growth rate from FY2011 to FY2016. This robust pace was driven largely by rapidly

expanding e-commerce sales and significant M&A activity.

To rank among the Fastest 50 required compound annual revenue growth of at least 11.8% over the five-year period. Three-quarters of the Fastest 50 (38 companies) were also among the 50 fastest-growing retailers in FY2015.

The Shifting Powers of the Global Top 250 Retailers

Summarizing my views of the 2018 Global Powers of Retailing Deloitte report:

- Technology is forever disrupting the evolution of retail. Branding and immersive customer experiences are the future of retail. Digital strategies are driving the leadership of multiple of the successful global retail brands.

- The traditional grocery sector needs re-invention because as reflected in the top 10 and the group's profitability, traditional models are in trouble.

- Hardlines which includes the major e-commerce players is the growth sector to watch.

- Apparel has some near term challenges and even fast fashion is not safe.

- Look to China and India for the next set of fastest growing retailers. As explained in the last NRF 2018 post, Asia is the "below the surface" retail innovation laboratory. Russia also has the potential to drive strong future retail brands.

I agree with Deloitte that "it is a transformative time in retail. The shopper is clearly in the driver’s seat, enabled by technology to remain constantly connected and more empowered than ever before to drive changes in shopping behavior. “Everywhere commerce” has taken root, allowing consumers to shop however, wherever, and whenever they want—whether in stores, online, by mobile, voice activation or click-and-collect."

Global Top 250 retailers, welcome to the disruptive future of retail.