The Top 5 Pure Retail, Apparel, and Luxury Brands

"Brands will matter more in the world the virus leaves behind, and those that work now to build trust by acting, visibly and decisively, with an essential and authentic purpose, will be among the survivors. If they find new reserves of agility, creativity, and resolve, they can shape the way consumers view them in the midst of the crisis, and emerge not just with a viable business, but a sharp competitive edge." - BrandZ 2020 Report

Every year I look forward to the latest BrandZ Global Most Valuable Brands Report. Timely for 2020, BrandZ published a separate Global Top 75 Retail Brands edition that includes in-depth COVID-19 analysis on the impact of the pandemic to brands.

"The combined value of the BrandZ Top 75 Most Valuable Retail Brands has risen by 12% in the past year, to $1.514 trillion. These brands come from four sub-categories: Pure Retail, Fast Food, Apparel and Luxury, and they are growing despite – and in some cases as a result of – severe disruption in the market."

This article summarizes some of my favorite insights from the 131 pages 2020 retail report.

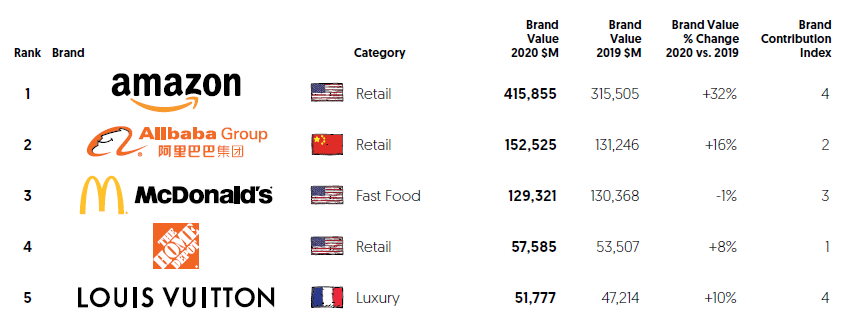

Top 5 Global Retail Brands

The top five most valuable retail brands include very familiar logos.

Surprised that Walmart is not in the top 5, especially considering their performance during the lockdown phase of the pandemic. Amazing the difference in the brand value between number one Amazon and the balance of the companies listed.

One of Amazon's advantages is its intensive focus on innovation. On average, the top world's top 10 traditional retailers will be putting an estimated $100 billion less into IT than Amazon over the next five years.

The Top 5 Pure Retail Global Brands

Pure retail includes supermarkets, convenience, department stores, e-commerce specialists and hardware stores. This group accounts for the majority of the placings in the top 75, as well as the majority of the ranking's total value.

"What began as an online bookseller in 1994, Amazon is now the BrandZ Most Valuable Retail Brand, exceeding $250 billion a year in sales. The company operates e-commerce sites in 17 countries and offers shipping worldwide."

The company operates e-commerce sites in 17 countries and offers shipping worldwide."

"Alibaba is the first name in Chinese e-commerce, though most of its revenue comes from marketing activities, not directly from marketplace sales. Its technology controls the entire conversation around how shoppers discover, buy and receive items."

The Home Depot is the world’s largest home improvement superstore chain. "The business is focusing on its “One Home Depot” strategy aimed at creating a multiplatform, seamless shopping experience through store renovations and continued development of in-store and digital offers."

Walmart’s revenue in FY19 reached $510.3 billion, making it the largest company in the world by revenue. "It is the largest grocery retailer in the US, and generates 62% of sales from its home market."

The number of Costco membership cardholders worldwide reached 98.5 million in fiscal 2019. The business is expanding globally and is present in the US, Canada, Mexico, Australia, the UK, Spain, France, Iceland, Taiwan, South Korea, Japan, and more recently China.

The Top 5 Global Apparel Brands

The sector most negatively impacted by COVID-19 has been apparel. The IHL Group forecasts that apparel and department stores will not recover to 2019 levels until 2023. Yet several of the brands in this category are positioned for continued strong growth.

A "Just Do It" Nike leadership example surfaced when China entered their COVID-19 lockdown phase. When people were confined to their homes, Nike shifted heavy focus to their online workout apps which experienced an 80% weekly active usage increase by the end of their Q3. The strong engagement with the activity apps translated into strong engagement with the Nike commerce app. As a result, the Nike digital business in China grew 30%.

A "Just Do It" Nike leadership example surfaced when China entered their COVID-19 lockdown phase. When people were confined to their homes, Nike shifted heavy focus to their online workout apps which experienced an 80% weekly active usage increase by the end of their Q3. The strong engagement with the activity apps translated into strong engagement with the Nike commerce app. As a result, the Nike digital business in China grew 30%.

"Zara began as a single clothing store in the Spanish region of Galicia, and has since taken “fast fashion” to the world. The brand operates in 96 markets."

Adidas had a challenging quarter, but reported that e-commerce sales were up 35% for the quarter. In the month of March online sales were up 55% and grew even quicker in China.

The fastest-growing brand in the 2020 Top 75 BrandZ rankings is activewear brand Lululemon, posting growth of 40% percent increase on last year. Lululemon also led the fastest risers last year and has enjoyed success again as a result of the consumer appetite for health and fitness, especially among the young.

Uniqlo has more than 2,000 stores in 24 countries. Globally, brand sales increased 7.8% 2019 with the strongest growth coming from China, Southeast Asia and Oceania.

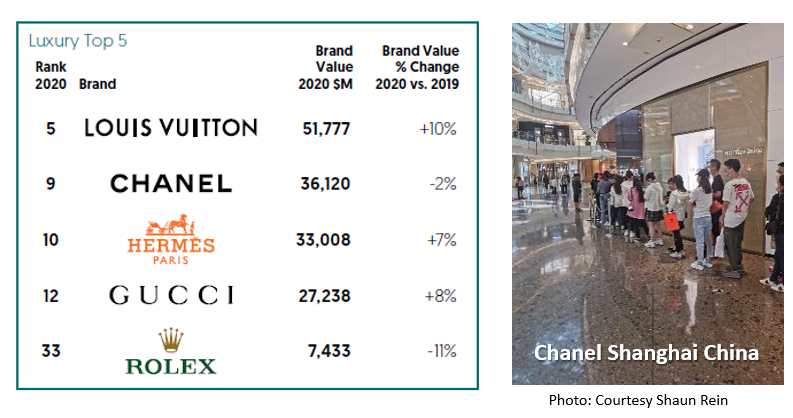

The Top 5 Global Luxury Brands

According to Bain, luxury sales fell 20% in Q1 2020 and could contract between 25% to 35% for the full year. China is the crucial market as it will account for nearly 50% of luxury sales by 2025.

Louis Vuitton is the 5th most valuable brand in the BrandZ Top 75 overall list. A good sign ahead for luxury are the long lines at a Shanghai Chanel store that recently reopened in China.

Hermes has 307 stores in total worldwide. For 2019, the company announced that revenue increased by 15.4% over 12 months, with the greatest growth coming from Asia, especially China.

Gucci recently cut the number of fashion shows per year from five to two. "The label said the traditional rota of spring/summer, autumn/winter, cruise and pre-fall shows was 'stale'." Because of pandemic, Rolex put all product news on hold indefinitely.

What the Virus will Leave Behind

"Strong performances by many brands we might call “traditional” retailers show that physical retailing is far from dead – but it does need to be different. The strongest players in this year’s ranking, both young and old, stand out for focusing on the customer experience, whether that’s online, offline or a combination of the two. E-commerce natives continue to cause deep disruption in the market, and have been especially successful this year during times when people haven’t been able to shop in physical stores as they might have wished. But any format can win, if it justifies its pricing, is distinctive, and works in ways that consumers find useful and interesting."

For all retail sectors, COVID-19 has become a brutal accelerator of digital transformation trends that were already underway. The future of retail includes digitally supported leadership branding coupled with hyper-personalized immersive consumer experiences. In the world the virus leaves behind, the 'new normal' will elevate the importance and value of branding.