Today's world is media noisy, but much of the messaging is broadly delivered with minimal impact. Television and newspapers were primary historical mediums for delivering product knowledge, differentiation, and building consumer loyalty.

The average human attention span has dropped from 12 seconds in 2000 to a just 8 seconds in 2020. A goldfish now has a higher span that a human at 9 seconds.

The internet has intensified the media noise. Globally, individuals between the age of 16 to 64 now spend an average six hours, 40 minutes online (for the United States is 7 hours and 3 minutes). This equates to 47 hours per week and 101 days per year. By this estimation, beginning at age 18, a person who lives to 80 will have spent 17 years of their adult life using the internet.

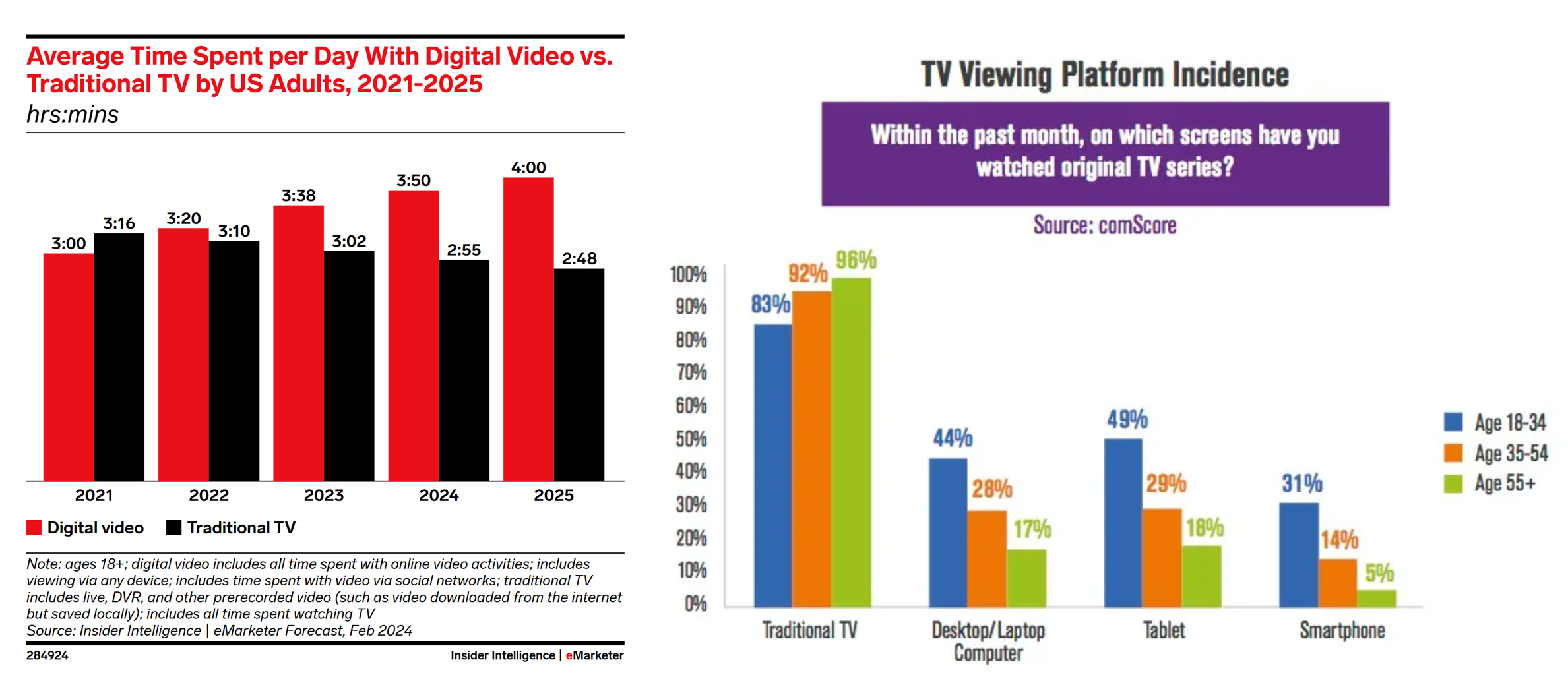

The increased online digital noise is changing viewer habits of traditional media such as television. Note the decline in daily viewing time with digital surpassing traditional television in 2022.

Younger generations are accelerating the shift to digital. About 1 out of 6 Millennials said they did not watch any original TV series from traditional TV sets within the past 30 days, a significant trend highlighting the potential for linear TV viewing to erode over time. If young people do watch television, it is on other digital devices, often skipping the commercials.

In the 1970's, the average person was exposed to 500 to 1,600 ads per day. The changes in media consumption including the proliferation of digital devices, growth of social media, programmatic advertising, and content distribution have dramatically elevated the ad numbers 4,000 to 10,000 per day.

Focusing on the retail industry, how does one break through all this digital noise and deliver effective content? Where is the best place to increase attention spans for targeted ads for the consumer? What is the profitable future of retail media networks?

The Retail Media Networks Opportunity

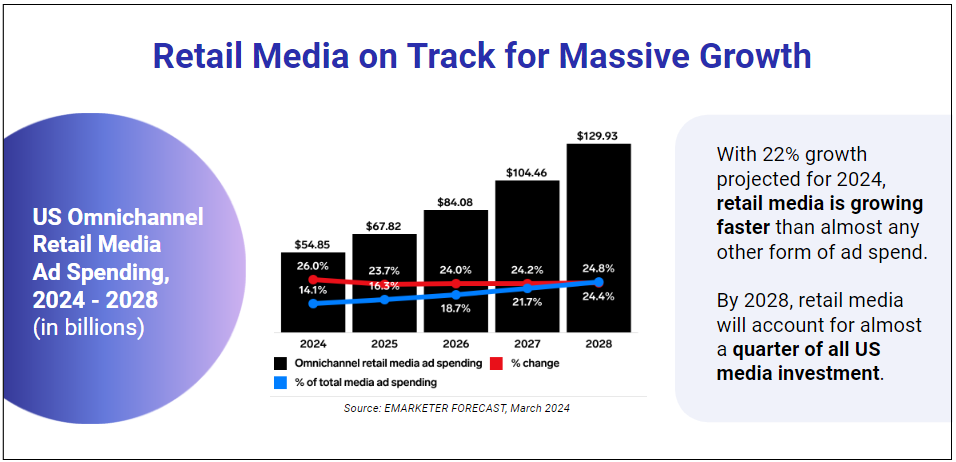

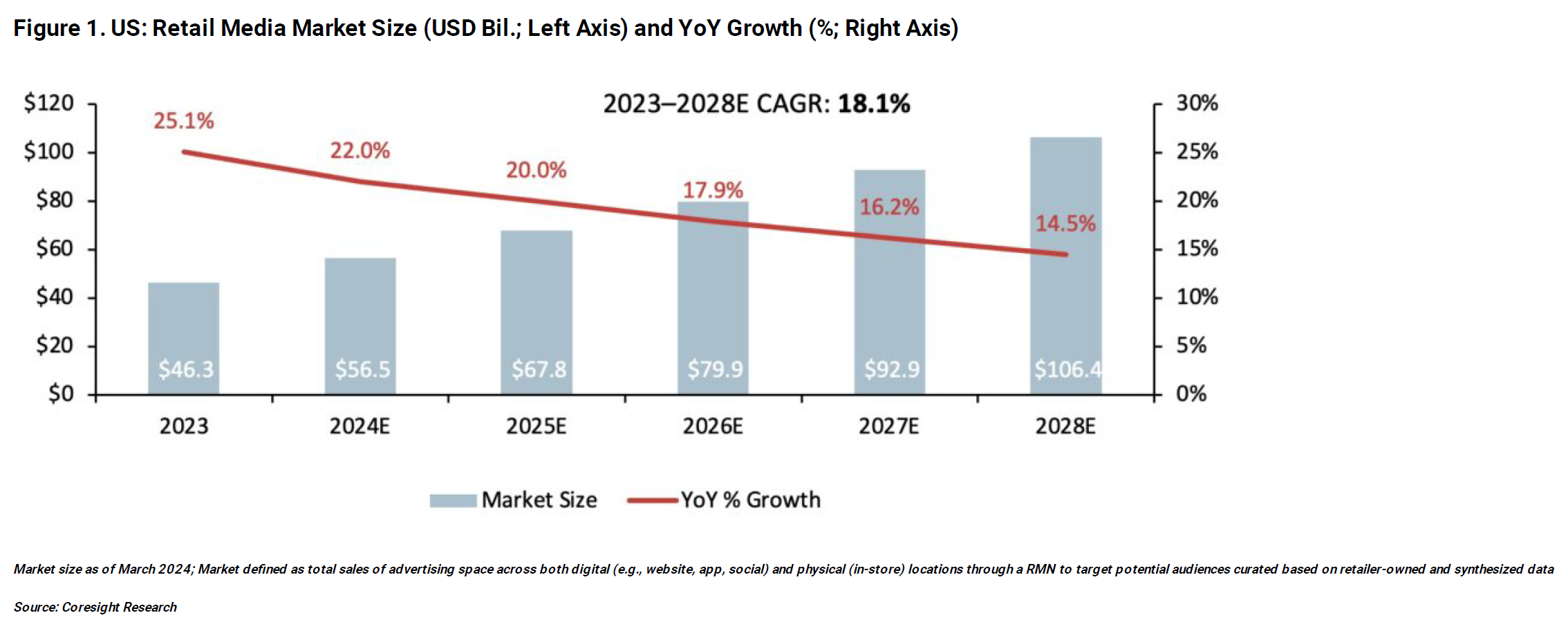

Multiple forecasts point to major growth opportunities for retail media networks (RMN). Emarketer predicts retail media will account for almost a quarter of all US media investment by 2028.

According to recent Skai and the Path to Purchase Institute research, 81% of advertisers feel that retail media is very to extremely important to their strategies, coming in higher than any other marketing channel.

Coresight Research has a similar high growth forecast for retail media networks with a CAGR of 18.1% from 2023 to 2028.

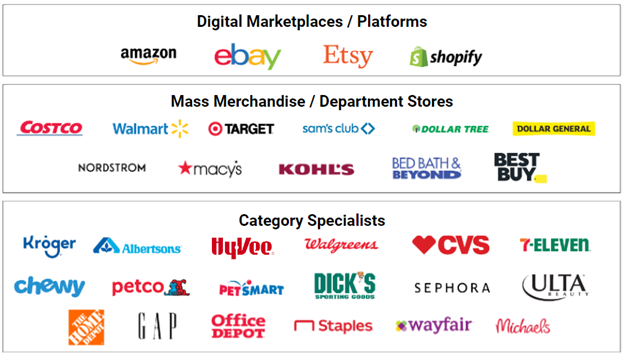

As of 2023, there are over 200 Retail Media Networks available. This list will continue to growth.

In 2023, Amazon generated $46.9 billion from advertising. This compares to Walmart at $3.4 billion and Target and Instacart, both earning more than $1 billion.

Why are Retailers Embracing Retail Media Networks

As summarized in Harvard Business Review.

- "McKinsey estimates that by 2026, retail media will add $1.3 trillion to enterprise values in the U.S. alone, with $820 billion of that amount extracted by retailers.

- McKinsey also predicts that by 2026 profit margins for retail-media platforms will be between 50% and 70%."

- "The Boston Consulting Group is even more sanguine, estimating profit margins of between 70% and 90% by 2026."

The high-growth, high-margin advertising business contrasts favorably to typical retailers low-growth, low-margin businesses.

The In-Store Profitable Retail Media Networks Final Frontier

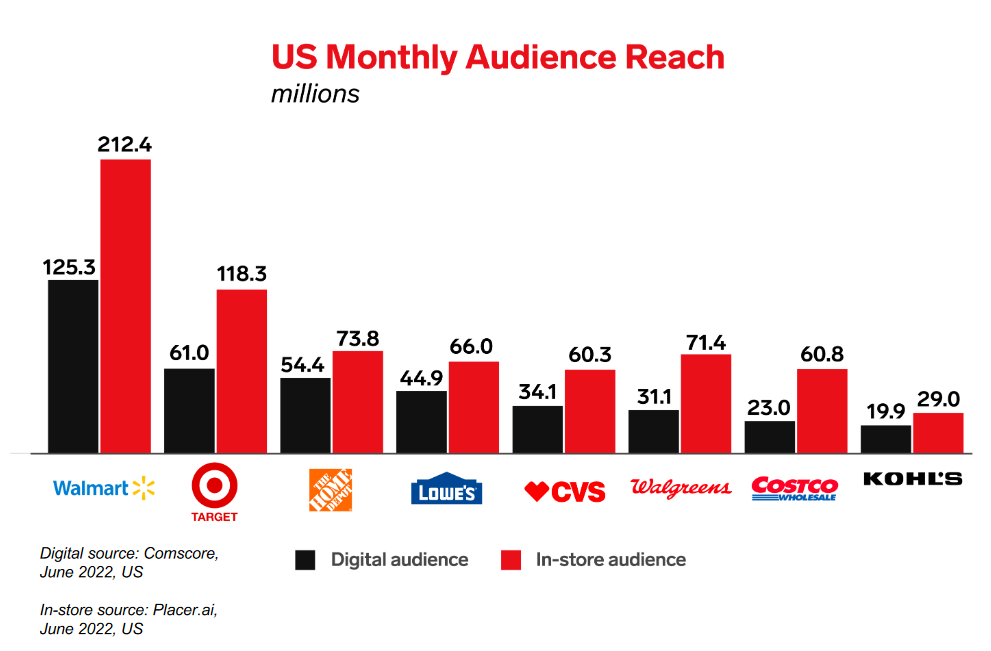

Currently, the majority of retail media networks revenue growth is coming from online retail ecommerce platforms such as Amazon. By comparison, in 2023, brick-and-mortar retail represented 80.1% of worldwide retail sales. Note the audience below by channel comparing physical stores traffic to online platforms.

Emarketer projects that in-store retail media advertising spend will top $1 billion by 2028, growing an average 30% per year. Advertising inside physical stores will lead to higher conversion rates as that is where often consumers make the decision to buy. Inside physical stores, customer interaction can be measured at point-of-purchase for more accurate feedback on advertising programs. Combining digital and in-store media will lead to greater harmonized shopping experiences from shopping online to physically in the store.

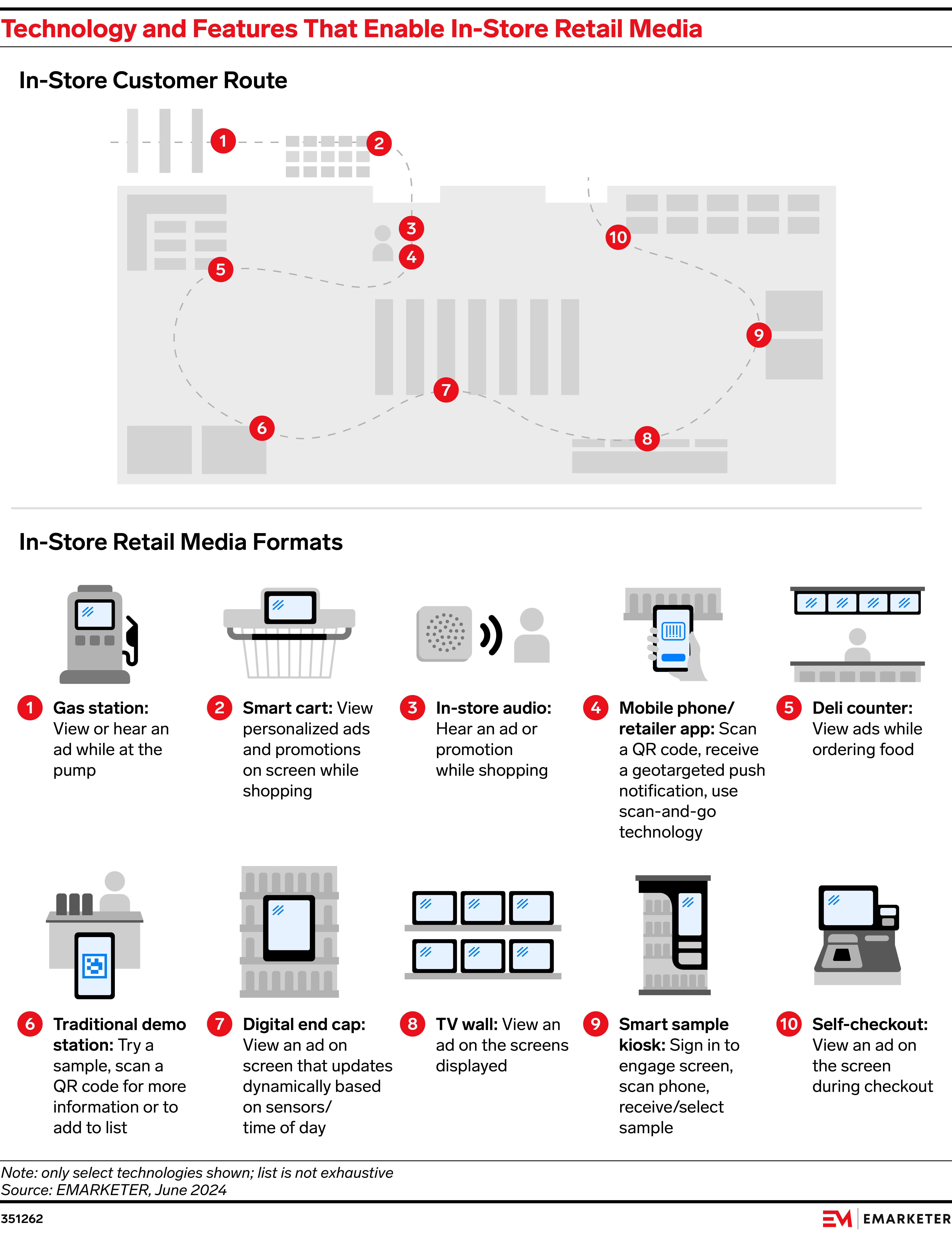

Places where ads can be placed inside physical stores will continue to grow.

Above are just a few examples. More locations are coming at critical locations inside the store to drive increased consumer engagement.

Strategically, retail media networks are an additional tool to engage customers, increase loyalty, and communicate critical messaging more effectively at the point of purchase. The physical store can and should be the next generation digital canvas in which harmonizes physical and digital channels to WOW consumers to greater purchases.

Amazon has proven the value of retail media networks and Walmart is aggressively growing their profitable share. As I wrote in another article, it is time for all of Retail to Get Phygital and Get the Future Retail Party On.