The latest 2020 IHL Group forecast points to a COVID-19 negative $1.6 trillion global retail economic impact, with USA sales declining 7.6% this year. Fortunate sectors such as grocery and mass merchandisers will achieve double digit growth. Among the worst performers are departments stores (-23%) and specialty soft goods (-33%).

How do these challenged retail sectors, which are not expected to recover to 2019 levels until 2023, return to growth? One potential answer can be found in China, which on multiple levels remains the innovation laboratory for the future of retail.

"Virtually nonexistent three years ago, livestreaming now accounts for 4% of total online retail sales in China and about 1% of total retail sales. The number of products promoted on Taobao (Alibaba) via livestreaming nearly tripled in 2019—before the pandemic—and the number of Taobao livestreaming merchants almost doubled."

What is livestreaming e-commerce? What is making it successful in China?

Key Opinion Leaders (KOL's) Drive Livestreaming

"Livestreaming is a term being thrown around the retail world with increased frequency these days — but describing it is not easy. Start with a TV shopping show like you might find on QVC or HSN. But put it on your mobile phone rather than your television. Then layer on social media functions, the ability to interact with what’s on your screen in a way that’s impossible on one-way electronics devices. Then add some Tik Tok razzle dazzle, a little Instagram influencer hype and a modicum of good old-fashioned entertainment."

KOL's or influencers are key to the success of the model as they curate products to their fans' tastes. "That leads to high conversion rates. Indeed, Taobao (Alibaba) boasts that its conversion rate across livestream is an astonishing 32%. That is, for every one million viewers a livestream reaches, 320,000 will add the showcased product to cart."

Direct live continuous engagement with the audience, including answering direct product questions, is part of the mix.

Livestreaming was the perfect shopping platform during the COVID-19 lockdown. “During the height of the coronavirus in China in February, users spent an average of 120 minutes per day watching live streams on Douyin, which is the Chinese version of Tik Tok, and only 89 minutes per day watching other forms of content on social media.”

Retail Products in Action

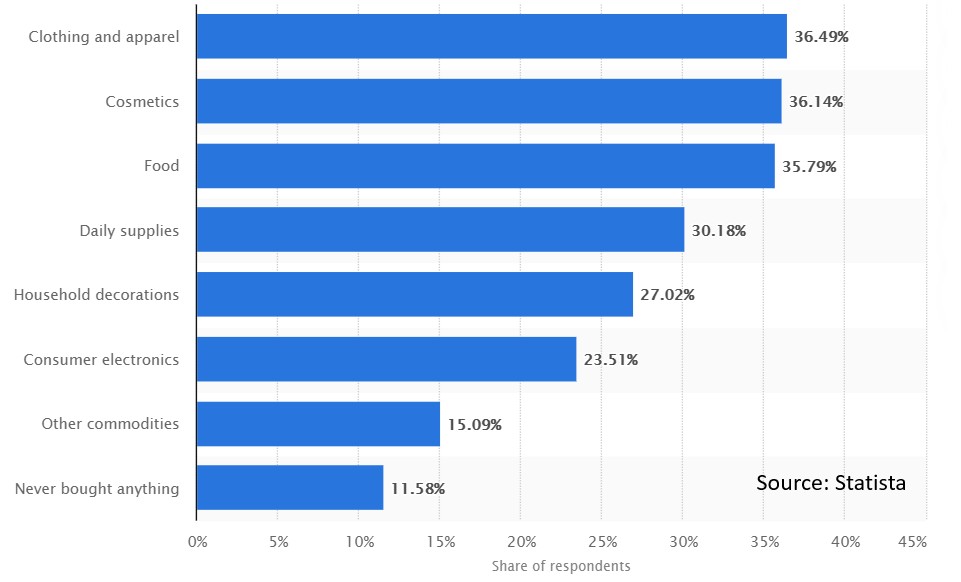

Statista June 2020 research highlighted the following as the highest livestreaming China retail categories.

With livestreaming, viewers can see the products in action. As indicated above, "this is particularly helpful for a number of product categories, like color cosmetics, clothes and furniture, where size, color and effect aren’t easily discerned from stock photos or videos."

Fashion which is the hardest hit sector by COVID-19 could benefit globally from this platform. "In the future, clothes shopping will be interactive. Instead of scrolling through static pictures or browsing by category, you can watch as a model tries on outfits in quick succession—every one of them purchasable. On Douyin, this is the status quo for fashion influencers, who might showcase five to 10 outfits in a single 15-second video. Shopping in this way is entertaining—more like watching a challenge than dutifully clicking through photos."

China's Advanced Digital Retail Model

For Singles Day 2019 (world's biggest shopping holiday), livestreaming generated $2.9 billion, and livestream stars such as Viya Huang and Austin Li reached celebrity status as millions of fans watched their livestreaming sessions. Over 100,000 brands and sellers leveraged livestreaming, including Kim Kardashian who partnered with live-streamer Viya to sell 15,000 bottles of her new KKW Beauty perfume; it sold out 15,000 bottles in within minutes. Kim's session drew over 13 million viewers.

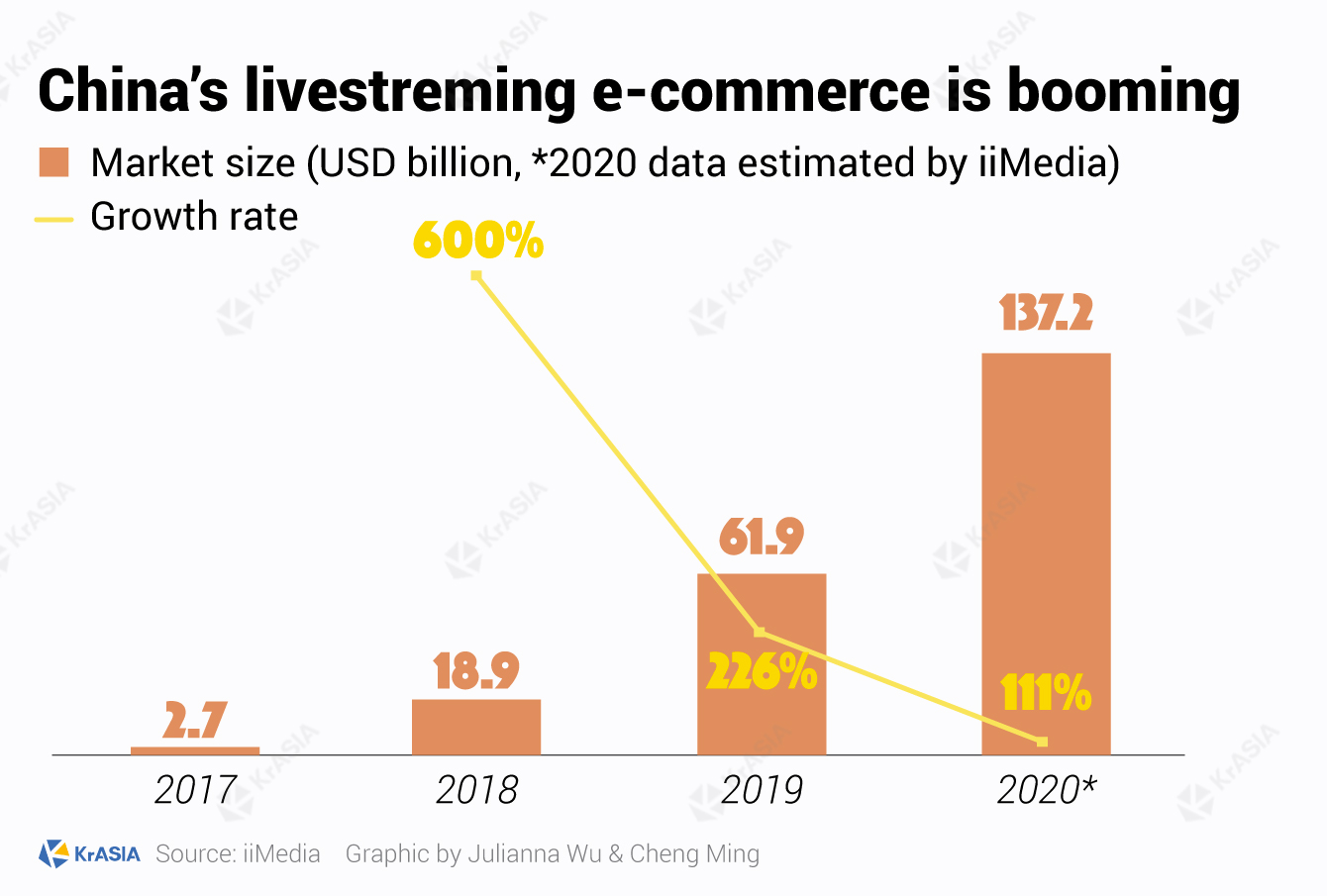

In 2020, the livestream commerce industry in China is expected to complete a 453% three-year growth rate (from $29 billion in 2018 to a projected $129 billion by the end of 2020). iiMedia in the KrAsia chart below has the 2020 projection even higher.

China benefits from a much more consolidated retail digital landscape. "Chinese users spend their time on “super apps”, Alibaba’s being the biggest. Alibaba’s infrastructure powers platforms for content distribution (Taobao Live), ecommerce (Taobao and Tmall), e-payments (Alipay), and shipping / returns logistics (Cainiao). It even runs an incubator for influencer talent (Ruhan) to ensure that Taobao Live is always broadcasting premium personalities."

Livestreaming into a Video-First Future of Retail

"If a picture is worth a thousand words, than a video is worth a million, making a far more compelling case than a static-image advertisement." Livestreaming hits multiple major disruptive chords critical to the future of retail.

"In the future, we’re all going to be shopping on video apps like TikTok. Whether you’re buying instant noodles or high-end sweaters, it has become increasingly clear that short video clips are the future of ecommerce. Think of them as compulsively watchable commercials—with a direct link to buy." For apparel as an important example, a video-first strategy may need to happen much sooner than a very painful later.