With trade barriers rising, it is time to look deeper on the impact for both consumers and the retail industry. China with a 145% rate is the outlier country to the temporary 90 day pause to reciprocal tariffs recently announced by the United States.

The result as reported by the Wall Street Journal is that shipping bookings of out China have dropped by 60% this past week. According to Greg Buzek from IHL Services, so far, 90 container ships have been cancelled which is 80% more than when China shut down from COVID in May of 2020. As he elaborates, each ship carries the equivalent of 3 USA malls worth of products with the expected pain to be felt in stores in the June timeframe.

China represented 11% of all U.S. trade in 2024, with electronics, machinery, toys, sports equipment and furniture making up more than half of all imports. For consumers related products, China manufactures 73% of toys, 22% of apparel, 36% of footwear, 28% of cutlery, 22% of leather goods, 29% of glassware, 31% of ceramic products, 41% of printed materials such as books, 93% of umbrellas, 36% of musical instruments, 26% of silk / yarn, 35% of vegetables not fully prepared, 77% of chalk, and much more.

Most retailers have been working to mitigate exposure to China. In terms of cost of goods sold, 20% of Target's, 15% of Walmart, 60% of Five Below, 32% of Dollar Tree, 25% of Home Depot, 20% of Lowe's, 55% of Best Buy's, and 25% of Dick's Sporting Goods originate in China. The full exposure is difficult to measure as some Chinese products are shipped to other countries as raw materials where they are turned into finished goods for export to the United States.

Primarily from a consumer point of view, this article delves into the impact of tariffs for the retail industry. How concerned are consumers? How are they responding? Which retail categories have the highest impact? What products will face cutbacks? How do different countries perceive tariffs? How should retailers respond?

Tariffs Adding to Consumer Stress

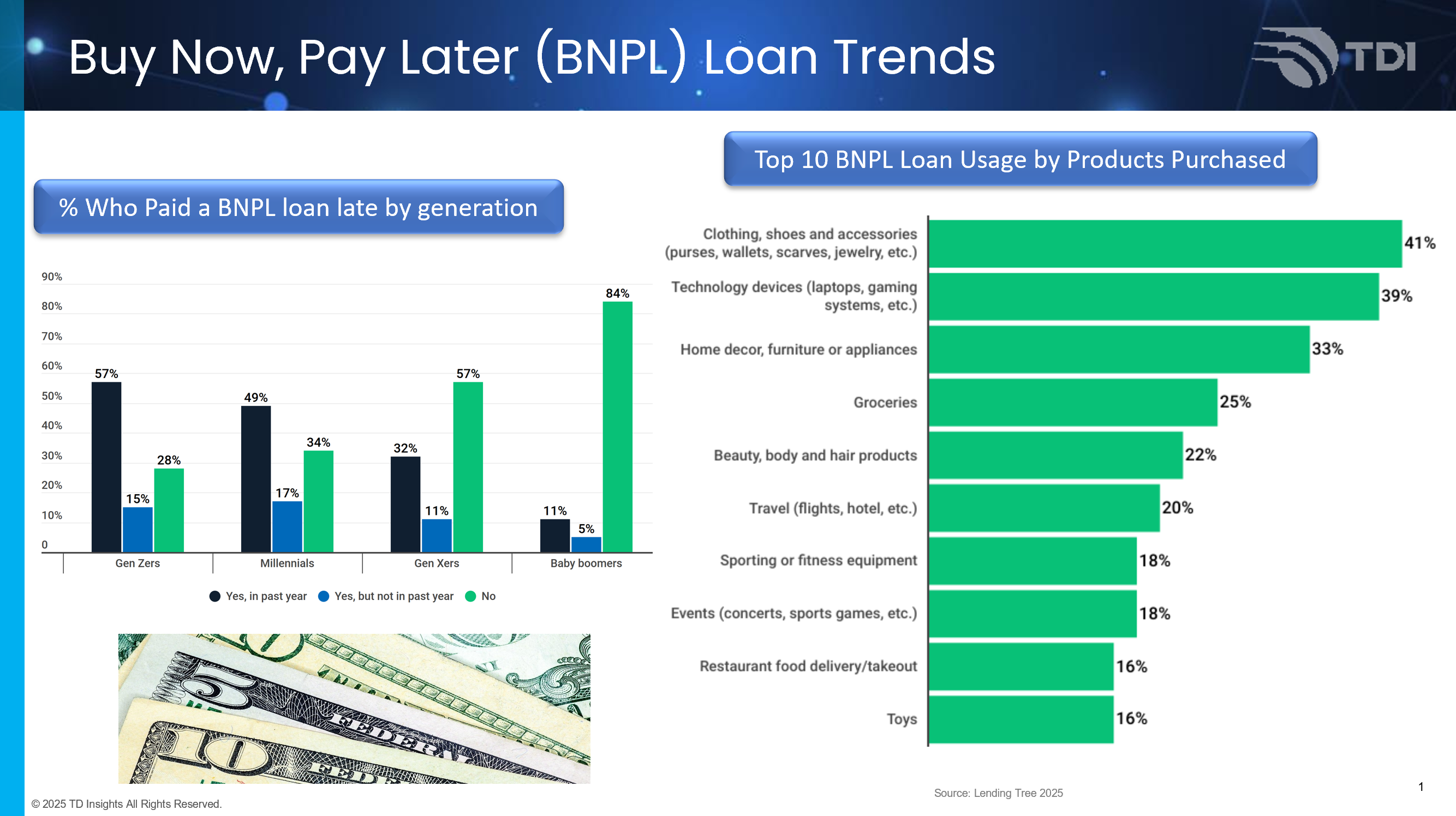

According to a new Lending Tree survey, nearly half of consumers have been using buy now, pay later (BNPL) loans in the past year, including 11% that have used them at least six times. Men are more likely than women (53% vs 46%) to use BNPL loans with young generations having highest use -- 64% for GenZs compared to 29% for baby boomers. The April 2025 data shows that 39% of Americans are considering a BNLP loan and it is up eight percentage points in March, the biggest increase in a year.

More than 4 in 10 (41%) BNPL users say they paid late on at least one of their loans in the past year.

The surprise in the latest data is the increased usage of buy now, pay later (BNPL) loans in groceries "This year’s survey found that 25% of BNPL users have done so, up from 14% just a year ago. Gen Z is the most likely age group to have done so, with 33% of BNPL users in that range having brought groceries with BNPL. It was the fourth-most common BNPL purchase for the age group, trailing clothing, technology and home decor items."

All of the above confirm a CNBC March headline that "U.S. consumers are starting to crack as tariffs add to inflation, recession concerns." The latest University of Michigan consumer confidence index plunged to 50.9 -- lower than during the Great Recession of December 2007 and close to the historic low in the period following the Covid-19 pandemic.

Continued Consumer Concerns

USA consumers are closely tracking tariffs and their potential impact. The latest Numerator survey finds:

- 89% of U.S. shoppers say they’re aware of new or proposed tariffs.

- 85% are concerned about the impact of tariffs on their finances or shopping.

- 83% anticipate making changes to their shopping habits in response to tariffs.

- 72% are worried about tariffs raising the price of everyday goods.

- 50% anticipate limited availability for certain products.

- 39% worry about a potential slowdown in economic growth.

- 21% expressed concerns tariffs may impact their job or industry.

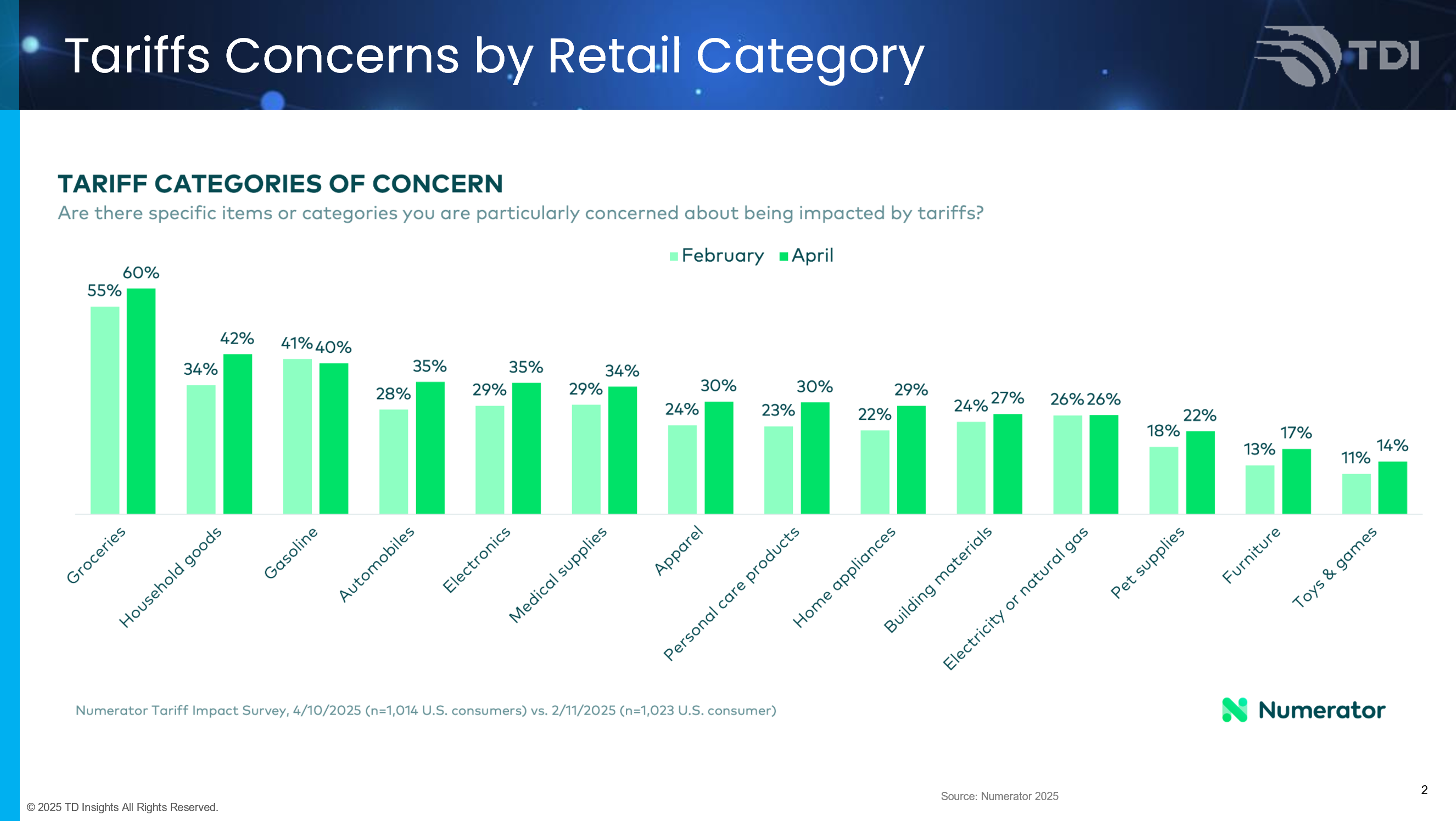

Groceries which coincidentally saw an increase in BNPL loans is the number one category of concern for tariffs.

All tariff-related concerns were up in the Numerator survey versus February, particularly economic concern (+15 points), higher prices (+8 points) and job impacts (+7 points). As the Chief Economist for Numerator summarized, "changes in consumer sentiment are a leading indicator for changes in purchasing behaviors, and if consumers remain this pessimistic about the future of the U.S. economy, we can expect cutbacks in consumption going forward and a potential recession later this year.”

Cutbacks, Global Perceptions, and Consumer Responses

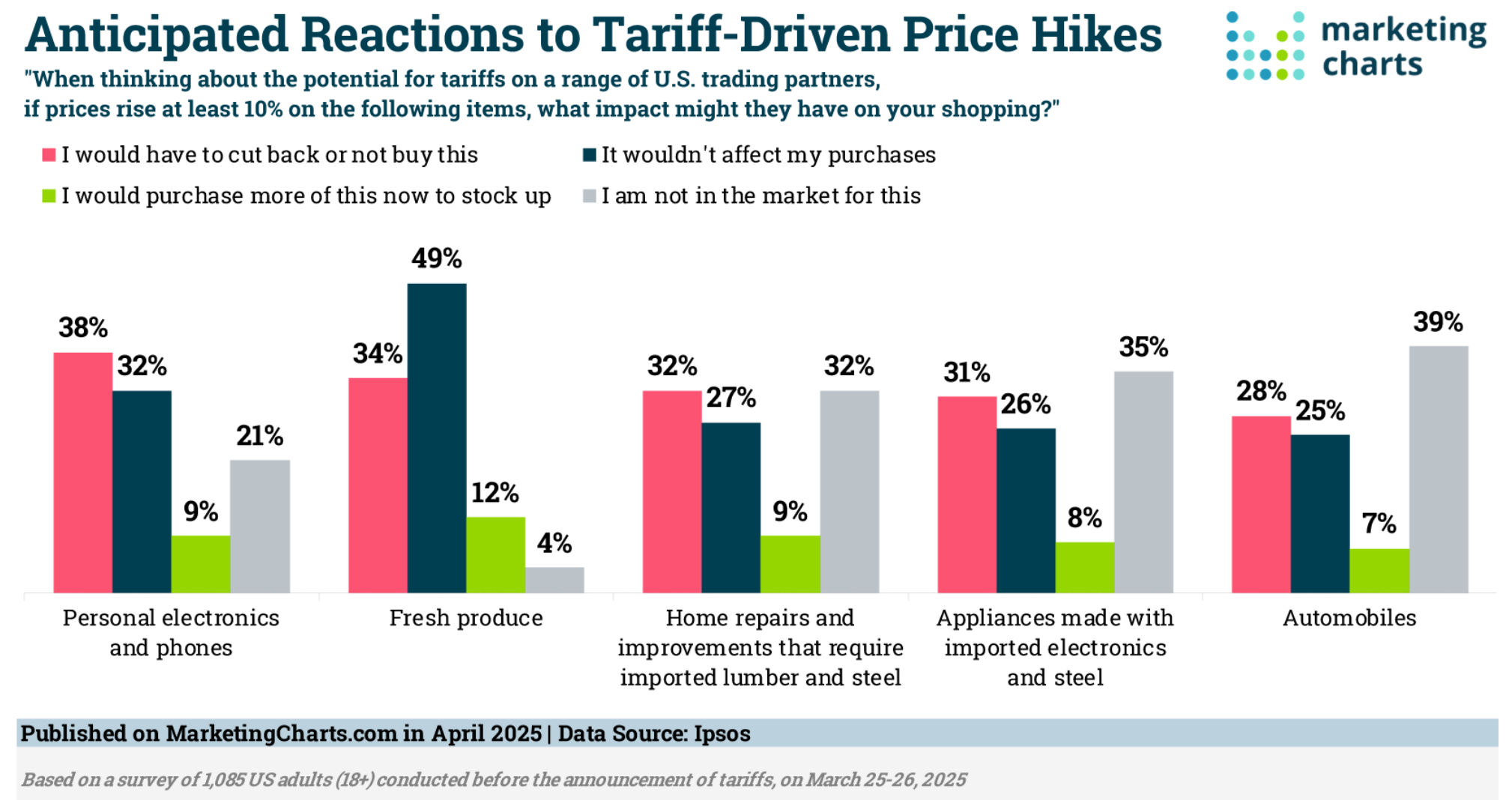

Consumers are forecasting cutbacks due to tariff related price hikes in multiple categories.

In the latest Ipsos survey, asked about prices increases of at least 10% as a result of tariffs, personal electronics and phones would be the most effected at 38% followed surprisingly by fresh produce at 34%, and home repairs / improvements at 32%. Close behind are appliances and automobiles.

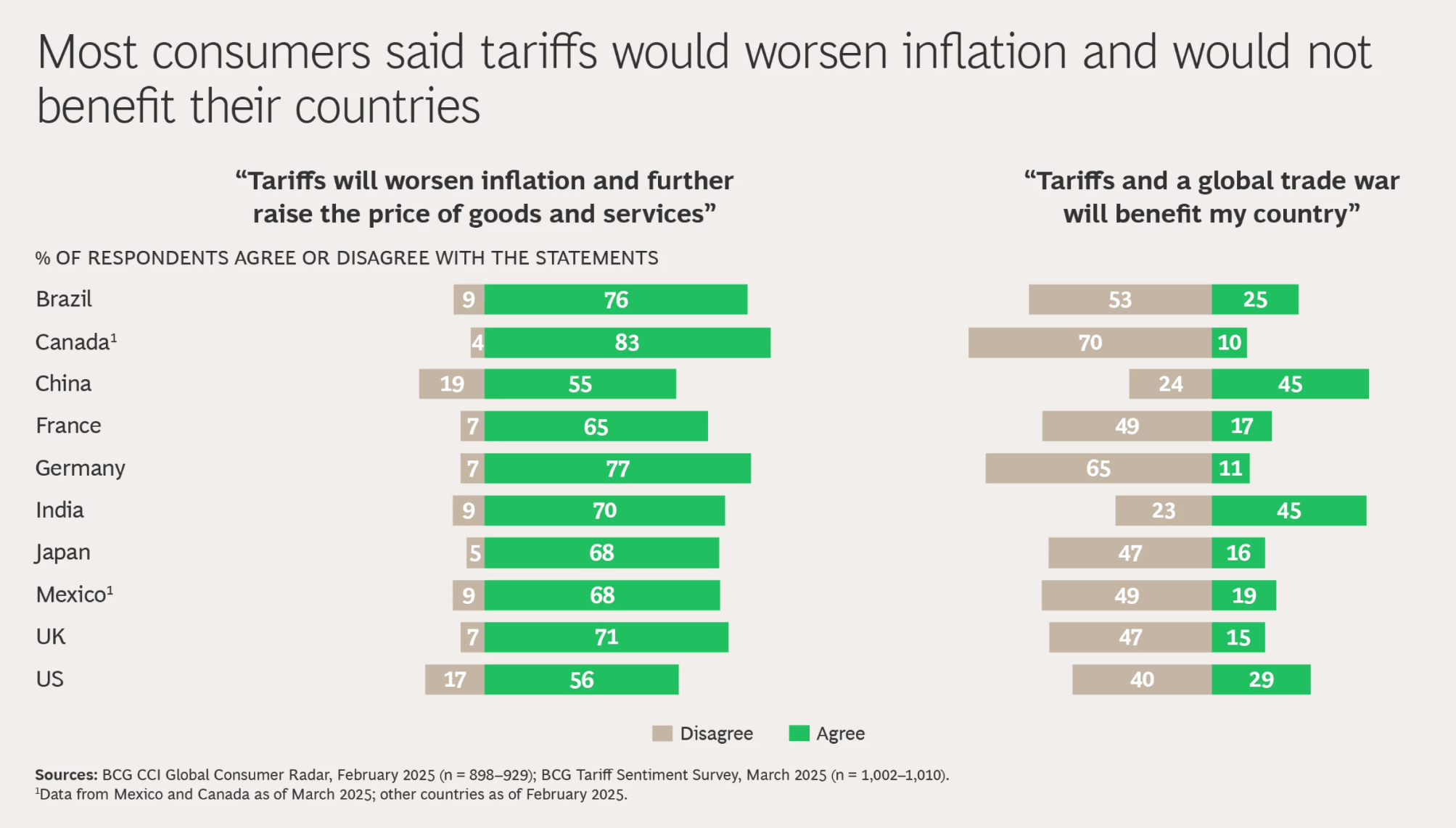

Globally there is a uniform view that tariffs will worsen inflation and further raise the price of goods and services.

Most countries see minimal benefits to tariffs, but note the percentage positive views in China and India in above chart. Both countries have large important growing retail markets.

Consumers go back to basics when responding to price increases.

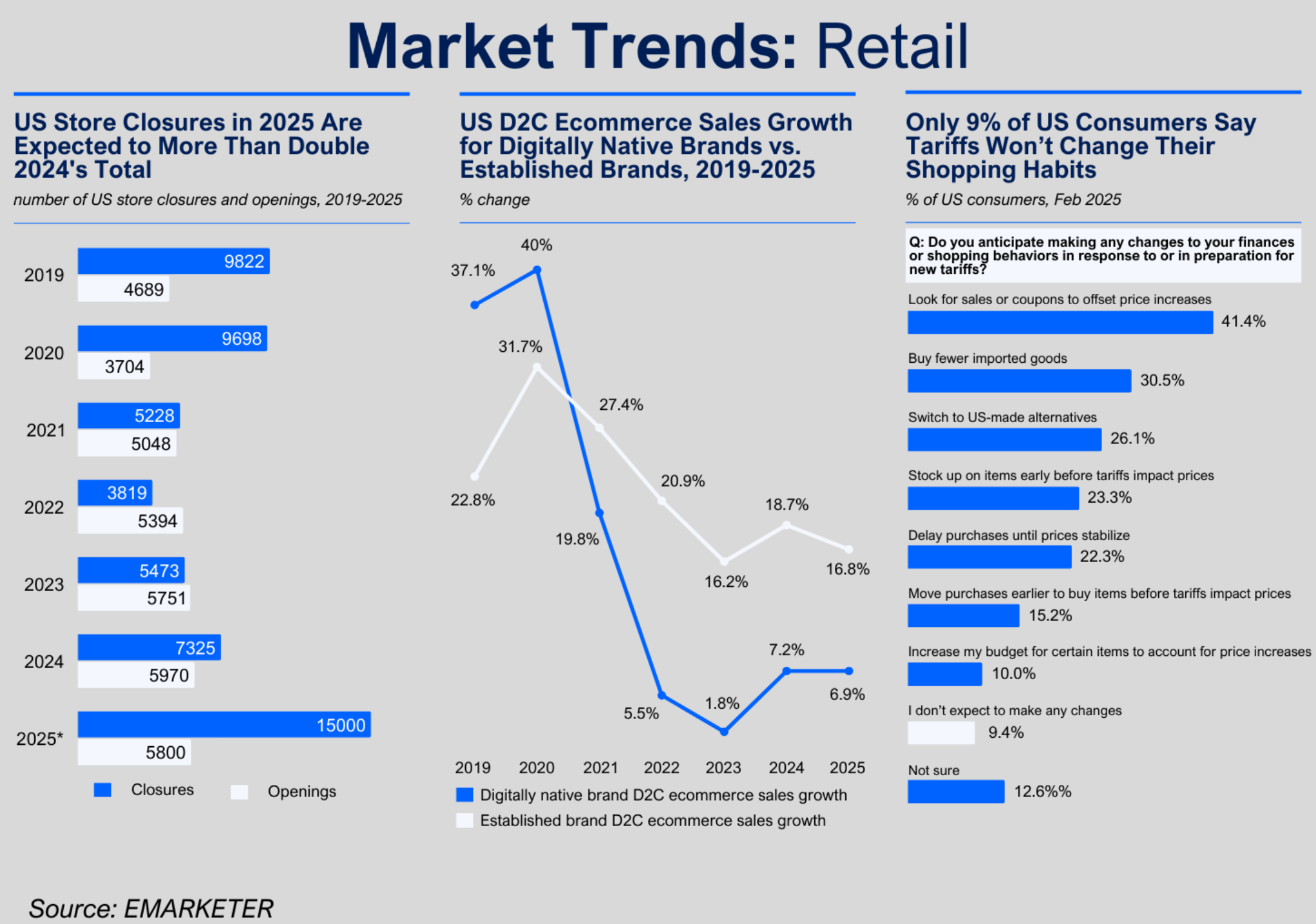

Coupons lead the savings approach, followed by delay in purchases, buying fewer imported goods, and stocking up before tariffs. "Switching to U.S. made products was the only reaction that declined in the past two months (-2 points), while delaying purchases (+10 points) and stocking up (+8 points) saw the largest increase."

Responding to the Tariff Retail Challenges

"Shoppers are keeping a close eye on prices right now, meaning sudden spikes could drive them to competitors. If price increases are unavoidable due to new tariffs, companies should implement them gradually to minimize consumer pushback. Running targeted promotions or loyalty rewards can also be a bridge strategy to retain price-sensitive shoppers. Companies should consider monitoring sentiment and switching behaviors through surveys and verified purchase data to ensure their strategies are on track, course-correcting as needed. Exploring alternative materials sourcing from non-tariffed countries and evaluating domestic production feasibility will also set up businesses for future tariff resilience."

This article has focused primarily on consumers and has intentionally stayed away from politics. It is important to remember that not everyone is anti-tariff. Agree with eMarketer that retailers should be very transparent on price increases and focus on messaging that emphasizes value.

There are multiple risks that need to be mitigated in retail for the rest of 2025.

Only 9% of U.S. consumers say that tariffs will not change their shopping habits. Inaction is not a strategy for success and over reaction will lead to loss of market share.

Short term it will be painful, but the retail industry will survive and return to growth. Projections indicate that by 2030, global retail sales will reach nearly $38 trillion, up from nearly $31 trillion in 2024. Re-configuring supply chains to support this growth (and avoid tariffs) will continue to be a major component of the growth story.