Consumer spending accounts for roughly 70% of USA economic growth in the United States. In a short amount of time, COVID-19 has become a brutal disruptor of traditional buying patterns.

Research indicates that it takes 66 days or roughly two months for a behavior to become an automatic habit. That is roughly how long most countries were in various lockdown phases.

As we reopen stores, we are in unchartered shopping territory. This article summarizes the latest shopping data, key insights on the digital shifts underway, and recommendations for a stronger retail industry recovery.

"Retailers need to stop expecting business to return to “normal.” There’s no going back to how it was anytime soon. Even before the Covid-19 pandemic and economic crisis, brick-and-mortar retailers had been fighting a fierce battle against Amazon and other e-commerce players. Those challenges have now accelerated at staggering speed."

The Toilet Paper Crisis in NOT Over

A new USA PwC survey indicates that for the foreseeable future, consumers will keep aggressively stocking their pantry. During the COVID-19 crisis, 47% of respondents loaded their pantry slightly more than normal, 39% more than normal, and 14% substantially more than normal.

Nearly two-thirds (64%) of respondents' plan to continue this more intensive shopping pattern. Of these consumers, 42% will stop extra loading only when COVID-19 is fully resolved. Twenty-four percent will keep loading until grocery stores are restocked. Eighteen percent won't stop loading their pantry, and 14% will load until shelter-in-place measures ease.

As a harbinger on what's needed to get shoppers back into stores:

- 39% would shop in a store if physical distancing and other safety measures are in place.

- 30% would shop in a store only if they needed a product immediately and could not buy it online.

- 12% would immediately shop in a store.

- 10% will most likely shop in a store with online pickup

- 9% prefer shopping online and have no need to shop in a store.

As other good news for essential grocery retailers, 69% said cooking from home significantly increased consumer's quality of life during the pandemic. Thirty-eight percent said more online shopping has somewhat increased quality of life.

The Consumer Shift to Digital

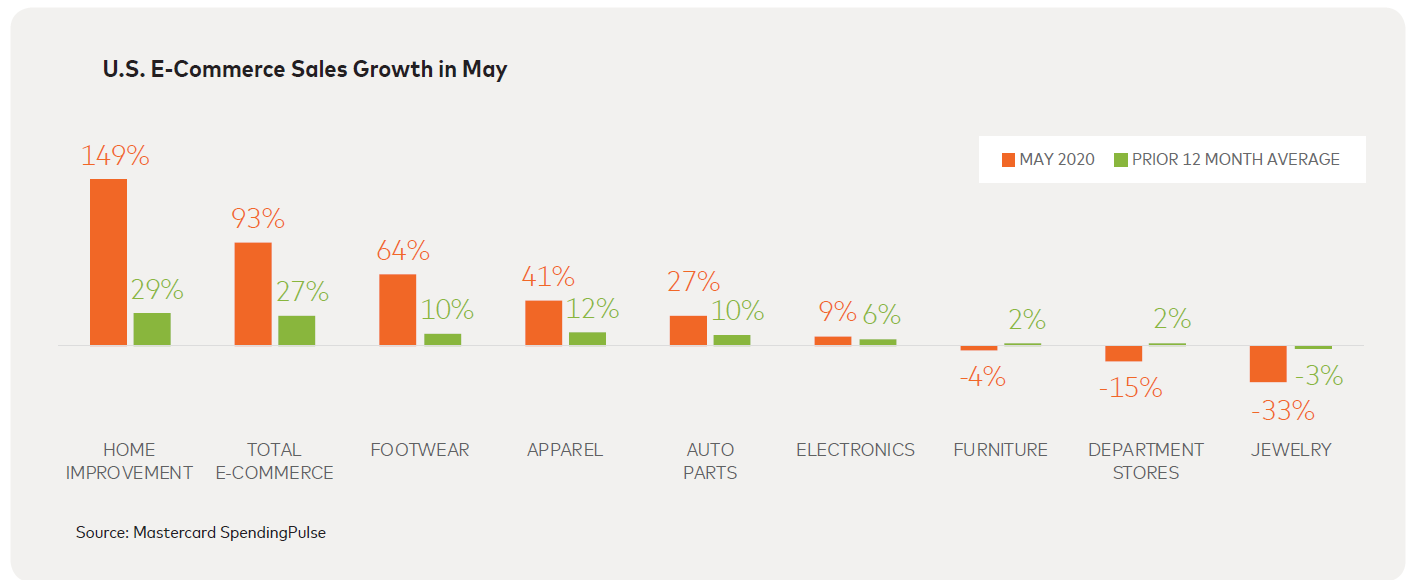

New Mastercard Services research highlights several interesting COVID-19 retail recovery insights. In 2019, USA e-commerce represented roughly 11% of total retail sales. During April and May 2020, online sales doubled to 22%. For the UK, ecommerce sales in the same two months spiked to an astounding 33% of total retail sales.

More money was spent online in April / May 2020 in the USA than the last 12 Cyber Mondays combined.

Of the total increased online spending of $53 billion in April / May 2020, roughly $9 billion came from home improvement.

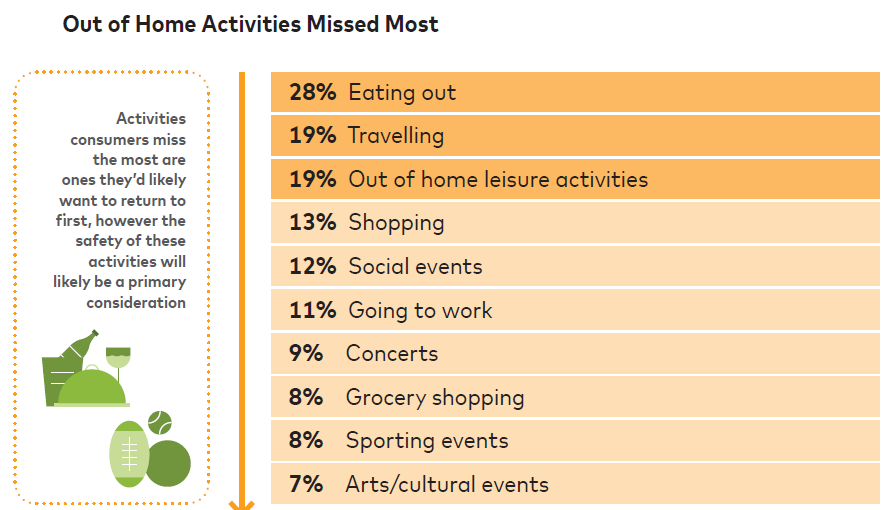

Again, as a harbinger to the future, here is what consumers miss most.

Consumers are not jumping back to these activities as 49% believe this crisis will last 4-12 months and 20% more than a year.

Finally, from this section, what are the changes that consumers believe are here to stay?

Note the increased focus on hygiene, working remotely, home cooking, fewer mass events, and 47% less shopping in stores.

Back to "Normal" is a Fantasy

Multiple other surveys point to similar concerns about shopping in stores and the increased required visibility of health safety protocols. Still resonating is a list of recommendations from McKinsey as part of their post COVID-19 Asia discretionary spending review.

Thriving post the pandemic "will ultimately require changes in how companies in these sectors think about staying relevant to consumers while managing increased operational complexity as well as potential delays in the rebound of demand and customer traffic. Combined with sales migration toward online channels and the renewed focus on value, these changes could contribute to margin compression. Moreover, there are certain behaviors that are likely to shift fundamentally, requiring reconsideration of the consumer proposition and companies’ go-to-market strategy and operating model."

Near term, McKinsey recommends the following five actions:

- Don't Just Reopen - Rethink the Store - Reimagine "end-to-end consumer engagement on digital channels and seamlessly linking online and offline experiences to radically accelerate in-store omnichannel integration."

- Earn and Maintain Consumers' Trust - With incomes and savings being impacted, consumers are more cautious about their brand choices.

- Radiate Value - Clearly understand customer segmentation, adopt fast "test and learn", and deliver increased personalization.

- Follow the Consumer - "As consumers use more channels, it is important for companies to ensure that their experiences at each touchpoint are consistent, generate delight, and further enhance companies’ understanding of consumers."

- Communicate Purpose - "Customers and employees appreciate brands that exhibit a social purpose and communicate honestly about how the crisis has affected their service levels and overall business."

Crystalizing all of the above, it is now more critical than ever to stay close to your customer base. Spend the time to understand their shifting concerns. Find ways to increase value and personalization. Understand clearly your brand value and how it's being perceived by consumers. STOP expecting that business will eventually return to the previous normal.