It is beginning to look a lot like Christmas, everywhere you go. With decorations now appearing in stores as early as August, reminders are everywhere on the continued importance of each holiday shopping season.

Some statistics on the importance of retail, the holiday season,and the impact on the overall USA economy:

- Roughly 70% of U.S. gross domestic product (GDP) is generated by consumer spending.

- Holiday sales in the months of November and December have averaged 19% of total annual retail sales over the last five years.

- In 2023, USA retailers hired between 345,000 to 450,000 holiday seasonal workers.

- 75% of retail small businesses rely heavily on holiday sales to meet their annual revenue goals.

It is time to summarize multiple of my favorite retail holiday forecasts For 2024, most of these project lower historical retail sales growth, even as the September's job report continued to deliver positive economic surprises.

Global Consumers Are Feeling the Pinch

According to Salesforce.com research, "after remaining largely resilient throughout four years of economic uncertainty, consumers are finally feeling the pinch. From sustained inflation to supply chain woes, consumers worldwide have been through a lot."

“From sustained inflation to supply chain woes, consumers worldwide have been through a lot.” Thirty-two percent of global shoppers reported using alternative credit services like buy now, pay later (BNPL) more frequently this year.

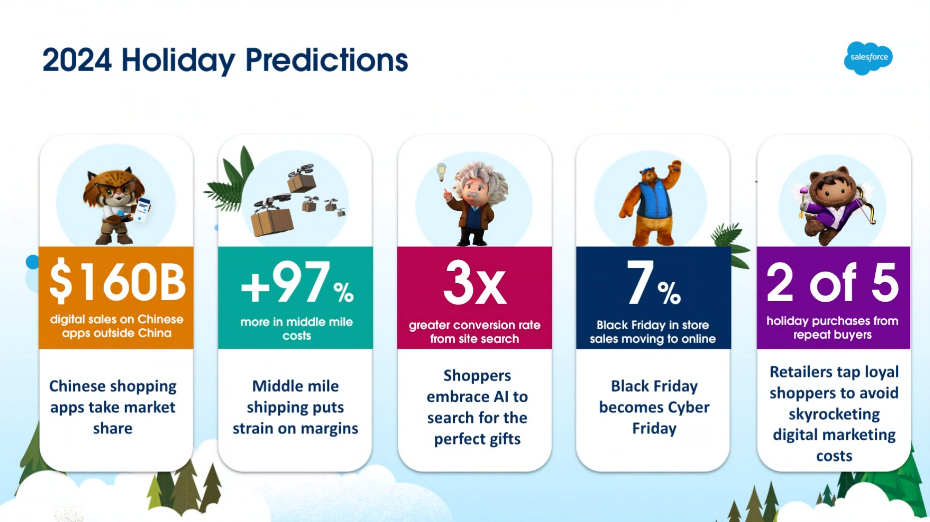

Salesforce makes five predictions for the November through December 2024 holiday shopping season.

- A surprising 63% of Western consumers plan to purchase from Chinese shopping apps during the 2024 holiday season. That includes merchants such as Aliexpress, Cider, Shein, Temu and TikTok. Chinese shopping apps will take 21% of sales outside China itself in the 2024 holiday season.

- Brands and retailers will spend an extra $197 billion on middle- and last-mile expenses during the 2024 holiday shopping season. That would be a 97% increase over last year’s holiday season.

- Artificial intelligence (AI) influenced 17% of online purchases during the 2023 holiday shopping season. This year more consumers will leverage AI, whether they know it or not. Already, 53% of shoppers Salesforce surveyed said they are interested in using generative AI for discovering gift ideas.

- Ecommerce will capture 7% of in-store sales on Black Friday. Nearly two-thirds of shoppers Salesforce surveyed said they’re waiting until the Cyber 5 period (5 days between Thanksgiving and Monday) to make large holiday purchases.

- Shoppers are doubling down on loyalty programs. 63% of shoppers are making more purchases from stores where they can earn and redeem loyalty points. 46% of shoppers say earning and redeeming loyalty points is the second-highest factor, behind price, influencing where they buy. Loyal, repeat buyers will make 40% of purchases in the 2024 holiday season.

2024 Holiday Sales Growth Below Ten-Year Average

Bain & Company predicts overall holiday retail sales growth at 3% this year, well below the 5.2% ten-year industry average.

Bain predicts that instore sales will only grow 0.5% with non-store contributing a 9.5% increase to the overall 3% growth. The winners this year will be ecommerce followed by grocery, clothing & accessories, and general merchandise retailers. Consumers are putting a freeze on their overall outlook and spending.

Physical Stores More Relevant

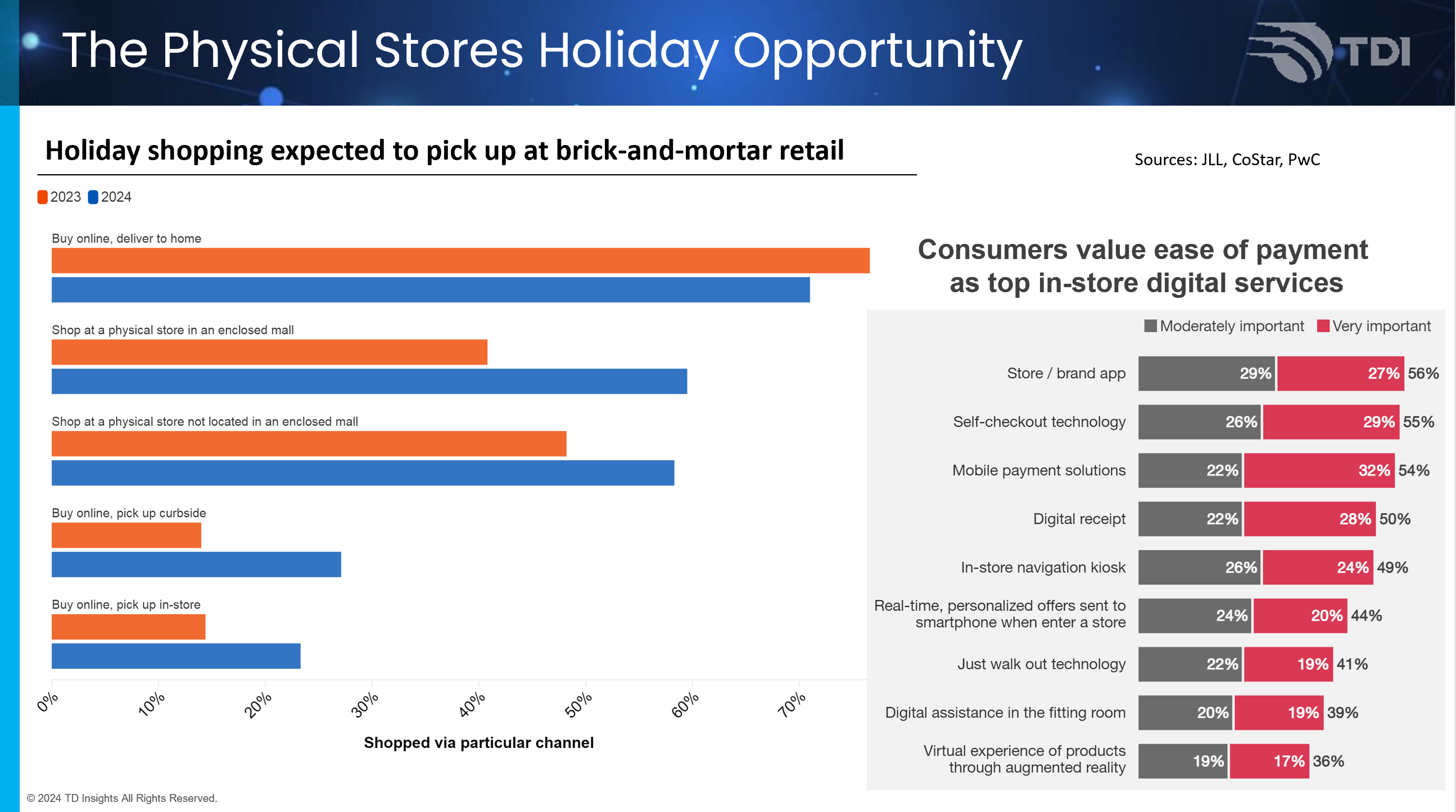

This year, 59.5% of those surveyed plan to shop in a store in an enclosed mall, compared with 40.8% last year, according to JLL. And 58.3% of Americans will shop at a store not in an enclosed mall, compared with 48.2% last year.

According to PwC, "physical stores continue to play a crucial role in holiday shopping, in part due to their experiential appeal. Nearly one-fifth of consumers rank holiday displays and store atmosphere (22%), holiday-specific products (21%) and making an event out of the shopping trip (17%) as the top three factors influencing their decision to visit physical stores during the holiday season."

PwC adds that "consumers who plan to shop in stores more frequently than usual are big spenders too, averaging $2,307 compared to $1,297 for less frequent visitors. A substantial 63% of consumers who shop in stores more frequently than usual during the holiday season say that self-checkout technology and mobile payment solutions are important when doing their holiday shopping. Forty-eight percent place the same importance on just-walk-out technology. These preferences indicate a shift toward tech-enhanced shopping experiences, offering retailers opportunities to build loyalty and shape their future stores."

For the first time, department stores topped the list of store types where consumers plan to holiday shop, followed by apparel and mass merchandisers. Over half of consumers or 57.9% are planning to visit a department store.

The locations correlate with the rise in mall visits overall, where mall shoppers will increase by 18.7% this year, according to JLL. "Mall shoppers will linger longer, spending an average of 74.1 minutes (versus 66.2 minutes, on average)," JLL found. "A relatively higher percentage of mall shoppers will also spend over 90 minutes on each visit. Mall shoppers are more likely to visit six or more stores."

The Ten Busiest Shopping Days of the Holiday Season

Based on Sensormatic Solutions traffic data, the firm predicts that the 10 busiest shopping days in the U.S. will be:

- Friday, Nov. 29 – Black Friday;

- Saturday, Dec. 21 – Super Saturday;

- Monday, Dec. 23 – Monday Before Christmas;

- Sunday, Dec. 22 – Sunday before Christmas;

- Saturday, Dec. 14 – Second Saturday before Christmas;

- Saturday, Nov. 30 – Saturday after Black Friday;

- Thursday, Dec. 26 – Boxing Day;

- Saturday, Dec. 7 – Third Saturday before Christmas;

- Saturday, Dec. 28 – Saturday after Christmas; and

- Friday, Dec. 20 – Friday before Christmas.

"Due to the unique features of the calendar, not only are there less days this year in the traditional holiday shopping period, Christmas falls on a Wednesday. Retailers should look at historical performance records from 2019, which is the last time the holiday fell on Wednesday as well as the last pre-COVID holiday season."

"In the U.S, the top 10 busiest shopping days account for approximately 30% to 40% of all holiday retail traffic. Sensormatic predicts U.S. in-store traffic will be relatively flat, down no more than 3% year-over-year. To date, traffic has been down 2.6% on average compared to 2023."

With US consumers currently carrying $1.142 trillion in credit card debt (highest since New York Fed started tracking it in 1999), retail holiday growth is actually decent this year. As a positive sign for the industry, the recovery of physical stores is also welcome. Just like the other recent general positive economic news, all of us might be pleasantly surprised by the actual growth of retail this holiday season. Happy Shopping Everyone.