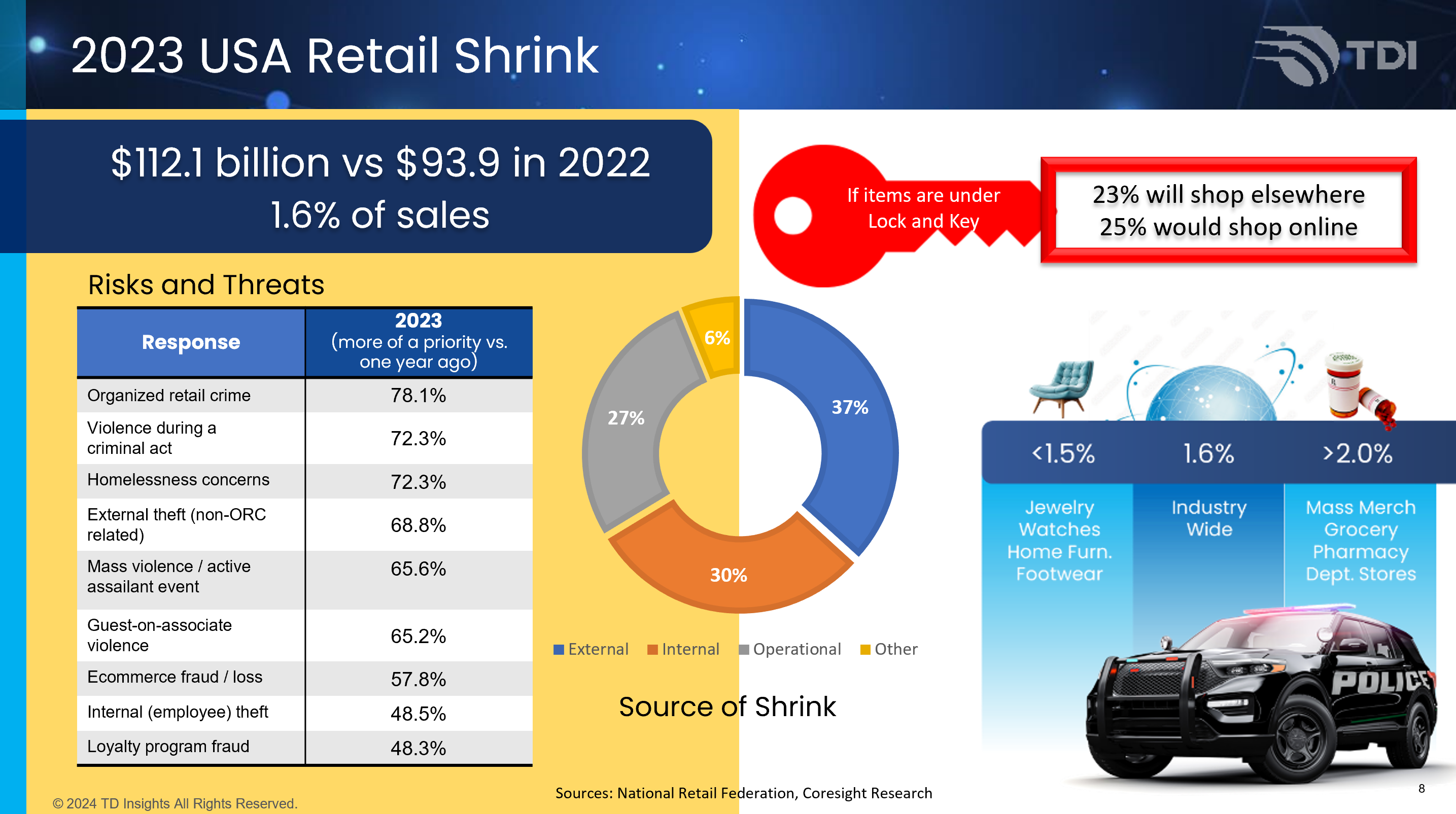

In the latest USA National Retail Federation Security Survey published in September 2023, retail shrink increased from 1.6% of sales from 1.4% in the previous year. This equates to $112.1 billion in losses, up from $93.9 in the previous year. The top 3 retailer priorities in the new NRF survey versus the previous year were organized retail crime (78.1%), violence during a criminal act (72.3%), and homelessness concerns (72.3%).

What's changed since the 2023 NRF security survey was published? How does theft impact inventory distortion? What are the latest shoplifting trends? How do consumers respond to retail theft? Why is retail crime at a crisis point? How does USA compare to other countries with this problem? How do we solve the problem of retail shrink?

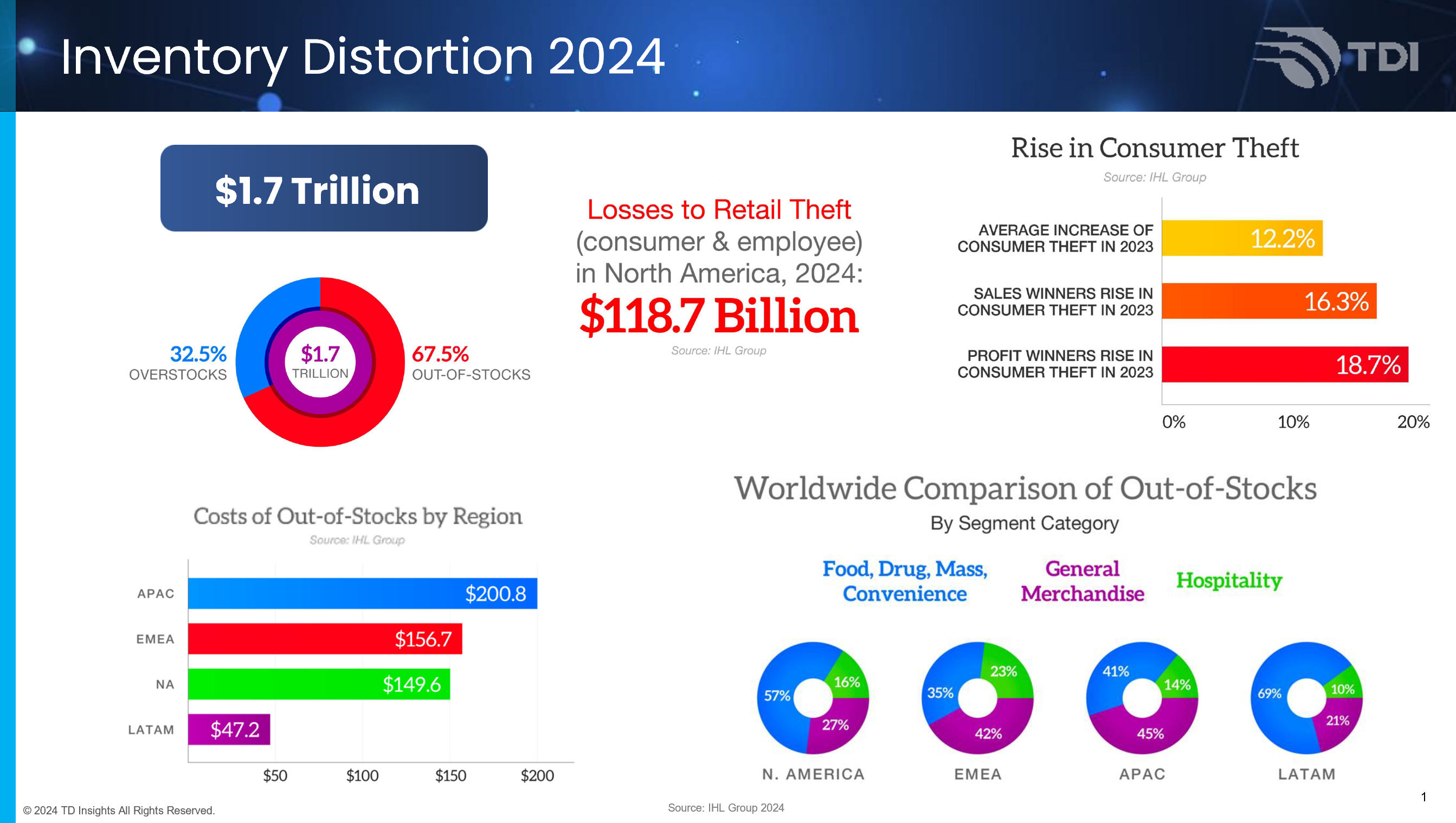

The $1.7 Trillion Dollar Global Retail Problem

The IHL Services group has been studying the problem of inventory distortion (out-of-stock plus overstock costs) for the last 15 years. In their 2024 just published update, "the problem amounted to over $1.7 USD trillion worldwide, a decrease of 2.8% from 2023 (Out-of-Stocks improved by 3.7%, Overstocks by 0.7%), and a decrease of 12.0% since 2022. The total lost is equivalent to approximately 1.0% of the global GDP, or the entire GDP of Australia. As an equivalent of a percent of retail sales, inventory distortion has been trending downwards from a high of 10.4% in 2021 and in 2024 currently sits at 6.8% worldwide. Retailers have been making good progress at cutting the problem down to size, but there is still so much more to do."

The IHL research noted that a considerable factor that contributes to inventory distortion is consumer theft which in their study they estimated to reach $118.7 billion in 2024. Interesting that the average theft rise is higher for what are considered the retail winners which are retailers that experienced 15%+ growth in the previous year.

Shoplifting Trends Continue to be Highly Negative

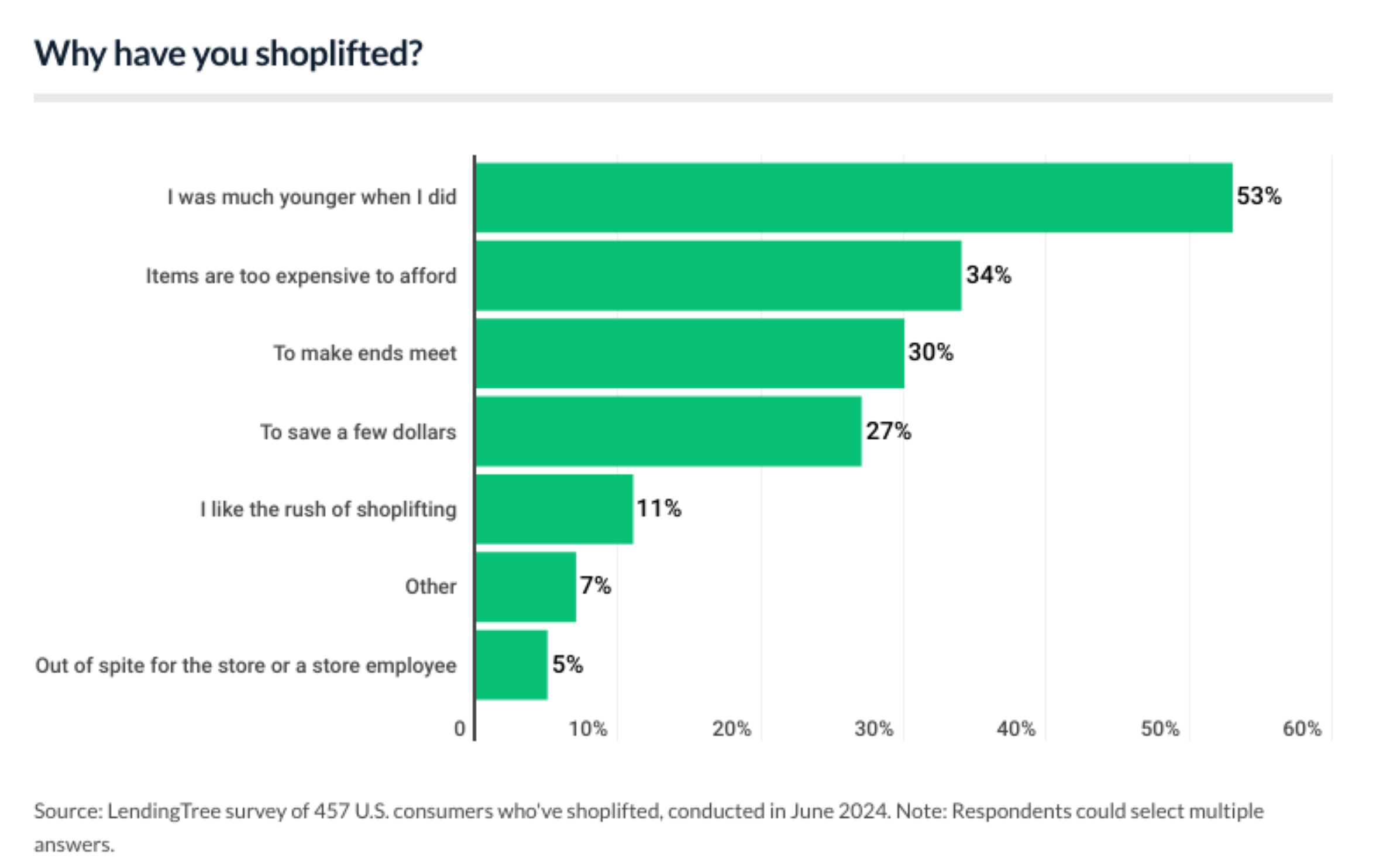

New research from Lending Tree found that more than 1 in 4 Americans (23%) have shoplifted from physical stores, with 90% citing inflation and the current economy as the primary reason. Other interesting findings from Lending Tree:

- Of those with a shoplifting history, 52% were older than 16 at the time.

- Shoplifters are most likely to hide the items on their bodies (55%) or in purses or bags (36%), while 25% are bold enough to walk out with their loot in plain sight.

- Over a third (34%) of shoplifters rely on five-finger discounts because prices have become otherwise unaffordable, while 30% say it helps make ends meet and 27% say it helps save a few bucks.

- Favorite destinations are grocery (46%) followed by department (36%) and convenience stores (26%).

- The most common shoplifted items are food and nonalcoholic drinks (45%), clothing, accessories or jewelry (39%), and makeup or cosmetics (21%).

Not all shoplifting is intentional. Forty-one percent of Americans have accidentally taken something without paying for it. Of this group, 45% felt guilty about it and 32% were embarrassed the last time it happened. Still, 51% didn’t bring it back to the store to return it or pay for it.

Interesting that just over half (52%) of shoplifters say they got away with it, leaving 48% admitting they were caught red-handed. Of those caught, 33% were given a warning, 24% were arrested, 22% were banned from the store, and just 6% faced no consequences.

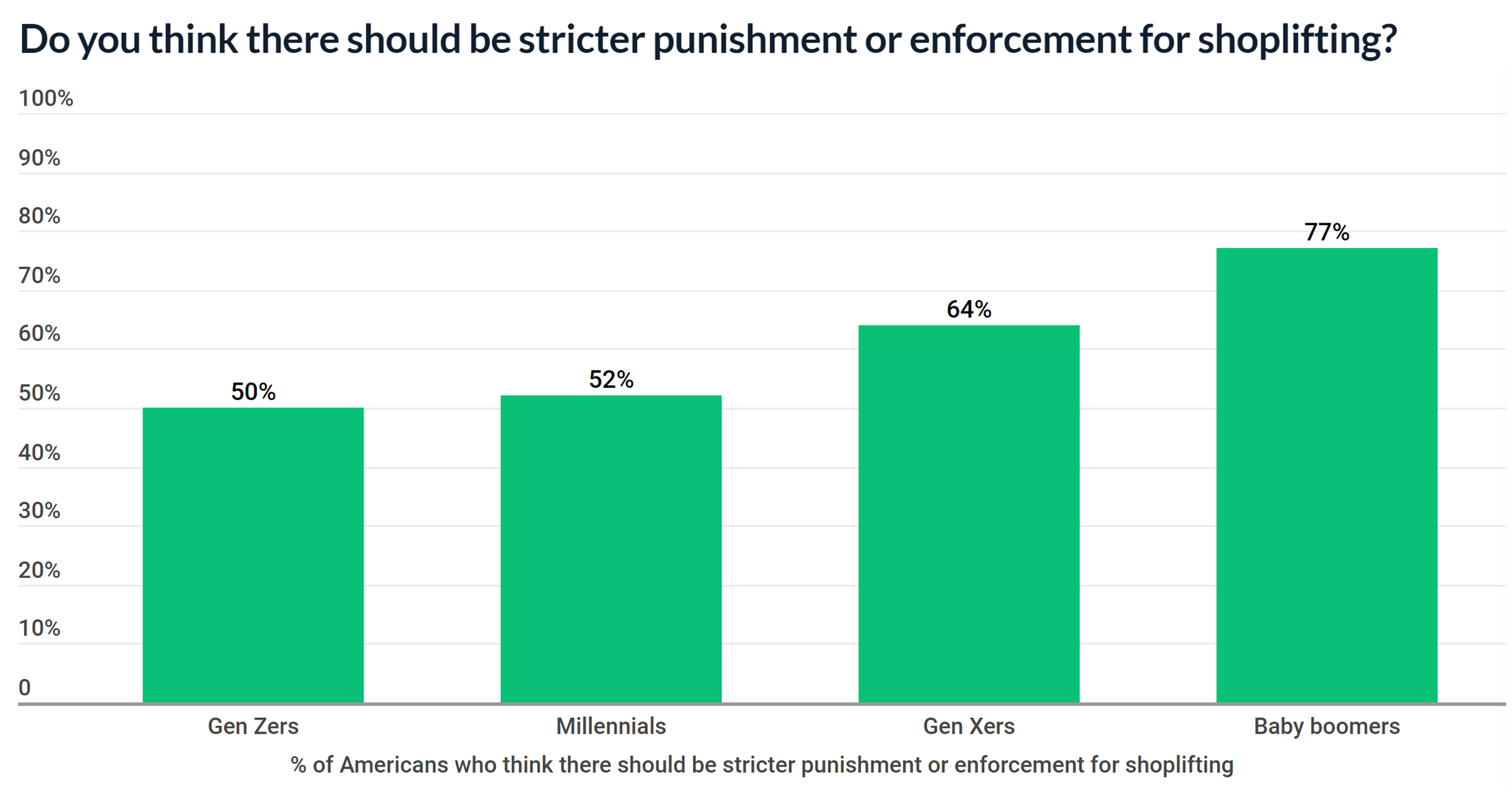

Note the lower tolerance for punishment for these crime activities by younger generations.

Consumers Response to Theft: Losing Inventory, Losing Customers

New research from Coresight finds that:

- 27% of their respondents personally witnessed someone shoplifting while shopping in the last 12 months.

- 32% have stopped or reduced shopping at certain stores because they felt unsafe in the area around the store’s location.

- 58% are concerned (moderately to extremely) that stores serving their community may be closed due to retailers experiencing higher theft.

- 23% would seek alternative locations if their local stores put commonly bought items under lock and key.

- 25% would make purchases online, if their local store put commonly bought items under lock and key.

- 75% are concerned (moderately to extremely) that retailers will raise prices to cover the cost of increased retail theft.

- 71% are concerned (moderately to extremely) about local governments’ ability to enforce the law.

Retail Theft Reaching a Crisis Point

New research by Avery Dennison reveals that four-in-ten (42%) senior retail leaders in the UK and the US believe that theft is more of a concern today than it was 12 months ago. In addition, almost two-thirds (64%) agree that the impact of theft has reached a crisis point.

In the Avery Dennison research, theft trumped other concerns in retailers’ ‘top five’ which were optimizing

omnichannel retail (27%), increased operating costs (27%), improving staff efficiency (26%) and retaining

customers (24%). Agree with their conclusion that RFID is taking a much more active role in helping solve some of the major problems caused by retail shrink.

The Global Problem of Retail Shrink

The British Retail Consortium (BRC) confirms that retail theft is growing in multiple other countries.

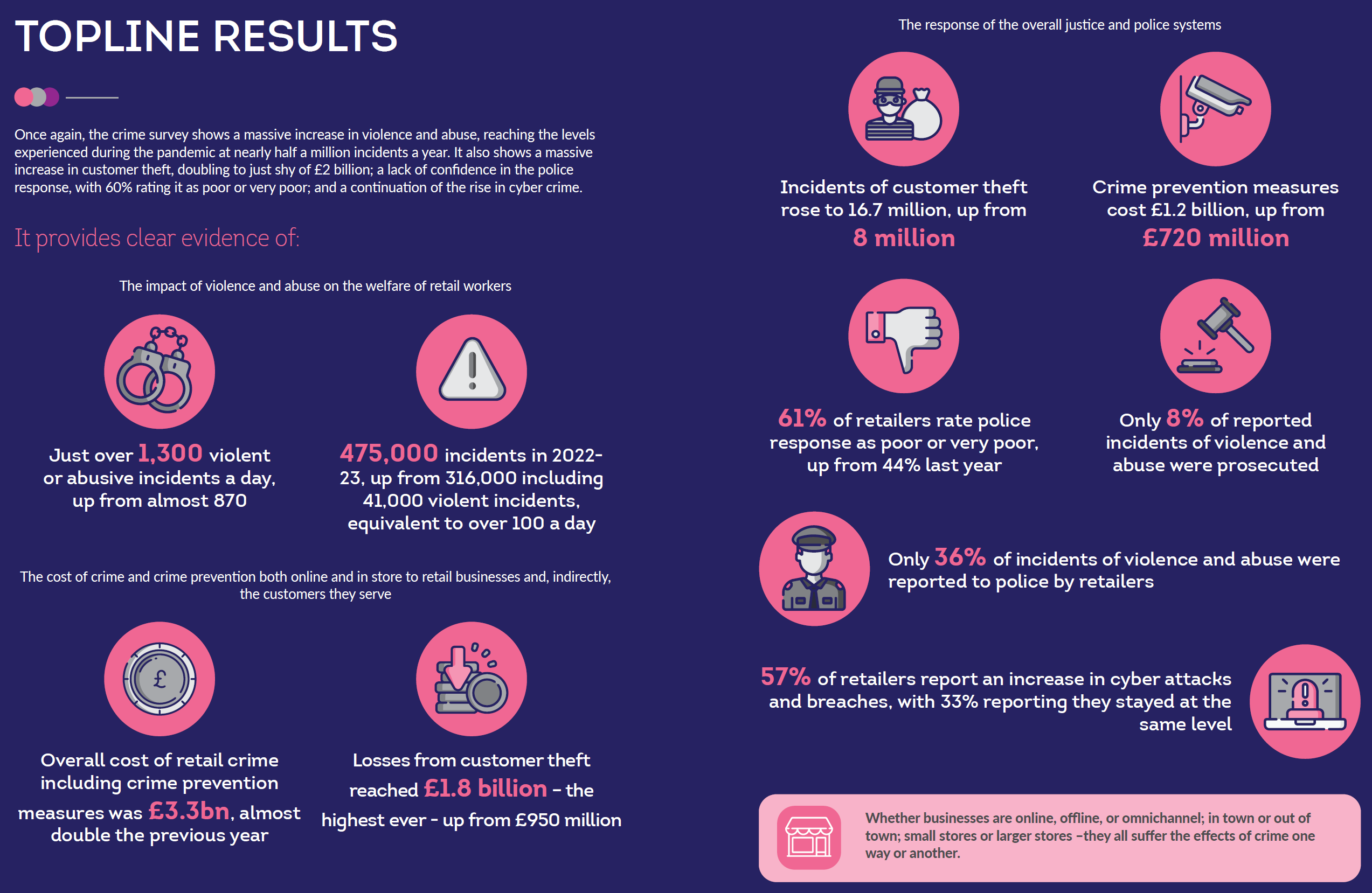

Note the dramatic UK increases in violent and abusive daily incidents, the doubling of the overall cost of cost of retail crime, doubling of retail customer theft incidents, the very low reporting of retail crime, and the just over one-third low reporting of the crime to the to police. As the BRC report summarizes, "violence and abuse; customer theft; concerns with the police response and rate of prosecutions; and the growth in cyber crime remain the overriding issues."

Solving the Retail Crime Problems

Retail crime threats are real, more visible, and are getting more violent. They are also not isolated to the United States as similar patterns have emerged in other countries including the UK and Australia.

The problem is complex as are the solutions.

Above is a chart that I have shared in multiple public presentations across the world. Key messages:

- Retail technology solutions have not kept up with the growth of the problem. Too many silo products chasing niche opportunities, not tackling the challenges in an integrated approach. AI will contribute to the growing list of important new solutions

- The legal framework is stuck in the past and is not keeping pace with advancements outside the retail industry in areas that both add to the problem and help solve it.

- The Internet is both an opportunity and a curse as a fencing stolen products platform. Better solutions and laws are needed to address this challenge.

- Higher connectivity across interrelated frameworks is the new required normal. To effectively tackle the problem of retail shrink, strong partnerships are needed across multiple boundaries, especially between retailers, industry groups, and law enforcement. The good news, successful models are in place in various parts of the world, but it will take different more innovative thinking to evolve to broader global adoption.

Locking up merchandise to reduce shrink reduces revenue and increasingly drives consumers to alternate retail models. Customer and employee safety need to be our number one priority in whatever path we take to address the problem. It is time, to reinvent retail once again to a brighter more profitable future where shrink is managed and consumers are the center of immersive, safe customer experiences.